- What Are the Mandatory Requirements?

- Packaging and Labelling

- Quality Requirements

- What Additional Requirements Do Buyers Often Have?

- What Are the Requirements for Niche Markets?

- Which Quality Support Organizations in Lebanon Can Help Me?

- Main References

What Are the Mandatory Requirements?

Olive oil exported to Germany must comply with established safety standards, product composition and a clear product label.Pesticide Residue

The European Union has set maximum residue levels (MRLs) for pesticides in and on food products. Products containing more pesticide residue than allowed will be withdrawn from the European market. The European Commission currently includes 647 pesticide residues with limits varying from one pesticide residue to the other and one product to the other. For substances that are not yet included in the European regulation, the default MRL of 0.01mg/Kg applies.

Some commonly tested pesticide residues in olive oil include pyrethroids, organochloro pesticides, organophosphorus pesticides, poly-chlorinated biphenyls and nitrogen-containing pesticides.

High levels of pesticide residue are not common for olive oil; however, some European importers request a detailed test for the presence of pesticide residues. In 2018, 0.6% of the tested olive oils on the European market contained pesticide residues above the allowed limits and a non-approved pesticide iprodione in virgin olive oil.

Note that buyers in several Member States, including Germany, apply MRLs that are stricter than those established in the European Unio legislation. The MRLs applied and their relative strictness very according to the buyer. Always consult your buyer to determine the specific adopted MRLs.

Some commonly tested pesticide residues in olive oil include pyrethroids, organochloro pesticides, organophosphorus pesticides, poly-chlorinated biphenyls and nitrogen-containing pesticides.

High levels of pesticide residue are not common for olive oil; however, some European importers request a detailed test for the presence of pesticide residues. In 2018, 0.6% of the tested olive oils on the European market contained pesticide residues above the allowed limits and a non-approved pesticide iprodione in virgin olive oil.

Note that buyers in several Member States, including Germany, apply MRLs that are stricter than those established in the European Unio legislation. The MRLs applied and their relative strictness very according to the buyer. Always consult your buyer to determine the specific adopted MRLs.

Tips

- Consult the EU pesticide database to identify relevant MRLs for your product (olives, for oil production). The database can be searched according to product or the pesticide used. A list of of approved pesticides authorized for use by the European Union can be found on EUR-Lex .

- Check the latest official test report for olive oil, which is among the 12 most consumed food products that are tested every three years by the European Union control program.

- Check the supermarket factsheet on pesticides from PAN Europe to know more about the standards of some supermarket chains in Europe regarding pesticide levels.

- One good way to reduce the amount of pesticides involves the application of integrated pest management (IPM), an agricultural pest control strategy using complementary strategies, including growing practices and chemical management. Read more about IPM on the European Commission website.

Contaminants Control

According to FAO, contaminants are substances that have not been intentionally added to food, but might have entered the food from the environment or during the production process (during manufacturing, handling, storage, processing or distribution). One of the most common problems faced by olive oil exporters is contamination derived from the raw material or from foreign matter. Therefore, Tips Consult the EU pesticide database to identify relevant MRLs for your product (olives, for oil production). The database can be searched according to product or the pesticide used. A list of of approved pesticides authorized for use by the European Union can be found on EUR-Lex. Check the latest official test report for olive oil, which is among the 12 most consumed food products that are tested every three years by the European Union control program.

Check the supermarket factsheet on pesticides from PAN Europe to know more about the standards of some supermarket chains in Europe regarding pesticide levels.

One good way to reduce the amount of pesticides involves the application of integrated pest management (IPM), an agricultural pest control strategy using complementary strategies, including growing practices and chemical management. Read more about IPM on the European Commission website.

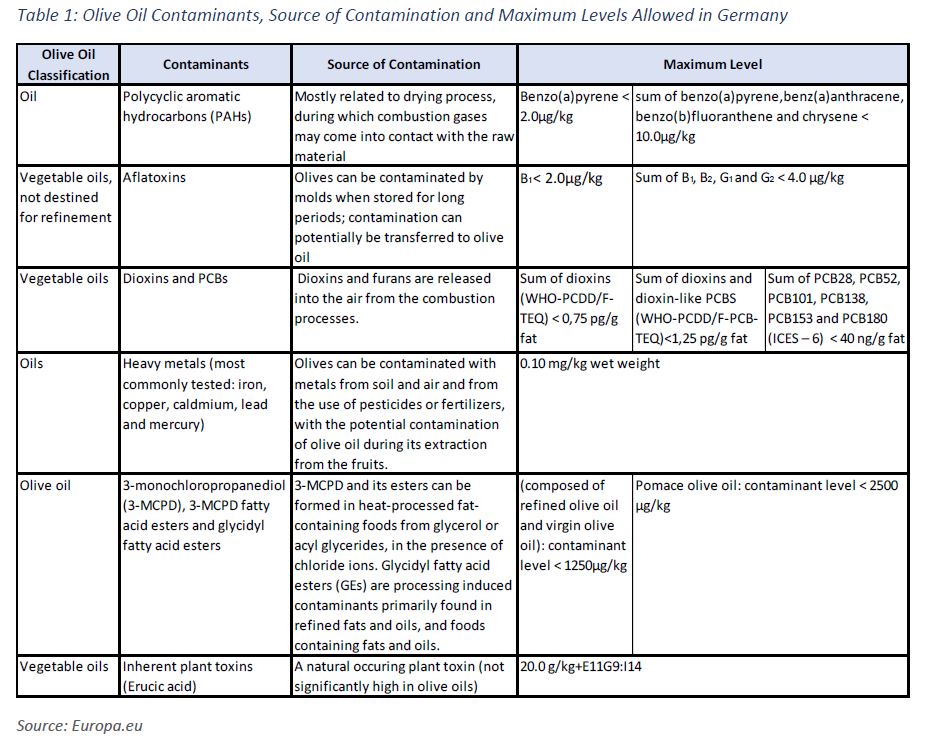

it is crucial for the exporter to know of and comply with the maximum levels allowed by European legislation. The European Commission Regulation sets maximum levels of certain contaminants in food products. The EU frequently releases updates to the regulations set on 19 December 2006. The latest update on 14 October 2020 specifies the maximum levels in the table below.

Other Contaminants

Current EU legislation does not specify and microbiological criteria for olive oil or other vegetable oils. Nevertheless, food safety authorities can withdraw imported food products from the market or prevent them from entering the EU if salmonella or other microbes are found in them. Although irradiation is one way of combating microbiological contamination at the level of raw materials, EU legislation prohibits its use for oilseeds. Contamination by foreign matter (e.g. chemicals, dust) is likely to occur in vegetable oils if food safety procedures are not carefully followed. In some cases, olive oil can become contaminated by foreign matter, thus posing a major threat in terms of food safety.

Extraction Solvents

Extraction solvents can be used in the production or fractionation of vegetable and other oils. Be aware that maximum residue limits restrictions also apply to extraction solvents (e.g. 5 mg/kg for ethyl-methyl-ketone in the fractionation of oils; 1 mg/kg for hexane in the production and fractionation of oils).

Olive Oil ClassificationContaminantsSource of ContaminationOilPolycyclic aromatic hydrocarbons (PAHs)Mostly related to drying process, during which combustion gases may come into contact with the raw materialBenzo(a)pyrene < 2.0μg/kgVegetable oils, not destined for refinementAflatoxinsOlives can be contaminated by molds when stored for long periods; contamination can potentially be transferred to olive oilB1 < 2.0μg/kgVegetable oilsDioxins and PCBs Dioxins and furans are released into the air from the combustion processes.Sum of dioxins (WHO-PCDD/F-TEQ) < 0,75 pg/g fatSum of dioxins and dioxin-like PCBS (WHO-PCDD/F-PCB-TEQ)<1,25 pg/g fatSum of PCB28, PCB52, PCB101, PCB138, PCB153 and PCB180 (ICES – 6) < 40 ng/g fatOilsHeavy metals (most commonly tested: iron, copper, caldmium, lead and mercury)Olives can be contaminated with metals from soil and air and from the use of pesticides or fertilizers, with the potential contamination of olive oil during its extraction from the fruits.Olive oil 3-monochloropropanediol (3-MCPD), 3-MCPD fatty acid esters and glycidyl fatty acid esters3-MCPD and its esters can be formed in heat-processed fat-containing foods from glycerol or acyl glycerides, in the presence of chloride ions. Glycidyl fatty acid esters (GEs) are processing induced contaminants primarily found in refined fats and oils, and foods containing fats and oils.(composed of refined olive oil and virgin olive oil): contaminant level < 1250μg/kgVegetable oilsInherent plant toxins (Erucic acid)A natural occuring plant toxin (not significantly high in olive oils)20.0 g/kg+E11G9:I14Maximum Levelsum of benzo(a)pyrene,benz(a)anthracene, benzo(b)fluoranthene and chrysene < 10.0μg/kgSum of B1, B2, G1 and G2 < 4.0 μg/kg0.10 mg/kg wet weightPomace olive oil: contaminant level < 2500 μg/kg

Extraction solvent limits (e.g. the use of acetone is prohibited in the refining of olive-pomace oil) apply in addition to the requirements described in

Commission Regulation (EEC) No 2568/91, specifically for olive oil.

Tips

- Read more about contaminants on the European Commission factsheet on food contaminants and check, at a regular basis, the maximum contaminant levels in the Annex of Regulation (EC) 1881/2006 or in the CBI Product Factsheet – Olive Oil Germany .

- Maintain good contact with your clients who can highlight changes in regulations affecting the olive oil product.

- Keep an eye out on border rejections and alerts for specific olive oil on the RASFF Portal under the product category ‘Fats and oil’. Browsing these lists can help you to learn about common problems faced by suppliers during border controls and to adopt appropriate measures to avoid them. Examples include adulteration and contamination.

- Find out more about the prevention and reduction of various olive oil contaminants on FAO’s Codex Alimentarius website for international food standards.

- Refrain from using extraction solvents that are not allowed by EU law. Refer to EU Directive 2009/32s/EC for additional information about the restriction of such solvents.

Packaging and Labelling

All goods marketed in the European Union are subject to general legislation on legislation on packaging and liability .Packaging Requirements

Olive oil packaging volume and material varies according to the destination. Bulk packaging includes various sizes and

containers, such as steel drums, reusable (intermediate) bulk plastic containers, flexi tanks and truck cisterns. Bulk

packaging can vary in size and range from 200 kg (drums) to over 20 tonnes (flexi tanks). For the food service sector,

most pack sizes vary between 5 kg and 25 kg and very often tin cans are used. For specialized olive oil stores and the

food service sector, olive oil is also packed into special dispensers between 5 L and 15 L, or in bag-in-box packaging.

For retail sales of olive oil, the maximum container capacity should not exceed 5 liters, according to the European olive oil marketing regulation. Such packaging shall be fitted with an opening system that can no longer be sealed after the first time it is opened. Packaging can be larger if the oil is sold to food service (restaurants, hotels) or public segments (hospitals, governments). The most preferred packaging is a dark-colored glass bottle that protects the oil from light. Transparent bottles do not protect the oil from light, which induces oxidation reactions.

Glass is the preferred type of retail packaging, mostly due to consumer preferences and image of quality olive oil. Still, olive oil is packed in many other materials for retail sales, including plastic bottles (such as PET and PVC), aluminum cans, tinplate cans and coated paperboard. Even ceramics is used for some premium olive oils.

Another packaging requirement is that the content in the packaging corresponds to the indicated quantity (in weight or volume) on the label. Importers check the packaging size and weight to ensure that pre-packed products are within the limits of tolerable errors. Most common sizes of retail olive oil bottles in Europe are between 0.5 and 1 liter. Premium olive oils are mostly packed in sizes of 0.5 L and 0.75 L. Sometimes it is packed into smaller bottles of 100 ml, 250 ml, and even 20 ml single-use bottles for restaurants and catering.

According to the EU olive oil marketing regulation, extra virgin olive oil (EVOO) can only be sold in single-use sealable containers for retail sale; refilled dispensers should only be used for flavor-infused olive oil.

For retail sales of olive oil, the maximum container capacity should not exceed 5 liters, according to the European olive oil marketing regulation. Such packaging shall be fitted with an opening system that can no longer be sealed after the first time it is opened. Packaging can be larger if the oil is sold to food service (restaurants, hotels) or public segments (hospitals, governments). The most preferred packaging is a dark-colored glass bottle that protects the oil from light. Transparent bottles do not protect the oil from light, which induces oxidation reactions.

Glass is the preferred type of retail packaging, mostly due to consumer preferences and image of quality olive oil. Still, olive oil is packed in many other materials for retail sales, including plastic bottles (such as PET and PVC), aluminum cans, tinplate cans and coated paperboard. Even ceramics is used for some premium olive oils.

Another packaging requirement is that the content in the packaging corresponds to the indicated quantity (in weight or volume) on the label. Importers check the packaging size and weight to ensure that pre-packed products are within the limits of tolerable errors. Most common sizes of retail olive oil bottles in Europe are between 0.5 and 1 liter. Premium olive oils are mostly packed in sizes of 0.5 L and 0.75 L. Sometimes it is packed into smaller bottles of 100 ml, 250 ml, and even 20 ml single-use bottles for restaurants and catering.

According to the EU olive oil marketing regulation, extra virgin olive oil (EVOO) can only be sold in single-use sealable containers for retail sale; refilled dispensers should only be used for flavor-infused olive oil.

Food Contact Materials

Specific health control provisions apply to consumer packaging materials that come into contact with food (e.g. bottles, containers). For example, food contact materials made from recycled or other plastic and ceramic must be manufactured in a manner that prevents them from transferring constituents to food in quantities that could endanger human health, change the composition of the food in an unacceptable way or cause deterioration in the flavor and odor of foodstuffs. Commonly restricted substances include vinyl chloride monomer N-nitrosamines, N-nitrosatable BADGE, NOGE, BFDGE and heavy metals.

Tips

- The European Union legislation on food contact materials is quite extensive. It is not easy to prove to your EU importer that your product complies with all requirements. For this reason, EU importers of food products require documentation on toxicology and risk assessment of chemical migration from food contact materials and/or declarations of compliance.

- One interesting substance of which suppliers should be aware is Bisphenol A (BPA), which is known for its use in plastic bottles. Although the use of BPA is still allowed in the European Union, recent discussions have led some buyers to ban it.

- For a full overview of requirements for olive oil, consult the EU Export Helpdesk, selecting product code 1509 (olive oil), as well as specific origin (e.g. Lebanon) and export destination (e.g. Germany).

Labelling Requirements

European olive oil marketing standards regulate the information that must be placed on the label and what optional

information can be included. According to these regulations, virgin olive oils must be labelled with a ‘designation of

origin’. However, it is enough to state that the oil is produced within or outside the European Union, or as blend of

different origins.

European food labelling legislation requests nutritional information. The minimum font size for the mandatory information is 1.2 mm. European health claims regulations prohibit claims that any food can cure illnesses. Currently allowed health claims labelling for olive oil include only polyphenols, oleic acid, vitamin E and monounsaturated and polyunsaturated fatty acids. Beneficial effects of polyphenols can only be used on the label for olive oil that contains at least 5 mg of hydroxytyrosol and derivates per 20 g of olive oil. EU approval requires nutrition or health claims to be based on scientific evidence and to have advance approval from the European Food Safety Agency (EFSA).

European food labelling legislation requests nutritional information. The minimum font size for the mandatory information is 1.2 mm. European health claims regulations prohibit claims that any food can cure illnesses. Currently allowed health claims labelling for olive oil include only polyphenols, oleic acid, vitamin E and monounsaturated and polyunsaturated fatty acids. Beneficial effects of polyphenols can only be used on the label for olive oil that contains at least 5 mg of hydroxytyrosol and derivates per 20 g of olive oil. EU approval requires nutrition or health claims to be based on scientific evidence and to have advance approval from the European Food Safety Agency (EFSA).

Allergens

Pre-packed products (e.g. olive oil in consumer packaging) that contain allergens must be labelled in such a way that the presence of allergens is clearly visible to consumers. Under Regulation (EU) No 1169/2011, allergens must be highlighted in the list of ingredients. Requirements concerning allergen information also apply to foods that are not pre-packed, including those sold in restaurants and cafés. Although olive oil allergies are quite uncommon, undisclosed and illegal fillers (e.g. those containing nut oils) could be fatal to some consumers.

Tips

- Labelling requirements for olive oil are supplemented by the Implementing Regulation (EU) No 29/2012 on marketing standards for olive oil, which addresses product-specific requirements. The section ‘Products specifications’ covers labeling.

- Perform laboratory tests only in ISO/IEC 17025:2005 accredited laboratories.

- Train employees inside your company to perform in-company sensory tests for the regular monitoring of olive oil quality. Follow ISO 8586:2012 training guidelines for sensory assessors.

- To be prepared for potential new changes in the MRLs, read the Ongoing Reviews of MRLs in the European Union.

- Read more about transport and storage conditions of olive oil on the websites of Transport Information Service. and Cargo Handbook. Packaging material and storage condition can impact the outcome of sensorial tests and phenol levels.

- Read CBI study about buyer requirements for processed fruit and vegetables for a general overview of buyer requirements in Europe.

- Refer to Annex II of Regulation (EU) No 1169/2011 for an overview of all allergens.

Quality Requirements

The different categories of olive oils are graded according to quality parameters relating to the physical-chemical features and the organoleptic (sensory) features. High-quality olive oil is commonly defined as the oil with low acidity, high content of polyphenols and good flavor.The main chemical features related to quality are the acidity level, peroxide index, fatty acid content and sterols composition. Olive oil chemical composition depends mainly on olive cultivars, production region, olive health condition, freshness and production process. Low acidity levels indicate higher quality olive oil. Acidity increases when olives are too mature (fermentation starts), when temperature during crushing is too high, and when the time between harvest and pressing is too long. Storing time also increases acidity.

Chemical tests alone are not enough to establish quality category in olive oil. Additional sensory testing is necessary to define characteristics such as fruitiness and the absence of organoleptic defects. Sensory tests are required only for virgin olive oils and they are performed by a team (panel group) of 8–12 qualified assessors, who participate yearly in proficiency tests to prove their competence.

Sensory tests are performed by smelling and tasting. Bitter taste is frequently related to olive oils produced from green olives or olives turning color, while pungency is related to olive oil produced from unripe olives. Fruitiness, bitterness and pungency are perceived to be positive characteristics. Extra virgin olive oil must not have any sensory defects and must have an average sensory fruity attribute above zero. Virgin olive oil can have sensory defects between 0 and 3.5.

Extra virgin olive oil of protected origin can have unique sensory properties. For these oils and for premium olive oils, additional sensory attributes are evaluated, such as artichoke, citrus, flowers, grass, green and herbs. Fermentation of olive oils is not allowed, according to standards.

Olive Oil Composition

EU olive oil legislation

defines the different categories of olive oils and olive pomace oils, as well as the relevant

methods of analyses

to be used by Member States’ control authorities. European legislation is in line with

standards of the International Olive Council (IOC)

.

Sales of fake or falsely declared olive oil in Europe is prevented through regular controls. Each European country must perform certain number of controls to ensure that marketing standards for olive oils are respected.

Authenticity tests on olive oil are performed to avoid fraud. Common frauds include adding cheaper vegetable oil, false quality grading, false organic certification and false geographical origin. Authenticity tests include detecting the amount of wax (revealing the presence of pomace oil), 2-glyceril-monopalmitate (the presence of re-esterified oils), stigmastadienes (the addition of refined oil), ECN42 (the addition of seed oil) and fatty acid composition (to find out if olive oil is a blend). There are also several other tests for authenticity.

Buyers and EU customs authorities may reject products with undeclared, unauthorized (e.g. mineral oil, Sudan 4 color) or high contents of extraneous materials. Specific EU legislation applies to additives and enzymes (e.g. colors, thickeners) and to flavorings . The substances that are allowed for use in food products are listed as E-numbers, which indicate approval by the EU. To obtain an E-number, an additive must have been fully evaluated for safety by the competent food safety authorities in the EU (EFSA). The use of extraneous materials is generally not allowed for olive oil, and caution is advised when using flavorings (e.g. truffle), as they are subject to this specific legislation.

Sales of fake or falsely declared olive oil in Europe is prevented through regular controls. Each European country must perform certain number of controls to ensure that marketing standards for olive oils are respected.

Authenticity tests on olive oil are performed to avoid fraud. Common frauds include adding cheaper vegetable oil, false quality grading, false organic certification and false geographical origin. Authenticity tests include detecting the amount of wax (revealing the presence of pomace oil), 2-glyceril-monopalmitate (the presence of re-esterified oils), stigmastadienes (the addition of refined oil), ECN42 (the addition of seed oil) and fatty acid composition (to find out if olive oil is a blend). There are also several other tests for authenticity.

Buyers and EU customs authorities may reject products with undeclared, unauthorized (e.g. mineral oil, Sudan 4 color) or high contents of extraneous materials. Specific EU legislation applies to additives and enzymes (e.g. colors, thickeners) and to flavorings . The substances that are allowed for use in food products are listed as E-numbers, which indicate approval by the EU. To obtain an E-number, an additive must have been fully evaluated for safety by the competent food safety authorities in the EU (EFSA). The use of extraneous materials is generally not allowed for olive oil, and caution is advised when using flavorings (e.g. truffle), as they are subject to this specific legislation.

Tips

- The International Olive Council has specific standards and guidelines for quality control within the olive oil industry, covering various stages of production in mills, refineries, packing plants and olive-pomace extraction plants.

- For an overview of E-numbers, refer to the Annex to Regulation 1333/s2008 (see under Consolidated versions). Additional information is available in the CBI Buyer Requirements for the sector including natural colors, flavors and thickeners.

What Additional Requirements Do Buyers Often Have?

Buyer requests have become equally important to mandatory requirements.Specific Quality Characteristics

Some buyers may have special quality preferences for olive oils in terms of intensity and olive ripeness. All olive oils

can be classified as intense (robust), medium and light (delicate). Intensity is defined by fruitiness, bitterness and

pungency. Depending on the harvest time, olive oil can be produced from unripe olives (green), from ripe olives and from

a combination of both. Other preferences include infused, organic, monovarietal and olive oils from specific regions.

Some buyers specialize in premium olive oils. Although there is no official European categorization of premium olive oil, it is commonly understood as olive oil that has an extremely low acidity level, if possible, less than 0.3 g per 100 g. Premium olive oils are also promoted with remarkably high positive sensory attributes. The most common marketing method for premium olive oil is through international olive oil competitions. When olive oil wins competition awards, it is then commonly promoted as ‘premium’, ‘high-end’ or ‘superior quality’.

Some buyers specialize in premium olive oils. Although there is no official European categorization of premium olive oil, it is commonly understood as olive oil that has an extremely low acidity level, if possible, less than 0.3 g per 100 g. Premium olive oils are also promoted with remarkably high positive sensory attributes. The most common marketing method for premium olive oil is through international olive oil competitions. When olive oil wins competition awards, it is then commonly promoted as ‘premium’, ‘high-end’ or ‘superior quality’.

Food Safety Certification

Food hygiene (based on HACCP methodology) is a legislative requirement for producers and exporters of olive oil entering European market.

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established European importers will not work with you if you cannot provide some type of comprehensive food safety certification. Compliance with such Tips The International Olive Council has specific standards and guidelines for quality control within the olive oil industry, covering various stages of production in mills, refineries, packing plants and olive-pomace extraction plants. For an overview of E-numbers, refer to the Annex to Regulation 1333/s2008 (see under Consolidated versions). Additional information is available in the CBI Buyer Requirements for the sector including natural colors, flavors and thickeners. additional standards can allow olive oil exporters to enter specific market segments or gain competitive advantages relative to their competitors. Certifications concerning general quality and food safety management systems from recognized and trustworthy sources demonstrate the supplier’s commitment to high and consistent quality and safety. This is highly relevant to the production and handling of olive oil, especially for olive oil in consumer packaging. As a general rule, quality management requirements become stricter at higher levels of processing and packaging.

Most European buyers, especially large retailers and private label manufacturers, will ask for Global Food Safety Initiative (GFSI) recognized certification. For olive oil, the most popular certification programs recognized by GFSI are:

This list is not exhaustive and food certification systems are constantly developing.

Although the various food safety certification systems are based on similar principles, some buyers prefer one specific standard over the other. For example, IFS is often required by German retailers. Food safety certification is only a basis to start exporting to Europe. Serious buyers will usually visit or audit your production facilities before buying.

Although food safety certification is not obligatory under European legislation, it has become a must for almost all European food importers. Most established European importers will not work with you if you cannot provide some type of comprehensive food safety certification. Compliance with such Tips The International Olive Council has specific standards and guidelines for quality control within the olive oil industry, covering various stages of production in mills, refineries, packing plants and olive-pomace extraction plants. For an overview of E-numbers, refer to the Annex to Regulation 1333/s2008 (see under Consolidated versions). Additional information is available in the CBI Buyer Requirements for the sector including natural colors, flavors and thickeners. additional standards can allow olive oil exporters to enter specific market segments or gain competitive advantages relative to their competitors. Certifications concerning general quality and food safety management systems from recognized and trustworthy sources demonstrate the supplier’s commitment to high and consistent quality and safety. This is highly relevant to the production and handling of olive oil, especially for olive oil in consumer packaging. As a general rule, quality management requirements become stricter at higher levels of processing and packaging.

Most European buyers, especially large retailers and private label manufacturers, will ask for Global Food Safety Initiative (GFSI) recognized certification. For olive oil, the most popular certification programs recognized by GFSI are:

- International Featured Standards (IFS): This standard corresponds to ISO 9001, but with a focus on food safety, HACCP, hygiene, the manufacturing process and business surroundings. The IFS is a quality and safety standard published by the union of German supermarket chains, HDE (Hauptverband des Deutschen Einzelhandels).

- British Retail Consortium Global Standards (BRCGS): This private institution promotes private (BRC) standards, which contain rules on Good Manufacturing Practices (GMP) that extend beyond the HACCP plan (e.g. regarding organization and communication).

- ISO 22000: This standard combines the HACCP plan with prerequisite programs (PRPs) . It specifies requirements for a food safety management system along the food chain, up to the point of final consumption.

- Food Safety System Certification (FSSC 22000): This standard is based on the existing international standards ISO 22000 and ISO/TS 22002-1.

This list is not exhaustive and food certification systems are constantly developing.

Although the various food safety certification systems are based on similar principles, some buyers prefer one specific standard over the other. For example, IFS is often required by German retailers. Food safety certification is only a basis to start exporting to Europe. Serious buyers will usually visit or audit your production facilities before buying.

Tips

- Take a self-assessment using the producer starter kit on the Amfori BSCI website.

- Consult with your preferred buyers about their certification preferences to select the right food safety certification company.

- Read more on the different Food Safety Management System on the Standards Map .

What Are the Requirements for Niche Markets?

Organic Olive Oil

To market olive oil as organic in Europe, the olives must be grown according to organic production methods under

European

legislation.

Growing and processing facilities must be audited by an accredited certifier before exporters can put the European

Union’s organic logo on the bottle, as well as

the logo of the standard holder, for example,

Naturland

in Germany. A specific niche opportunity to sell organic olive oils at higher prices is to follow

Demeter’s

rules of biodynamic certification.

Importing organic products to Europe is only possible with an electronic certificate of inspection (e-COI). Each batch of organic products imported into the European Union has to be accompanied by an electronic certificate of inspection as defined in the regulation covering imports of organic products from third countries . This electronic certificate of inspection has to be generated via the Trade Control and Expert System (TRACES).

Importing organic products to Europe is only possible with an electronic certificate of inspection (e-COI). Each batch of organic products imported into the European Union has to be accompanied by an electronic certificate of inspection as defined in the regulation covering imports of organic products from third countries . This electronic certificate of inspection has to be generated via the Trade Control and Expert System (TRACES).

Tips

- Companies must comply with the EU Regulation (Council Regulation (EC) No 834/2007 and Commission Regulation (EC) No 889/2008 (OJ L-250 18/09/2008) for organic production and labelling, which does constitute a legal requirement. Commission Regulation (EC) No 1235/2008 of 8 December 2008 establishes detailed rules for the implementation of Council Regulation (EC) No 834/2007 and its latest amendments, with regard to arrangements for importing organic products from third countries. This regulation is available on the EUR-Lex website

- Investigate possibilities for organic certification, including the opportunities and costs involved in the process.

- For information on organic certification in Europe, visit the website of Organic Farming in the European Union, which also contains guidelines concerning the import of organic products. For information on certification standards, consult the International Federation of Organic Agriculture Movements (IFOAM) website.

- To become acquainted with Germany's national organic label, consult the Bio-Siegelwebsite.

- For additional information on organic certification standards consult the Standards Map database

Sustainability Certification

Sustainability is a broad term with many aspects, and there is still no recognized sustainability certification covering

all aspects. One increasingly used aspect is to publish CO2 emission rates on products, but it is difficult to have

reliable measurements for those claims. In olive oil production, sustainability is mostly promoted through waste

reduction and by using production waste as biomass. Currently, the most famous certification schemes focus on

environmental impact and ethical aspects.

Several sustainability private certifications, standards, audits and initiatives are already well known. Some focus on social and ethical impacts, such as FairTrade, SMETA, Ethical Trading Initiative, amfori BSCI, BCorp or Fair for Life . Some focus on a wider range of environmental issues such as Rainforest Alliance or ISO 14000, while some only deal with CO2 emission such as MyClimate or Carbon Footprint Certification.

There are also certification schemes that use a wide range of aspects, often based on ISO 26000 Guidance . One relatively new certification scheme supporting several sustainability aspects is Planet Proof . Planet Proof includes several themes such as energy and climate, crop protection, biodiversity and landscape, soil fertility, clean water, packaging and waste.

German buyers may expect you to comply with supplier codes of conduct regarding social responsibility, which are often based on the ILO labor standards . Some companies require adherence to their code of conduct or one or more of the common standards, such as the Supplier Ethical Data Exchange (SEDEX) , Ethical Trading Initiative (ETI), and Business Social Compliance Initiative code of conduct (BSCI) . If the olive oil is meant for the retail segment, suppliers will be asked to follow a code of conduct developed by the specific retailer. Many retailers have their own codes of conduct (such as Lidl and Rewe ).

Corporate responsibility initiatives also affect you as a supplier. Common requirements include signing a code of conduct for suppliers, in which you declare that you conduct your business in a responsible manner. More specifically, you declare that you (and your suppliers) observe such measures as respecting local environmental and labor laws and avoiding corruption. These

Several sustainability private certifications, standards, audits and initiatives are already well known. Some focus on social and ethical impacts, such as FairTrade, SMETA, Ethical Trading Initiative, amfori BSCI, BCorp or Fair for Life . Some focus on a wider range of environmental issues such as Rainforest Alliance or ISO 14000, while some only deal with CO2 emission such as MyClimate or Carbon Footprint Certification.

There are also certification schemes that use a wide range of aspects, often based on ISO 26000 Guidance . One relatively new certification scheme supporting several sustainability aspects is Planet Proof . Planet Proof includes several themes such as energy and climate, crop protection, biodiversity and landscape, soil fertility, clean water, packaging and waste.

German buyers may expect you to comply with supplier codes of conduct regarding social responsibility, which are often based on the ILO labor standards . Some companies require adherence to their code of conduct or one or more of the common standards, such as the Supplier Ethical Data Exchange (SEDEX) , Ethical Trading Initiative (ETI), and Business Social Compliance Initiative code of conduct (BSCI) . If the olive oil is meant for the retail segment, suppliers will be asked to follow a code of conduct developed by the specific retailer. Many retailers have their own codes of conduct (such as Lidl and Rewe ).

Corporate responsibility initiatives also affect you as a supplier. Common requirements include signing a code of conduct for suppliers, in which you declare that you conduct your business in a responsible manner. More specifically, you declare that you (and your suppliers) observe such measures as respecting local environmental and labor laws and avoiding corruption. These

Tips

- Check the guidelines for imports of organic products into the European Union to familiarize yourself with the requirements of the European organic market.

- Provide specific information to final consumers about your sustainability approach. You can use the internet, social media and even product packaging to tell your story and promote the positive effects on the communities where production takes place. This will be especially important for younger consumers in Europe, who want to know the story behind the brands they buy.

- Use sustainable approaches not only to satisfy consumers but also to improve production efficiency and to cut costs. Consider using sustainability services and tools such as Fair Match Support to track , analyze and improve your sustainability. Get familiar with social and ethical standards on the International Trade Centre’s Sustainability Map portal. You can use ISO 26000 guidance to improve your business’ sustainability.

- In selecting suppliers, German and other European buyers likely look for exporters who have adopted appropriate codes of conduct and targets for improvement in such key areas as child labor and the environmental footprint of the company. Key references at the international level include the UN Global Compact and ISO 26000 on Social Responsibility.

- The implementation of a management system (e.g. ISO 14000 for environmental aspects; ISO 45001 for occupational health and safety; SA 8000 for social conditions) is a complementary strategy for addressing sustainability and, possibly, for gaining a competitive advantage on the German market.

- Before implementing such systems, however, it is important to consult current or potential buyers to determine the extent to which they require and/or appreciate such standards.

Ethnic Certification

Islamic dietary laws (Halal) propose specific restrictions in diets. If you want to focus on the Islamic ethnic niche markets, consider implementing

Halal certification schemes.

Which Quality Support Organizations in Lebanon Can Help Me?

Lebanese Agricultural Research Institute (LARI) is a governmental organization under the Minister of Agriculture Supervision. The institute conducts applied and basic scientific research for the development and advancement of the agricultural sector in Lebanon. Extension services for farmers include management of soil fertility, water consumptive use, plant pest and disease control, crop rotation, and animal disease treatment and prevention, among others.The Lebanese Standards Institution (LIBNOR) is a public institution attached to the Ministry of Industry. It was established on July 23, 1962 by a law giving it solely the right to prepare, publish, and amend national standards, as well as to grant the Lebanese Conformity Mark NL. Lebanese standards are prepared by technical committees formed by LIBNOR. They include setting the dimensions, conventions, symbols, and the definition of product quality, as well as the methods of testing and analysis. They also include the codes of practice for professional and structural work.

Industrial Research Institute (IRI) is registered as a Lebanese nonprofit institution. It provides, on an international scientific level, reliable services in testing and analysis and also grants certificates of quality or conformity with standards and purchase specifications. It provides specialized technological, management, and economic consulting services to existing industries and industrial development schemes.

Chamber of Commerce, Industry, and Agriculture of Beirut and Mount Lebanon (CCIA-BML) is a non-profit private organization operating under Decree Law 36/67. The Lebanese Chambers are the sole providers of consular services, including certification of origin and authentication of commercial documents. Also, the chambers conduct training, develop partnerships, and organize matchmaking events and exhibitions, among other services. The CCIA-BML operates the Lebanese Training Center, which provides managerial and technical training for Lebanese enterprises. In addition, the Chamber of Commerce, Industry, and Agriculture of Tripoli and North Lebanon provides quality control center laboratories, among other services.