Market: Trade Statistics, Trends

Production, Consumption, and Exportation Trends

Canada is a major consumer of pickles worldwide. Some of the pickles are produced in Canada, while a large portion is imported from other countries. In fact, there are 253 establishments that are engaged in preserving fruits and vegetables by canning, pickling, brining, and dehydrating as of 2020, with 84.2% of companies having less than 100 employees. Moreover, 42.7% of these establishments are located in Ontario, 28% in Quebec, 14.6% in British Columbia, 6.3% in Alberta, 4% in Nova Scotia, 1.6% in Saskatchewan, 1.2% in Prince Edward Island, and 0.8% in each of Manitoba and New Brunswick. Additionally, employers’ establishments represented 54.9% and non-employers represented 45.1%. The majority of employers’ establishments were small-sized companies (54% of total employers‘ establishments), followed by micro-companies with 30%. The data of 155 companies shows that 78% of these firms were profitable in 2019, and the annual revenues of all firms ranged between $30,000 and $5m. Furthermore, the manufacturing revenues increased from $2.1bn in 2015 to $3bn in 2018, while the cost of materials and supplies increased from $1.7bn in 2017 to $1.9bn in 2018. Also, the cost of energy, water, and vehicle fuel costs reached $78.5m in 2018. In addition, unlike the previous trends that supported the consumption of fresh products, processed vegetables witnessed an increase in popularity . The consumption of fresh vegetables represented 64.6% of total vegetables, followed by preserved vegetables (27%), frozen vegetables (7.8%), and juices (0.4%).However, the production of some types of pickles, like the cornichon, has been declining since the main distributors have been increasingly importing from other countries such as India and the U.S. Moreover, Canada’s exports of pickles grew by a compounded annual growth rate of 18.6% from 2016 to reach $11.8m in 2020, with 99% being absorbed by the U.S, as a first destination.

Import Trends

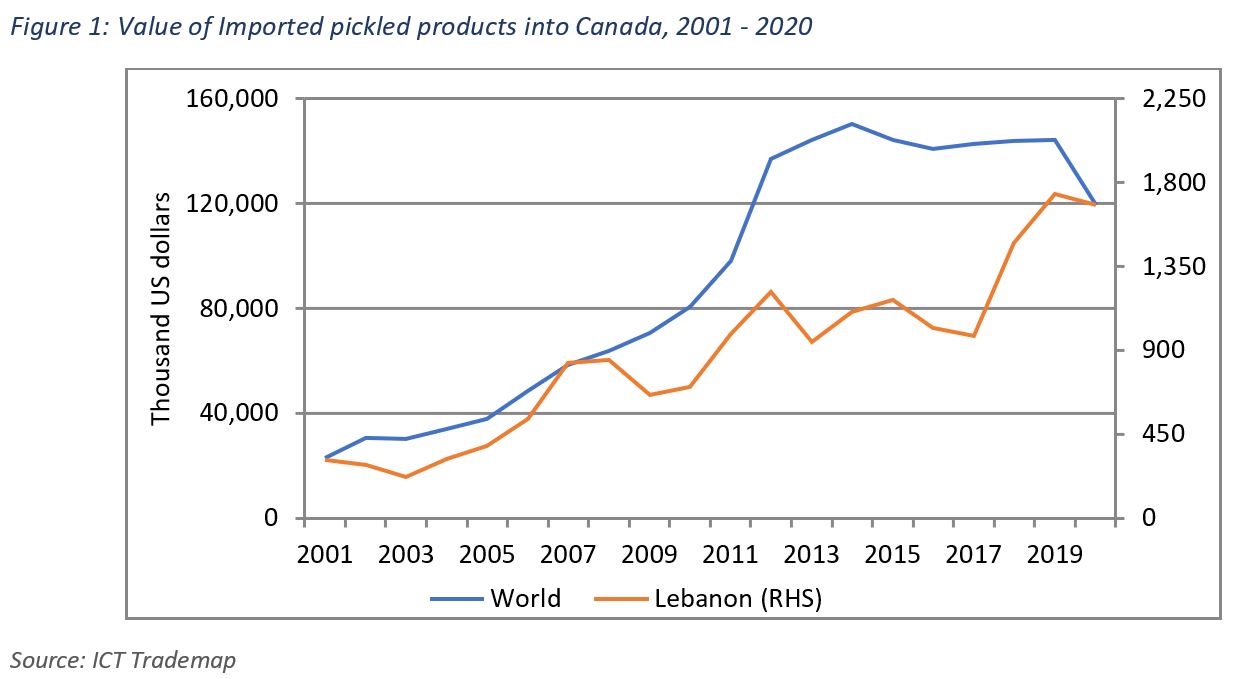

Canada is a net importer of pickled products, under HS code 2001 “vegetables, fruits, and nuts and other edible parts of plants, prepared or preserved by vinegar or acetic acid”. In fact, imports of pickled products grew by a compounded annual growth rate of 10.8% between 2000 and 2019 to reach $144.2m before declining significantly to $119.3m in 2020, amid the disruption in global trade due to the COVID-19 pandemic.Canada’s imports of pickled products witnessed significant growth over the years. In fact, they grew by 34% in value in 2002, by 28% and 21% in 2006 and 2007, respectively, and by 22% and 40% in 2011 and 2012, respectively. In 2020, Canada ranked as the 4th largest pickle importer worldwide. However, they declined in 2015 and 2016, and subsequently grew at a slower rate of 1.5% in 2017, 0.8% in 2018, and 0.3% in 2019. Moreover, Canada’s imports of pickled products from Lebanon grew significantly between 2004 and 2007, and in 2011, 2012, 2018, and 2019, reaching a peak of $1.74m in 2019, but declining to $1.68m in 2020, mainly due to the COVID-19 pandemic-related disruptions. Back in 2001, Canada’s imports of Lebanese pickled products were only about $312,000. In 2020, Lebanese exports constituted 1.4% of Canada’s imports of pickled products, whereas Canada’s imports constituted 9% of Lebanon’s exports of pickles.

Share of Imports and Unit Price in 2020

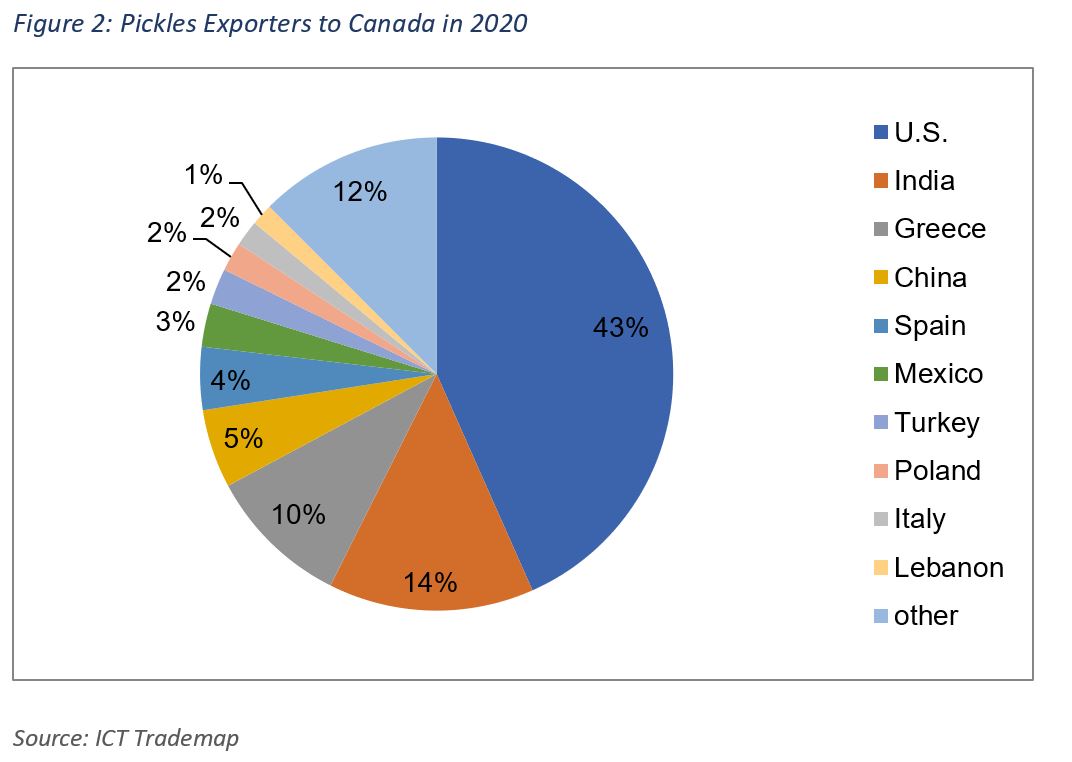

The U.S. is the main exporter of pickles to Canada, with a share of 43% in 2020. India followed with 14%, Greece (10%), China (5.4%), Spain (4.3%), Mexico (3%), Turkey (2.5%), Poland (2%), Italy (1.8%), Lebanon (1.5%), South Korea (1.3%), Germany (1.2%), and Pakistan (1%).In terms of quantity, the U.S.’s exports of pickles represent 48% of the total quantity imported by Canada. India followed with 20%, Greece and China (5% each), Mexico (3%), Turkey (2.6%), Poland (2.5%), Spain (1.9%), Lebanon (1.6%), Egypt (1.2%), Germany (1.1%), and Italy (0.8%).

The world average imported unit value in 2020 was $1,454/ton. The unit value of imports from France, Spain, Italy, Greece, Korea, Pakistan, Thailand, Germany, and China exceeded the world average. In fact, the unit value of imports from France, Spain, and Italy exceeded double the unit value of the world average. Those from Mexico, Turkey, the U.S., Poland, and India came below the world average. Meanwhile, pickled products from Lebanon were imported at a competitive price of $1,360/ ton in 2020 despite its comparative disadvantage in terms of transportation costs and tariffs, compared to other countries. Therefore, with a thorough study of the market and proper strategies of market entry, the Lebanese pickle export to Canada has the potential to grow.

Market Trends

Prior to the COVID-19 pandemic, imports of pickled products in Canada were mainly composed of cucumbers and gherkins that were prepared or preserved by vinegar or acetic acid, representing 50% of the total imports of pickles and other vegetables, fruits, and nuts prepared or preserved by vinegar or acetic acid. Imports of pickled cucumbers and gherkins grew by a compounded annual growth rate of 14.3% between 2001 and 2019, while the imports of other pickled products grew by a CAGR of 8.7% over the same period. In 2020, imports of other pickled products were unchanged, while imports of cucumbers and gherkins declined by 34.7% year-on-year.The most recent data from the ITC Trade Map showed that other vegetables, fruits, and nuts prepared or preserved with vinegar or acetic acid consisted of: olives (20% of total other pickled products for 2018), relishes (7.4%), onions (1.5%), while the remaining 72% consisted of other vegetables, fruits, nuts, and other parts of plants (HS codes 2001909090 and 2001909080). The growing consumer interest in pickled products in Canada, as reflected by trade figures, is mainly due to the fact that these products are served as a side dish as part of the Canadian diet, as well as in other cuisines that are gaining traction in the country.

In this context, the large appetite for new cuisines, specialty foods, and ethnic foods (mainly Mediterranean cuisine) can also drive the demand for pickles. Furthermore, the new trends of abiding by a healthy diet, as well as vegetarianism, call for a larger intake of vegetables and fruits, which can take the form of pickled products. In addition, being a large multicultural country, many communities in Canada consume different types of pickles and use a variety of recipes to occasionally make their own pickles. Historically, after the English discovered the continent, many cultures introduced different types of pickles into the region. To elaborate, the English introduced their own methods for sweet pickles, the Eastern Europeans brought several types of lacto-fermented pickles, the French communities used to produce their known spiced cornichons, the Middle Eastern populations consumed different types of pickles with a large variety of dishes (ranging from olives to cucumbers, peppers, and lemons), the Russian communities brought in recipes for pickled tomatoes, the Italians used to pickle eggplants and peppers, and finally, the Indians brought several types of pickled mangos, among others. The varieties in Canada’s culinary experience provide opportunities for Lebanese agri-food producers, especially for pickled products, to serve different recipes and different types of pickled vegetables, fruits, and nuts. While existing Lebanese pickled products could have a large potential market in Canada, some of the products might require an adjustment to the tastes requested by the Canadian market. However, such product innovation requires a deep study of the target market before launching new products.

Market Entry: Trade Channels and Segments, Selection of Channels

The majority of retail foods in Canada including processed fruits and vegetables are sold mainly at traditional grocery retailers, since consumers prefer to conveniently purchase all the products they need at the same place. Also, non-grocery retailers, like Walmart, Costco, and Alimentation Couche-Tard, among others, are increasingly including food products. However, as clients are becoming more price-sensitive and aware of local price differences, discounters are gaining traction.

Consumers are also actively shopping for processed fruits and vegetables at convenience stores. While online grocery shopping is growing slowly, online advertising is important for producers to be able to distribute their products across the country.

Pickled products enter the Canadian market mostly via two main channels:

When selecting the best distribution channels for your products, you must first:

If you are aiming to directly target consumers, you must take into consideration the positioning of your product. If the pickles are sold as Lebanese food, ethnic shops are usually the easiest way to unlock the Lebanese and Arab community in the specific region you are considering.

Going beyond the Arab community, specialty food stores can be a good place for some specific pickled products that can fit under a product mix, or high-end type products for niche consumers.

If you are aiming for a larger crowd, with a large production capacity and a relatively low price, supermarkets and big retailers tend to be a good place, especially for consumers who are price-sensitive and those who try to find all their products at the same place.

Other buyers of pickled products are:

Direct potential buyers for Lebanese pickled products:

It is important to note that many restaurants in Canada go under the association Restaurants Canada, which represents them in the food-service industry.

Consumers are also actively shopping for processed fruits and vegetables at convenience stores. While online grocery shopping is growing slowly, online advertising is important for producers to be able to distribute their products across the country.

Pickled products enter the Canadian market mostly via two main channels:

- Through the intermediary role of traders (such as importers)

- Through retailers and wholesalers

When selecting the best distribution channels for your products, you must first:

- Determine your potential clients

- Know your capacity

- Establish your product positioning and price

If you are aiming to directly target consumers, you must take into consideration the positioning of your product. If the pickles are sold as Lebanese food, ethnic shops are usually the easiest way to unlock the Lebanese and Arab community in the specific region you are considering.

Going beyond the Arab community, specialty food stores can be a good place for some specific pickled products that can fit under a product mix, or high-end type products for niche consumers.

If you are aiming for a larger crowd, with a large production capacity and a relatively low price, supermarkets and big retailers tend to be a good place, especially for consumers who are price-sensitive and those who try to find all their products at the same place.

Other buyers of pickled products are:

- Restaurants

- Catering agencies

- Hotels

Direct potential buyers for Lebanese pickled products:

- Mediterranean restaurants and caterers

- Middle Eastern (including Lebanese) restaurants and caterers

It is important to note that many restaurants in Canada go under the association Restaurants Canada, which represents them in the food-service industry.

Finding Potential Buyers

Contact points, especially for small pickle producers and exporters interested in the Canadian market, are

TFO Canada and bilateral chambers of commerce and business councils, such as the Lebanese Canadian Business Association, Chambre de Commerce et d’Industrie Canada-Liban, The Canada Arab Business Council, and the Lebanese Chamber of Commerce in Nova Scotia.

These organizations aim to promote bilateral trade and help in putting in contact business to business meetings. Contacting such organizations could help protect the exporter in cases of fraud and misrepresentation, which can sometimes be a risk when looking for potential buyers on social media and through other online resources. The services of such organizations usually include access to member companies, trade missions, workshops, roundtables and training, referrals for distribution channels, logistics, opportunities, and government-related services. TFO Canada provides services for foreign suppliers, such as an export readiness assessment tool, market insights, Canadian tradeshows, approved certificates, and connections with buyers.

Trade directories can also be helpful since they are paid online databases that provide business contacts by searching through several criteria including country, state, or city. Several platforms provide information on potential buyers like Eworldtrade and TradeKey. Additionally, online information on e-commerce, e-marketing, and online marketplaces can be found on Online Business Canada.

In addition, exporters can also approach potential customers on social media and online trade marketplaces. However, they must do due diligence to know if they are dealing with a legitimate business. They can also reach out to companies in Canada through direct (e-)mail and follow-up through personal visits or invitations of potential customers to visit their country. They may also meet with potential buyers by visiting international trade fairs.

Most of the imports of pickled cucumbers and cornichon, under HS code 200110, in Canada are imported by Conagra Brands Canada , E.D. Smith Foods, Gielow Pickles, Loblaws , Martin-Brower of Canada, Smucker Foods of Canada, Sobeys Global Sourcing, and Sysco.

In terms of other vegetables, fruits, nuts, and other edible parts of plants that are prepared or preserved by vinegar or acetic acid, the importers’ market was concentrated among 10 importers which account for about 49% of imported products in 2019. The full list of importing companies can be found on the Canadian Importers Database. The database also includes the specific companies importing pickled products from Lebanon.

Furthermore, LinkedIn can be used to look up and contact professionals who work at companies in food retail or distribution channels in Canada.

These organizations aim to promote bilateral trade and help in putting in contact business to business meetings. Contacting such organizations could help protect the exporter in cases of fraud and misrepresentation, which can sometimes be a risk when looking for potential buyers on social media and through other online resources. The services of such organizations usually include access to member companies, trade missions, workshops, roundtables and training, referrals for distribution channels, logistics, opportunities, and government-related services. TFO Canada provides services for foreign suppliers, such as an export readiness assessment tool, market insights, Canadian tradeshows, approved certificates, and connections with buyers.

Trade directories can also be helpful since they are paid online databases that provide business contacts by searching through several criteria including country, state, or city. Several platforms provide information on potential buyers like Eworldtrade and TradeKey. Additionally, online information on e-commerce, e-marketing, and online marketplaces can be found on Online Business Canada.

In addition, exporters can also approach potential customers on social media and online trade marketplaces. However, they must do due diligence to know if they are dealing with a legitimate business. They can also reach out to companies in Canada through direct (e-)mail and follow-up through personal visits or invitations of potential customers to visit their country. They may also meet with potential buyers by visiting international trade fairs.

Most of the imports of pickled cucumbers and cornichon, under HS code 200110, in Canada are imported by Conagra Brands Canada , E.D. Smith Foods, Gielow Pickles, Loblaws , Martin-Brower of Canada, Smucker Foods of Canada, Sobeys Global Sourcing, and Sysco.

In terms of other vegetables, fruits, nuts, and other edible parts of plants that are prepared or preserved by vinegar or acetic acid, the importers’ market was concentrated among 10 importers which account for about 49% of imported products in 2019. The full list of importing companies can be found on the Canadian Importers Database. The database also includes the specific companies importing pickled products from Lebanon.

Furthermore, LinkedIn can be used to look up and contact professionals who work at companies in food retail or distribution channels in Canada.

Export Promotional Activities

According to Uber Eats, “Extra pickles” was the most popular special instruction in Calgary, Edmonton, Halifax, Hamilton, London, Ottawa, Toronto, and Winnipeg. To elaborate, the Uber Eats Cravings Report showed that Canadians wanted spice and extra pickles among their meals. Canadians have a tendency towards a piquant palate, seeking more salt and vinegar concoctions . Also, Uber Eats revealed that in Victoria consumers wanted their pickles gluten-free. Furthermore, the ‘sweet mixed pickles’ are among the most popular commercial type, followed by mustard pickles in the Maritimes, and also followed by pasteurized dills in other parts of the country. In cities with large foreign-born populations, kosher dills, laden with garlic, and Polish dills, fiery with hot red pepper pods are in high demand. Therefore, marketing strategies should take these types of pickled products and flavors into consideration when tackling the Canadian markets for pickles.

As such, it is important to know the flavors requested by the consumers in the region you are aiming to target to compare with the products you already have and produce, so that you try, if possible, to adjust the product to fit the new market. Therefore, it would be advantageous to look for markets in Canada where consumers prefer tastes and types of pickles that you already provide, which can reduce the adjustments you might apply to your recipes and products.

Moreover, if you are aiming to go beyond the Arab and Mediterranean communities and reach a larger base of consumers, you might want to consider looking at the main pickle brands sold in the market.

Known Canadian brands include Bick’s, Lakeside, and Whyte’s brands like Stub’s, Coronation, and Mrs. Whyte’s. It is worth mentioning that the common features that these brands share in their messaging are the quality of the pickles, the methods of preparing the pickles, and the freshness of the products, as well as maintaining the traditions, among others. In addition, Alchemy Pickle Company, which operates in Toronto, highlights other features like being grown organically, always vegan, free from gluten, and hand-packed.

On a similar note, large producers of pickles show their products in the jar so that consumers can see the freshness of the product and the shape of the food. Thus, it can be deduced that clear packaging is crucial for consumers to notice the quality of the product. In other words, the sensory appeal is critical for customers, as the product should look pleasant and appetizing. Furthermore, brand messaging, online presence, packaging, and labels are very important factors to attract consumers. The packaging is the first thing that customers see on the shelf; in other words, the first impression of the pickles brand. When branding, marketers should determine the drivers of the brand and incorporate brand associations with those drivers. A strong marketing story could be one of those drivers.

In addition, an illustration of the taste and the characteristics of the pickle jar are central to the brand’s marketing strategy. A statement of identity is also important as it is one of the first things customers identify on the package.

Similarly, prices are another very important factor for Canadian grocery shoppers. As such, a competitive pricing strategy could prove important to gain market share, unless you can position your brand as a unique specialty food.

It is important to mention the health benefits or to include indications that show that the product is healthy, taking into consideration the rising health concerns and awareness among Canadians. Also, other statements and certificates which could show how the producer share environmental concerns with consumers are an advantage in reaching a larger crowd, as Canadians increasingly ask if companies adopt high ethical and green standards in their value chains.

In addition, consumers are increasingly looking for customized products as per their specific needs. In response, small- and medium-sized enterprises are designing niche products, while empowering their customer base to compete with larger producers. Some producers are highlighting certain aspects of their customized products like fitting for a special diet, varied tastes, or athletic needs.

A personal narrative can also attract consumers through advertisements and trade shows. This can cover the origin of the vegetables and fruits, the production methods (especially if they are traditional), the ingredients (what they add to the product), and the environmental and social impacts (substantiated with certificates).

Moreover, if your pickle brand has a promotional website, make sure it is mobile-friendly, optimized for Google (Search Engine Optimization - SEO), and straightforward and easy to navigate. You can also opt for paid advertising to increase the visibility of your website and consider the retarget option. Another option is to generate organic traffic from content which could be increased through email marketing, blogs (such as free recipes and engaging video tutorials), and an SEO-optimized website.

It is also important to point out that a strong social media presence is essential for a business nowadays. Therefore, you should work on posting regularly using consistent branding and information across social media platforms, using linked profiles. Also, make sure to be creative in your posts by running contests or providing food pairing suggestions that go along with your products. You can also make use of Facebook to interact with customers, advertise promotions, and help locate the nearest retail store with your product. Lastly, you can utilize Instagram to showcase your pickles in attractive photos or useful videos and to partner with influencer chefs.

Check the websites of Canadian trade shows and exhibitions to keep up with the newest trends. Food fairs in Canada include SIAL Canada, as well as the trade shows provided by the Canadian Federation of Independent Grocers, those of the Canadian Health Food Association (dedicated to natural health and organic products), the Canadian National Exhibition, the National Women’s Show, the Gluten Free Expo, and Planted Expo (Canada’s largest plant-based event).

It is also important to have a distributor, since promoting your brands without being able to distribute them in the target market may harm your sales.

The Embassy of Lebanon to Canada has created a free platform named Mouneh Box, which displays pre-packaged boxes of traditional products made in Lebanon and shipped by suppliers in Canada. You can find the contact information of the suppliers to get in touch with them, as they have extensive experience in the Canadian market if you are interested in shipping your products to Canada.

As such, it is important to know the flavors requested by the consumers in the region you are aiming to target to compare with the products you already have and produce, so that you try, if possible, to adjust the product to fit the new market. Therefore, it would be advantageous to look for markets in Canada where consumers prefer tastes and types of pickles that you already provide, which can reduce the adjustments you might apply to your recipes and products.

Moreover, if you are aiming to go beyond the Arab and Mediterranean communities and reach a larger base of consumers, you might want to consider looking at the main pickle brands sold in the market.

Known Canadian brands include Bick’s, Lakeside, and Whyte’s brands like Stub’s, Coronation, and Mrs. Whyte’s. It is worth mentioning that the common features that these brands share in their messaging are the quality of the pickles, the methods of preparing the pickles, and the freshness of the products, as well as maintaining the traditions, among others. In addition, Alchemy Pickle Company, which operates in Toronto, highlights other features like being grown organically, always vegan, free from gluten, and hand-packed.

On a similar note, large producers of pickles show their products in the jar so that consumers can see the freshness of the product and the shape of the food. Thus, it can be deduced that clear packaging is crucial for consumers to notice the quality of the product. In other words, the sensory appeal is critical for customers, as the product should look pleasant and appetizing. Furthermore, brand messaging, online presence, packaging, and labels are very important factors to attract consumers. The packaging is the first thing that customers see on the shelf; in other words, the first impression of the pickles brand. When branding, marketers should determine the drivers of the brand and incorporate brand associations with those drivers. A strong marketing story could be one of those drivers.

In addition, an illustration of the taste and the characteristics of the pickle jar are central to the brand’s marketing strategy. A statement of identity is also important as it is one of the first things customers identify on the package.

Similarly, prices are another very important factor for Canadian grocery shoppers. As such, a competitive pricing strategy could prove important to gain market share, unless you can position your brand as a unique specialty food.

It is important to mention the health benefits or to include indications that show that the product is healthy, taking into consideration the rising health concerns and awareness among Canadians. Also, other statements and certificates which could show how the producer share environmental concerns with consumers are an advantage in reaching a larger crowd, as Canadians increasingly ask if companies adopt high ethical and green standards in their value chains.

In addition, consumers are increasingly looking for customized products as per their specific needs. In response, small- and medium-sized enterprises are designing niche products, while empowering their customer base to compete with larger producers. Some producers are highlighting certain aspects of their customized products like fitting for a special diet, varied tastes, or athletic needs.

A personal narrative can also attract consumers through advertisements and trade shows. This can cover the origin of the vegetables and fruits, the production methods (especially if they are traditional), the ingredients (what they add to the product), and the environmental and social impacts (substantiated with certificates).

Moreover, if your pickle brand has a promotional website, make sure it is mobile-friendly, optimized for Google (Search Engine Optimization - SEO), and straightforward and easy to navigate. You can also opt for paid advertising to increase the visibility of your website and consider the retarget option. Another option is to generate organic traffic from content which could be increased through email marketing, blogs (such as free recipes and engaging video tutorials), and an SEO-optimized website.

It is also important to point out that a strong social media presence is essential for a business nowadays. Therefore, you should work on posting regularly using consistent branding and information across social media platforms, using linked profiles. Also, make sure to be creative in your posts by running contests or providing food pairing suggestions that go along with your products. You can also make use of Facebook to interact with customers, advertise promotions, and help locate the nearest retail store with your product. Lastly, you can utilize Instagram to showcase your pickles in attractive photos or useful videos and to partner with influencer chefs.

Check the websites of Canadian trade shows and exhibitions to keep up with the newest trends. Food fairs in Canada include SIAL Canada, as well as the trade shows provided by the Canadian Federation of Independent Grocers, those of the Canadian Health Food Association (dedicated to natural health and organic products), the Canadian National Exhibition, the National Women’s Show, the Gluten Free Expo, and Planted Expo (Canada’s largest plant-based event).

It is also important to have a distributor, since promoting your brands without being able to distribute them in the target market may harm your sales.

The Embassy of Lebanon to Canada has created a free platform named Mouneh Box, which displays pre-packaged boxes of traditional products made in Lebanon and shipped by suppliers in Canada. You can find the contact information of the suppliers to get in touch with them, as they have extensive experience in the Canadian market if you are interested in shipping your products to Canada.

Doing Business: Business Culture

Culture is defined as the collective attitudes and behavior which distinguishes one group of people from another. It is the patterns of thinking that are reflected in the meaning people attach to various aspects of life and which become crystallized in the institutions of a society. However, this does not mean that everyone in a given society is programmed in the same way.

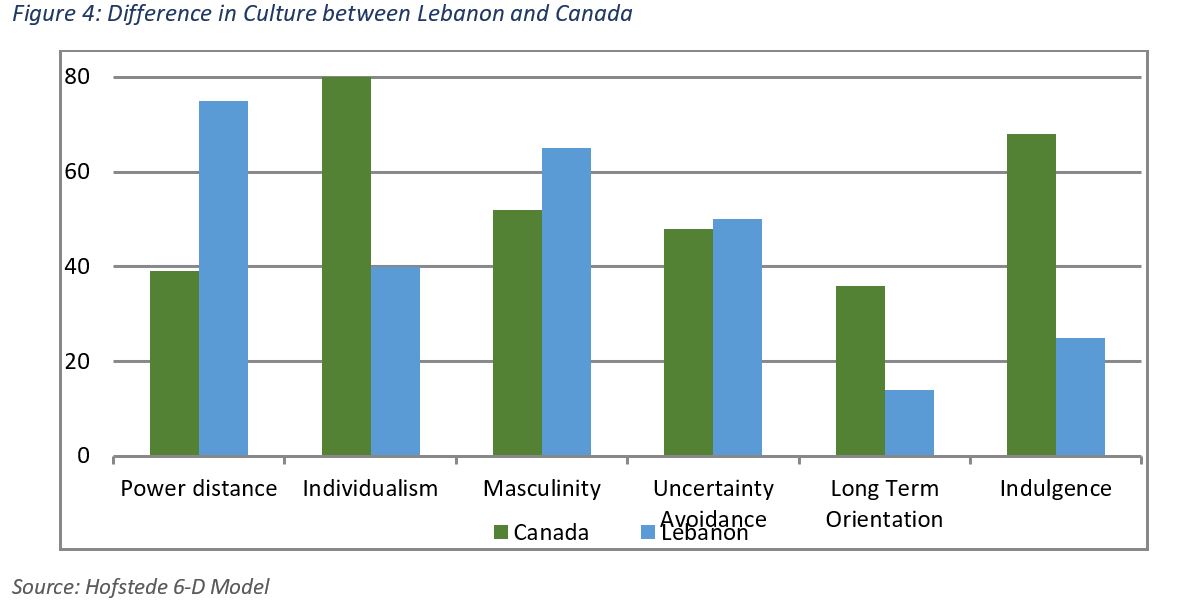

Power Distance: the extent to which the less powerful members of institutions and organizations within a country expect and accept that power is distributed unequally.

There is a large gap in the score of Lebanon and Canada on power distance. While Lebanon follows a hierarchical and centralized system, the Canadian culture is marked by interdependence among its inhabitants and values egalitarianism. Superiors in Canadian organizations are always accessible and rely on teams for their expertise. Similarly, Canadians value straightforward exchange of information.

Individualismm: the degree of interdependence a society maintains among its members.

While Lebanon scores low on individualism reflecting its collectivistic society, Canada scores high reflecting an individualistic culture. The former perceives employer/employee relationships in moral terms and management as that of the group, whereas the latter sees that the hiring and promotion decisions are based on merit. The Canadian culture also expects employees to be self-reliant and display initiative.

Masculinity: the degree to which society is driven by competition, achievement, and success (masculine), or dominant values in society are caring for others and quality of life (feminine).

While Lebanon scores high on masculinity highlighting a masculine society, Canada’s score reflects a moderately masculine society. Managers in Lebanon are expected to be decisive and assertive. There is a lot of emphasis on equity, competition, and performance. Although Canadians strive to attain high standards of performance in work, they tend to have a work-life balance.

Uncertainty Avoidance: the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these. Lebanon scored midway concerning uncertainty avoidance and thus, shows no clear preference. Canada, however, is more accepting when it comes to uncertainty, indicating that Canadians show a willingness to try something new or different in terms of technology. The Canadian culture is not rule-oriented, and Canadians tend to be less emotionally expressive.

Long Term Orientation: the degree to which a society maintains some links with its past, while dealing with the challenges of the present and future.

Both countries score low on this indicator reflecting cultures that are considered normative and prefer to maintain time-honored traditions and norms, while viewing societal change with suspicion. Canadians have a small propensity to save for the future and focus on achieving quick results.

Indulgence: the extent to which people try to control their desires and impulses.

Lebanon scores low on this dimension, indicating that its culture is rather restrained in nature. Such societies tend to be cynical and pessimistic. They have the perception that their actions are restrained by social norms and that self-indulgence is wrong. In contrast, Canada scores high on this dimension, meaning that its culture is classified as indulgent, i.e. showing a willingness to realize their desires and impulses are related to enjoying life. Canadians emphasize having leisure time and spending money as they wish.

Furthermore, for Canadians, punctuality is highly appreciated in meetings according to Cultural Atlas. Even though they may seem reserved at first, they tend to warm up as the conversation proceeds. They look forward to reasonable and sensible discussions during negotiations, aiming for a win-win outcome. As such, they are usually not tempted by tough bargaining pressures. It is best to keep the conversation simple, avoid exaggerated claims, and support your goals with facts and figures. In addition, Canadians tend to make professional friendships rather than build personal relationships with their colleagues. They value privacy and like to keep a line between those they do business with and those they socialize with outside the work environment. They look forward to settling disputes in a discrete and non-confrontational way; subsequently, they tend to avoid the company of very argumentative or opinionated people. In this context, it is better not to be too combative or express yourself too intensely.

Their core concepts revolve around honesty, tolerance, fairness, modesty, sensitivity informality, and unity in diversity.

Power Distance: the extent to which the less powerful members of institutions and organizations within a country expect and accept that power is distributed unequally.

There is a large gap in the score of Lebanon and Canada on power distance. While Lebanon follows a hierarchical and centralized system, the Canadian culture is marked by interdependence among its inhabitants and values egalitarianism. Superiors in Canadian organizations are always accessible and rely on teams for their expertise. Similarly, Canadians value straightforward exchange of information.

Individualismm: the degree of interdependence a society maintains among its members.

While Lebanon scores low on individualism reflecting its collectivistic society, Canada scores high reflecting an individualistic culture. The former perceives employer/employee relationships in moral terms and management as that of the group, whereas the latter sees that the hiring and promotion decisions are based on merit. The Canadian culture also expects employees to be self-reliant and display initiative.

Masculinity: the degree to which society is driven by competition, achievement, and success (masculine), or dominant values in society are caring for others and quality of life (feminine).

While Lebanon scores high on masculinity highlighting a masculine society, Canada’s score reflects a moderately masculine society. Managers in Lebanon are expected to be decisive and assertive. There is a lot of emphasis on equity, competition, and performance. Although Canadians strive to attain high standards of performance in work, they tend to have a work-life balance.

Uncertainty Avoidance: the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these. Lebanon scored midway concerning uncertainty avoidance and thus, shows no clear preference. Canada, however, is more accepting when it comes to uncertainty, indicating that Canadians show a willingness to try something new or different in terms of technology. The Canadian culture is not rule-oriented, and Canadians tend to be less emotionally expressive.

Long Term Orientation: the degree to which a society maintains some links with its past, while dealing with the challenges of the present and future.

Both countries score low on this indicator reflecting cultures that are considered normative and prefer to maintain time-honored traditions and norms, while viewing societal change with suspicion. Canadians have a small propensity to save for the future and focus on achieving quick results.

Indulgence: the extent to which people try to control their desires and impulses.

Lebanon scores low on this dimension, indicating that its culture is rather restrained in nature. Such societies tend to be cynical and pessimistic. They have the perception that their actions are restrained by social norms and that self-indulgence is wrong. In contrast, Canada scores high on this dimension, meaning that its culture is classified as indulgent, i.e. showing a willingness to realize their desires and impulses are related to enjoying life. Canadians emphasize having leisure time and spending money as they wish.

Furthermore, for Canadians, punctuality is highly appreciated in meetings according to Cultural Atlas. Even though they may seem reserved at first, they tend to warm up as the conversation proceeds. They look forward to reasonable and sensible discussions during negotiations, aiming for a win-win outcome. As such, they are usually not tempted by tough bargaining pressures. It is best to keep the conversation simple, avoid exaggerated claims, and support your goals with facts and figures. In addition, Canadians tend to make professional friendships rather than build personal relationships with their colleagues. They value privacy and like to keep a line between those they do business with and those they socialize with outside the work environment. They look forward to settling disputes in a discrete and non-confrontational way; subsequently, they tend to avoid the company of very argumentative or opinionated people. In this context, it is better not to be too combative or express yourself too intensely.

Their core concepts revolve around honesty, tolerance, fairness, modesty, sensitivity informality, and unity in diversity.

References

- Fruit and vegetable canning, pickling and drying – 31142, Canadian Industry Statistics, Government of Canada

- Portrait-Diagnostic Sectoriel de L’industrie des Legumes de Transformation Au Quebec, MAPAQ

- Le declin du cornichon québécois, La Presse

- History in a Jar: The Story of Pickles, the History Kitchen

- Where to find buyers to export my product?, BDC

- More pickles, please…, New Canadian Media

- Mapping Your Future Growth, Five Game-Changing Consumer Trends, BDC

- Canadian Culture, Cultural Atlas

- Country Comparison, Hofstede Insights

- ITC Trade Map

Tips

- Familiarize yourself with the Canadian pickle market and get more acquainted with your competitors.

- Study the target market for your products, and familiarize yourself with the adjustments that are needed to reach a wider crowd.

- Keep up with the trends of Canadian consumers.

- Study your market entry options to select from an appropriate pool of buyers.

- Make use of available trade fairs and exhibitions to promote your product. In other words, find the right fairs for your products (organic, gluten-free, and vegan, among others).

- Shed light on specific features of your product, such as ethical production methods, traditional methods, and health-related characteristics of your products.

- Remember that the packaging of your product gives the first impression to the customer. Thus, use attractive packaging and add your story and the origins of your product, since Canadians would appreciate the multiculturalism and diversity behind your products.

- Take advantage of your website and social media to promote your product. Also, keep your customers engaged through promotions and useful videos.

- Remember the cultural differences when dealing with Canadians, and respect their way of doing business.