Overview

Since the 1960s, Lebanon has been an important regional producer of potatoes using imports of quality seeds from western countries, such as the Netherlands, exporting to markets mainly in Arab countries.

Markets in Europe show a wide diversity. The UK, Scandinavia and France are considered high end, offering good prices. The German market is a bulk and discount market.

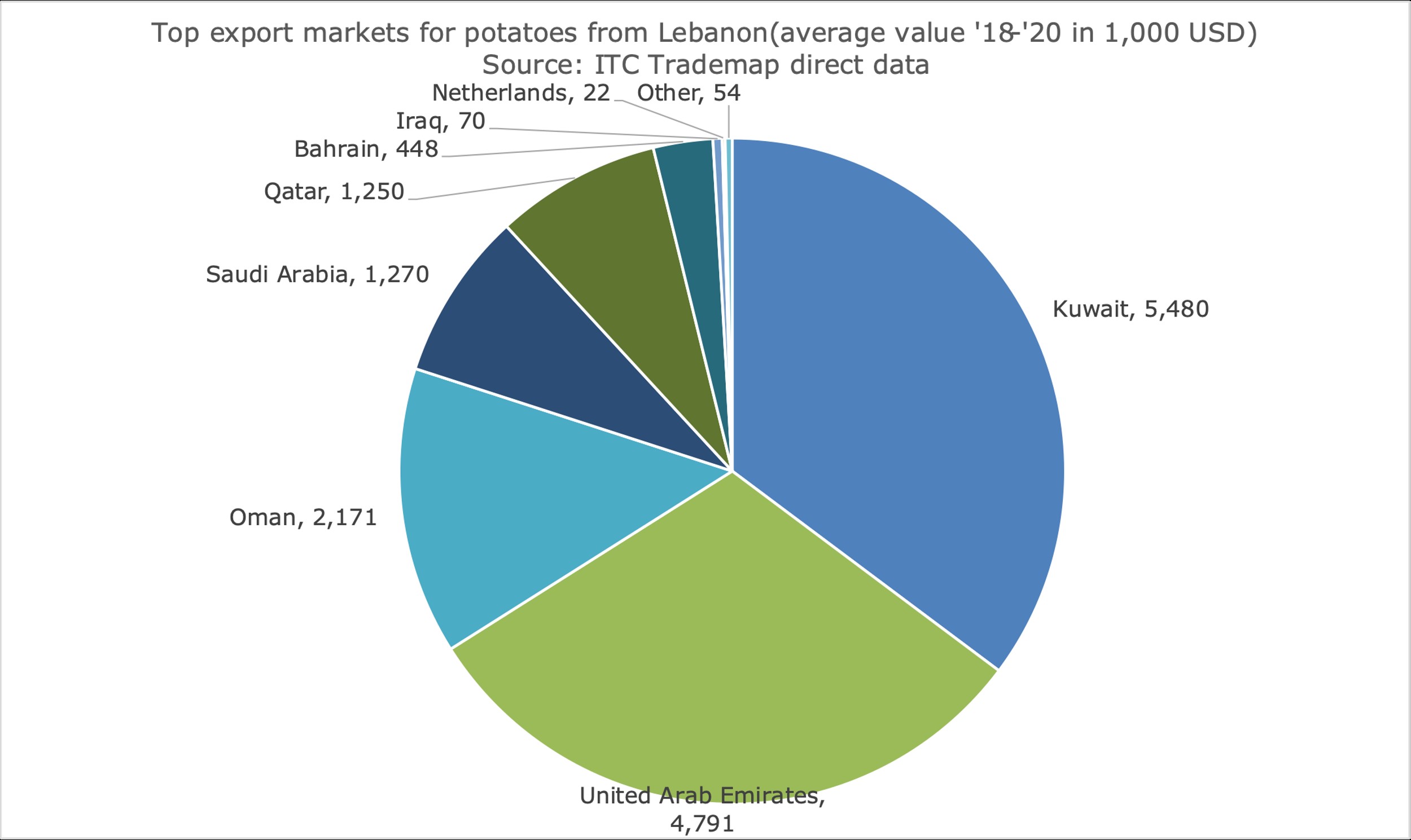

For the past 20 years, Lebanese exports of potatoes have been fluctuating over the years, reaching on all time high of $48 million in 2014. For the past 3 years, the average value hovers around $15 million.

This report provides an overview of Lebanon’s current production and exports of potatoes and its position in the international markets. It also sheds the light on the available opportunities to enhance the country’s export potential with an overall aim of strengthening Lebanese exporters’ capacities and competitiveness.

Product Definition

It is the third most important food crop in the world after rice and wheat in terms of human consumption with a global total crop production exceeds 300 million metric tons. Lebanese potatoes: the main varieties are Spunta and Agria. The different climatic zones in Lebanon ensure diversity in harvesting periods. Akkar and Bekaa are the major production areas. Seasonal availability: all year round.

Where do lebanese potatoes currently go to?

However, in recent years, potatoes were no longer a strategic product for exports, mainly because of the high need for water and because of stronger competition in GCC markets from Turkey, Pakistan and France.

Figure 1. Top export markets for potatoes from Lebanon between the years 2018-2020 in 1,000USD - Source: ITC Trademap data

What is lebanon’s position in the international market?

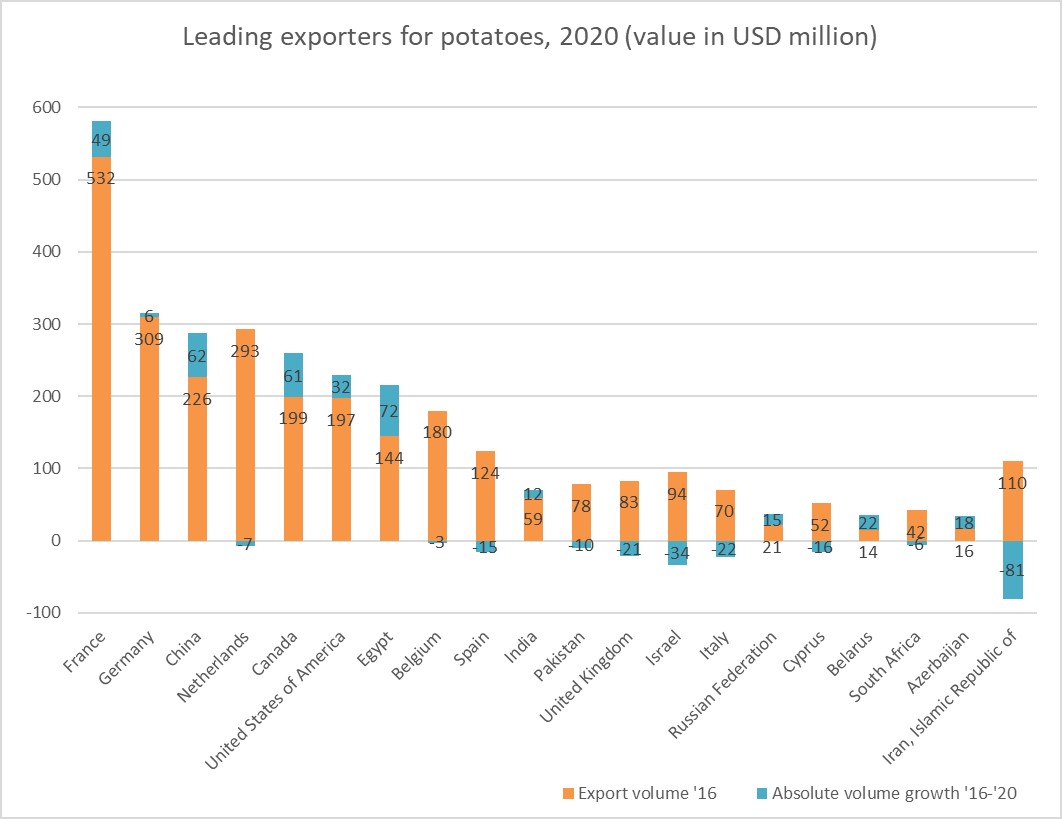

Lebanon is a small exporter of potatoes. In 2020, Lebanon’s export ranking worldwide stood at number 68 (trade hubs excluded). The top six producers, namely France, Germany, China, Netherlands, Canada and US accounted for about 60% of global production volumes in 2020.

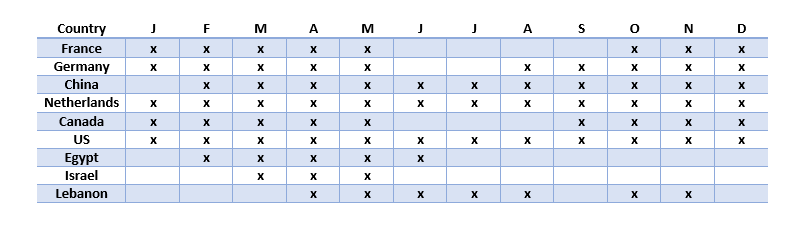

Potatoes in the north of Lebanon (Akkar region) give the earliest harvest season: planting from early December to the end of January results in harvest from early April to the middle of June. Then, after a one-month gap, harvest starts in the Bekaa valley.

Potatoes are grown in two seasons in the Bekaa Valley. Planting of the spring crop occurs in February through March, with harvest in June through July. A late crop is planted in July or August and harvested in October through November.

We note a decrease in potatoes exports from France during the months June to September. Also another decrease in exports from Germany during June and July. This is the period when most potatoes are harvested in Lebanon and awaits export.

In the regional competitive countries, the harvest season is from March till May in Israel and from February till June in Egypt creating a window for the Lebanese potatoes starting end of May till August. The late crop harvested in October through November in the Bekaa region also gives an advantage over regional competition.

Figure 2. Leading Exporters for potatoes 2020 - Source: ITC Trademap data

Table 1. Overview of potatoes harvest windows in the world’s leading production countries

What are the trends in trade in the 20 largest importing countries?

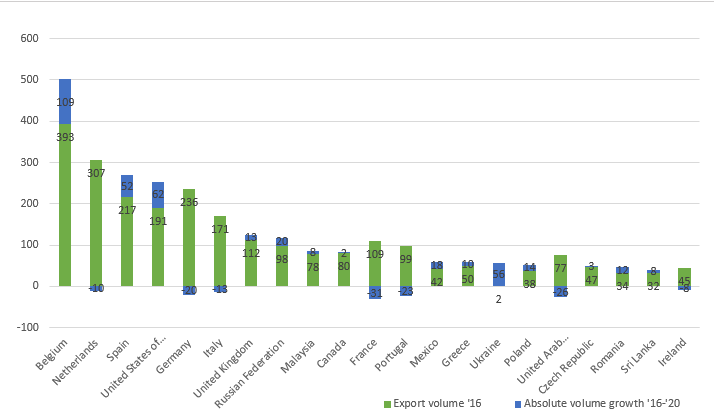

Belgium import value increased by 33% in the period 2018-2019. Netherlands is also a prominent potato importer internationally.

The European region is by a long way the largest importing market of potatoes. The main importers in the EU are Belgium, Netherlands, Spain, Germany, Italy and UK. Whereas, on top of the Asian market are Russia, Malaysia and Sri Lanka. It has been projected that in the future, world production is expected to grow at a rate of 2.5% per year.

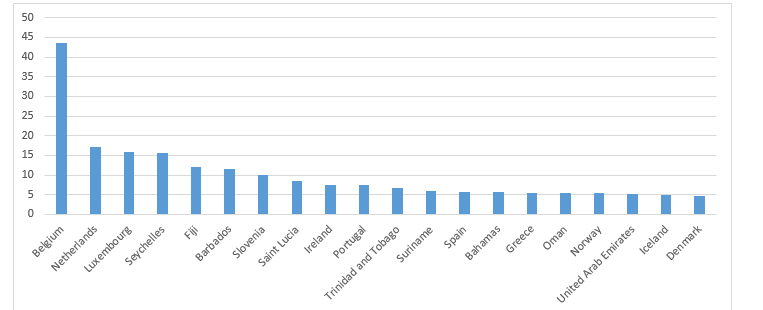

Interestingly, the per capita imports statistics of 2020 (see Figure 4, below) showed how Belgium, roughly followed by Netherlands, Luxembourg and islands like Seychelles and Fiji topped in potato consumption.

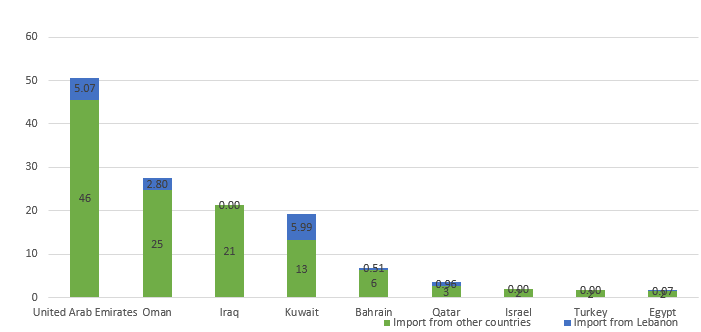

It also shows some shy potential for growth in countries with low per capita consumption, such as Portugal, Spain, Oman and UAE. What are the trends in trade in the GCC? Though the GCC markets do not compare to the mass of Europe and North America, the small market experienced some increase in demand depending on the year during the period 2016-2019. Lebanon mainly exports its potatoes to Kuwait, UAE, Oman and Qatar.

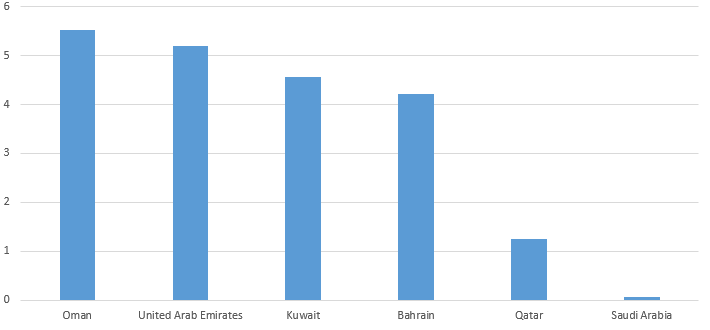

In terms of per capita consumption, Oman, UAE, Kuwait and Bahrain equally stand out with more than threefold the consumption of other countries. Figure 6 below shows there is still some potential growth possible in Qatar and Saudi Arabia mainly.

Figure 3. Leading importers for potatoes 2020 - Source: ITC Trademap data

Figure 4. Top 20 countries with highest net import value of potatoes in USD per capita 2020 - Source: ITC Trademap data

Figure 5. Import of potatoes in ME region 2020 - Source: ITC Trademap data

Figure 5. Import of potatoes in ME region 2020 - Source: ITC Trademap data

What are interesting markets for the future?

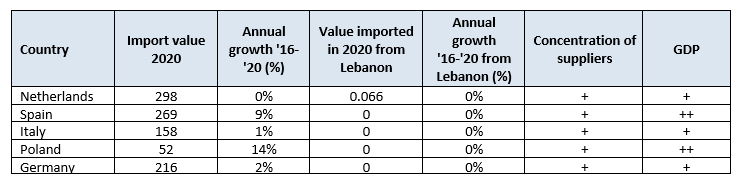

Based on the calculation and analysis of the figures, 7 countries were identified as promising (Figure 7) and offering great opportunities for Lebanese exporters of potatoes. These countries include Netherlands, Kuwait, Spain, Italy, Poland, Germany and Bahrain.

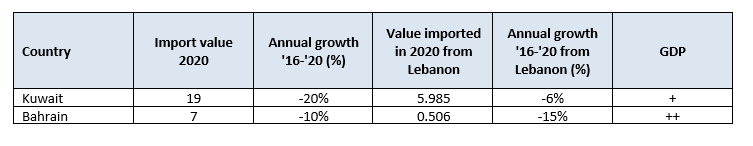

Table 2 below provides an overview of these potential export markets, identified as white spots, markets where Lebanon does not have a position yet. In addition to the white spot markets, Table 3 shows a few existing export markets that have good potential for expansion. These two markets are Kuwait and Bahrain.

Table 2. Top 5 potential export markets for potatoes from Lebanon – white spots

Table 3. Other potential export markets for potatoes from Lebanon – existing markets

Tips

- Given that Europe is a large and growing market for potatoes, Lebanon has a great opportunity to increase its market share in this region. With the Netherlands being the hub for potatoes in Europe, enhancing linkages between Lebanese exporters and distributers in Netherlands is a recommended distribution strategy.

- In addition to European markets, Lebanon has the potential to enlarge its market shares in the Middle East.