Market: Trade Statistics, Trends

Production, Consumption and Exportation Trends

The United Kingdom is a major consumer of sauces worldwide. Some of the products are produced in the UK, while a large portion is imported from other countries. The market of sauces and condiments was estimated at $5.1bn in 2015 and is forecast to grow at a compounded annual growth rate of 1.72% between 2020 and 2025 . Companies are trying new ingredients and flavors within their sauces to attract new customers. In addition, the lifting of COVID-related measures, including lockdowns, could push consumers back to restaurants, however, the income squeeze in the UK will continue to fuel home-cooked meals, and the required ingredients and groceries, especially cooking sauces.The sales of sauces manufactured in the UK grew from about GBP1.2bn in 2008 to GBP1.7bn in 2020. In terms of volume, sales of sauces manufactured within the country increased from 594 million kilograms in 2008 to 766 million kilograms in 2020.

The agri-food sector is the largest manufacturing sector in the country, composed mainly of SMEs (97%), with a turnover of GBP112bn and domestic sales of GBP100bn in 2021. However, food production in the UK is at risk mainly due to labor shortage and there is an increased pressure on manufacturers stemming from labor costs and the price of raw materials. This could lead some manufacturers to move out of the country. This provides room for Lebanese manufacturers of agri-food including sauces, to export products into the UK, contributing to product diversity in the country amid the rising pressure on producers.

The UK was the eighth largest exporters of sauces and seasonings in 2020, exporting about $461m in 2020. Exports of sauces grew from $145m in 2002, increasing by a CAGR of 6.6% over 18 years. Exports peeked in 2018 at $474.5m.

Import Trends

The United Kingdom is a net importer of sauces and seasonings, under HS code 2103 “Sauce and preparations therefor; mixed condiments and mixed seasonings; mustard flour and meal, whether or not prepared, and mustard”. In fact, imports of sauces grew from $333.1m in 2002 by a compounded annual growth rate of 6.3% to reach $995.7m in 2020, and slightly exceeded $1bn in 2021.The imports of sauces products in the UK witnessed a significant growth between 2002 and 2008. In fact, they grew by CAGR of 17.9% to $895.4m in 2008, but then stagnated until 2016 with net imports of $811.3m. Since 2016 they grew gradually at a rate of 5.3% until 2021. The UK’s imports of sauces and seasonings from Lebanon grew substantially between 2002 and 2020. They were negligible up until 2011. In 2012, exports of sauces to the UK reached $837,000, and more than doubled to reach a peak of $1.7m in 2013, before gradually declining to $1.3m in 2016.

Lebanese exports constituted 0.1% of the UK’s imports of sauces and seasonings, while the UK’s imports constituted 5.4% of Lebanon’s exports of these products.

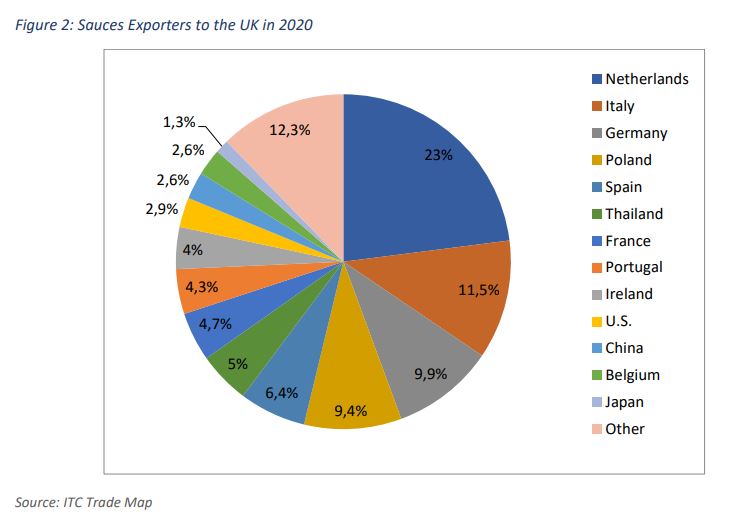

Share of Imports and Unit Price in 2020

Europe is the major source of sauces and seasonings for the UK, slightly exceeding 80% of the total imports of these products in 2020. In this context, Netherlands accounted for 23% of imported sauces in the UK in the same year, followed by Italy (11.5%), Germany (9.9%), Poland (9.4%), Spain (6.4%), France (4.7%), Portugal (4.3%), Ireland (4%), Belgium (2.6%), Romania (0.8%), Hungary (0.7%) and Switzerland (0.5%), among other European countries. Major non-European exporters of sauces and seasonings to the UK included Thailand with a share of 5% of total imports of sauces into the UK, the U.S. (2.9%), China (2.6%), Japan (1.3%), India, Hong Kong and Malaysia (1.1% each), and Pakistan (0.7%). These 20 countries accounted for about 94% of imported sauces in the UK in 2020.In terms of quantity, the Netherlands exports of sauces and seasonings represent 32% of the total quantity imported by the UK. Poland followed with about 10%, Italy (9.5%), Germany (9.3%), Portugal (8.2%), Spain (7.5%), Thailand (3.7%), France (3.5%), Ireland (2.5%), China (2%), the U.S. and Belgium (1.9% each), and India (0.9%), among others.

According to the ITC Trade Map, the unit value of imported sauces in the UK was $1,664/ton in 2019 and $1,876/tons in 2021. Based on calculations from data taken from the ITC’s dataset, the average price for 2020 was around $1,685/ton. The unit value of imports from Netherlands, Portugal, Poland, Spain, Greece, Malta, Nigeria and Sri Lanka to the UK came below the average unit value in the UK. The unit price of sauces exported to the UK from the remaining main exporting countries exceeded the average unit price of imported sauces in the UK, ranging between $1,700/ton and $4000/tons, with few exceptions such Pakistan ($4,981/ton) among the top 25 largest exporters. Most European exporters of sauces to the UK had the lowest unit value ranging between $900/ton and $3,000/ton, with an average of around $2,600/ton, with few exceptions such as Norway ($9,168/ton) and Switzerland ($6,424/ton). Meanwhile, sauces and seasonings from Lebanon were imported at price of $3,155/ton in 2020, which is relatively a bit high compared to main non-EU exporters, such as Thailand, the U.S., China, Japan and India. Still, the unit price of exported sauces from Lebanon to the UK was lower than that of Hungary, Pakistan, Switzerland, Mexico, Australia, Sweden and Denmark, among other relatively large exporters of sauces to the UK. However, the unit price of Lebanese sauces was higher than those exported from Egypt at $2.1/tons, but lower than the price of sauces exported from Oman, the two countries that exported relatively significant amounts of sauces to the UK in 2020. The lower the value per ton the more competitive the Lebanese products can be. Therefore, with a thorough study of the market and proper strategies of market entry, Lebanese sauces and seasonings exports to the UK have the potential to grow as the prices are relatively close to several exporters from Europe.

Market Trends

Main market trends in the agri-food market in the UK tend to evolve around healthy products as the aging population is more concerned about wellness and health-related issues. This trend also converges towards organic and Fair Trade products. In addition, consumers are paying more attention to sustainable products and environment-friendly items, seeking products that take into consideration animal welfare. This trend meets the rising vegan and vegetarianism lifestyle. Further, Ready meals are also trendy due to the fast-paced life in the UK. Free-From products are increasingly attracting consumers who avoid lactose, dairy, gluten and other components. In addition, the large ethnic population in the UK is driving the demand for ethnic dishes and cuisines. In parallel, efforts to support local producers have also increased through “Buy British” campaigns.In terms of sauces, Imports of sauces, seasonings and condiments into the UK were mainly composed of sauces and preparations that consist of mixed condiments and seasonings (excluding soya sauce, tomato ketchup and other tomato sauces, liquid mango chutney and aromatic bitters), which represented 74% of total value of imported sauces in 2020. The imports of these specific products (HS 21039090) grew by a compounded annual growth rate of 7.2% between 2003 and 2020. Imports of these products stagnated between 2009 and 2013, but they have been consistently growing since 2015 from $559.8m to $730.2m in 2020 and $741.1m in 2021.

Most recent data from ITC Trade Map showed that imports tomato ketchup and other tomato sauces (HS21032000) followed with a share of 19.5% in 2020, imports of soya sauce (HS21031000) represented 4.2%, then mustard including prepared flour and meal (1.5%), mustard flour and meal (excluding preparations) (0.4%), aromatic bitters (of an alcoholic strength of more than 44.2% but lower than 49.2%, among other specifications under HS 21039030) (0.2%) and Mango chutney liquid (0.1%).

The growing consumer interest in sauces, seasonings and condiments in the UK as reflected by trade figures is partly due to the country’s large multicultural population, being a hub of attraction for multinational businesses, as well as a hub for international students and one of the top destinations for tourists. Consumers are increasingly demanding meals that are easy to prepare as well as ethnic and authentic food flavors. With the fast development of distribution channels, consumers in developed markets are become easily accessible, which allow companies to raise product awareness. Also, the technological developments across processed food have been providing innovative products to developed markets such as the United Kingdom, introducing new flavors to the market. In addition, long working hours and a fast-paced lifestyle are pushing consumers towards ready-to-eat and to-prepare sauces. As such, traditional ethnic sauces are expected to gain more traction in the UK market.

In this context, the large appetite for new cuisines, specialty foods and authentic foods, especially the Mediterranean and Middle Eastern cuisines can also drive the demand for Lebanese sauces, seasonings, condiments and dips. Also, the new trends of abiding by a healthy diet, as well as vegetarianism call for a larger intake of free-from products, salads, and vegetables- and fruit-based dishes that require a variety of seasonings and added flavors.

For consumers as well as restaurants and food producers, sauces are no longer the after-thought in meal planning, but the main and leading component of new dishes, especially in the UK. New trends show that consumers are abandoning traditional sauces for new exciting and exotic products.

The varieties in the UK’s culinary experience provide opportunities for Lebanese agri-food producers, especially for sauces producers to serve different recipes and different types of sauces for multiple dishes.

While existing Lebanese sauces, seasonings and condiments could have a large potential market in the UK, some of the products might require an adjustment, or to be adapted to the tastes requested by the the UK market. However, such product innovation requires a deep study of the target market before launching new products.

Market Entry: Trade Channels and Segments, Selection of Channels

The majority of agri-foods in the UK enter the country through common routes such as partnerships with leading importers, distributors or consolidators, or by direct selling to retailers, private labeling, or E-commerce.

Sauces, seasonings and condiments can enter the UK market mostly via two main channels:

When selecting the best distribution channels for your products, you must first:

Importers play a key role as agents introducing brands to the country, given their expertise in navigating challenges and obstacles of the UK food law. If a company wants to export a wide range of products for mass distribution, importers tend to provide the best solutions as they deal with large varieties of products. For SMEs, seeking an importer could help them in listing their products in department store food halls, independent retailers and delicatessens, before reaching out to retails chains In parallel, distributors have a more targeted approach, as some of them are focused on restaurants and the hospitality sector, while other target retailers. Checking the network of retail outlets of importers is essential when choosing an importer.

After gradually introducing the product into the UK through importers, SMEs can try to start listing their products in relatively small retail chains aiming to gradually supply the large supermarkets in the future. However, this is contingent on the production capacity of producers, as consistency in quantities and timely deliveries are key for buyers in the UK.

It is worth mentioning that directly supplying retailers requires more efforts and could be challenging, despite the fact that some retailers aim to keep their prices as low as possible, which pushes them to sometimes try to buy directly from suppliers, reducing the margins of importers. The fees applied by importers vary significantly between start-up fees and commission-only agents. According to the USDA Retail Foods report, a full brokerage could range between 17% and 25%.

If you are aiming to directly target consumers you must take into consideration the positioning of your product. If the sauces, seasonings and condiments are sold as Lebanese food and siding Lebanese dishes, ethnic shops are usually the easiest ways to unlock the Lebanese and Arab communities.

Going beyond the Arab community, specialty food stores can be a good place for some specific sauces products that can fit under a product mix, or high-end type products for niche consumers.

If you are aiming for a larger crowd, with a large production capacity and a relatively low price, supermarkets and big retailers tend to be a good place, especially for consumers who are price-sensitive and those who try to find all their products at the same place.

In terms of ways to reach consumers, online grocery shopping has been the fastest growing channel since 2019 and discounters are expected to be the fastest growing channel. The pandemic altered the way consumers used to shop in the UK, and shopping habits of UK consumers are expected to continue that way, favoring a visit per week to one large shop, as well as buying their products online or shopping locally. In fact, many consumers are aiming to support local businesses leading a substantial growth in sales of convenience stores.

In terms of retailers, four main supermarkets account for 67% of the UK food retailing market, which are Tesco (mid-range), Sainsbury’s (mid-range), Asda (mid-range) and Morrison’s (mid-range). Others chains include Aldi (discounter), The Co-op (mid-range), Waitrose (upscale), Lidl (discounter), and Iceland.

Other buyers of sauces products are:

Direct potential buyers for Lebanese sauces, seasonings and condiments:

Sauces, seasonings and condiments can enter the UK market mostly via two main channels:

- Through the intermediary role of traders, such as importers, or

- Through retailers and wholesalers

When selecting the best distribution channels for your products, you must first:

- Determine your potential clients

- Know your capacity

- Product positioning and price

Importers play a key role as agents introducing brands to the country, given their expertise in navigating challenges and obstacles of the UK food law. If a company wants to export a wide range of products for mass distribution, importers tend to provide the best solutions as they deal with large varieties of products. For SMEs, seeking an importer could help them in listing their products in department store food halls, independent retailers and delicatessens, before reaching out to retails chains In parallel, distributors have a more targeted approach, as some of them are focused on restaurants and the hospitality sector, while other target retailers. Checking the network of retail outlets of importers is essential when choosing an importer.

After gradually introducing the product into the UK through importers, SMEs can try to start listing their products in relatively small retail chains aiming to gradually supply the large supermarkets in the future. However, this is contingent on the production capacity of producers, as consistency in quantities and timely deliveries are key for buyers in the UK.

It is worth mentioning that directly supplying retailers requires more efforts and could be challenging, despite the fact that some retailers aim to keep their prices as low as possible, which pushes them to sometimes try to buy directly from suppliers, reducing the margins of importers. The fees applied by importers vary significantly between start-up fees and commission-only agents. According to the USDA Retail Foods report, a full brokerage could range between 17% and 25%.

If you are aiming to directly target consumers you must take into consideration the positioning of your product. If the sauces, seasonings and condiments are sold as Lebanese food and siding Lebanese dishes, ethnic shops are usually the easiest ways to unlock the Lebanese and Arab communities.

Going beyond the Arab community, specialty food stores can be a good place for some specific sauces products that can fit under a product mix, or high-end type products for niche consumers.

If you are aiming for a larger crowd, with a large production capacity and a relatively low price, supermarkets and big retailers tend to be a good place, especially for consumers who are price-sensitive and those who try to find all their products at the same place.

In terms of ways to reach consumers, online grocery shopping has been the fastest growing channel since 2019 and discounters are expected to be the fastest growing channel. The pandemic altered the way consumers used to shop in the UK, and shopping habits of UK consumers are expected to continue that way, favoring a visit per week to one large shop, as well as buying their products online or shopping locally. In fact, many consumers are aiming to support local businesses leading a substantial growth in sales of convenience stores.

In terms of retailers, four main supermarkets account for 67% of the UK food retailing market, which are Tesco (mid-range), Sainsbury’s (mid-range), Asda (mid-range) and Morrison’s (mid-range). Others chains include Aldi (discounter), The Co-op (mid-range), Waitrose (upscale), Lidl (discounter), and Iceland.

Other buyers of sauces products are:

- Restaurants

- Catering agencies

- Hotels

Direct potential buyers for Lebanese sauces, seasonings and condiments:

- Mediterranean restaurants and caterers

- Middle Eastern, including Lebanese, restaurants and caterers

Finding Potential Buyers

Contact points especially for small sauces producers and exporters interested in the UK market are bilateral chambers of commerce and business councils, such as the Lebanese British Business Council or the British Lebanese Association, as well as the Arab British Chamber of Commerce.

These organizations aim to promote bilateral trade and help in putting in contact business to business meetings. Contacting such organization could help the exporter in some cases of fraud and misrepresentation, which can be a risk when looking for potential buyers on social media and through other online resources. Some of these organizations provide support to companies in terms of trade, ranging from visa services, business briefing, specialized research, networking events, improve access to markets and documentation. In addition, producers can get in touch with industry-related organizations such as the British Food Importers & Distributors Association to understand market requirements and trends, as well as to connect with potential importers or distributors who are possibly looking for new products.

Trade directories can be helpful, as they are paid online databases that provide business contacts by searching through several criteria including country, state or city. Several platforms provide information on potential buyers like Eworldtrade and TradeKey, also online information on e-commerce, e-marketing and online marketplaces can be found on Web Directories. In addition, there are new platforms, such as and Shelfnow, which provide producers with the possibility to showcase their products online, which facilitate the selection process for retailers who visit these platforms, offering visibility and new distribution channels for producers. In parallel, the producer can get in touch with the Seasoning and Spice Association for guidance on standards as well as trends and innovation in the sector, as well as to meet other processors in the UK. Also, exporters can also approach potential customers on social media and online trade marketplaces. However, they must do due diligence to know if the they are dealing with a legitimate business. They can reach out to companies in the UK through direct (e-)mail with follow-up through personal visits or invitations of potential customers to visit in their country. They may also meet with potential buyers by visiting international trade fairs.

In addition, producers of sauces in Lebanon can benefit from the UK Trade Info, which provides data on all traders in the UK. In fact, all importers of sauces, seasonings and condiments under HS Code 2103 can be found on the UK Trade Info, along with details about their address, Postal Code and HS8 classification of the products they import. This can help Lebanese producers finding new leads.

LinkedIn can be used to look up and contact professionals who work at companies in food retail or distribution channels in the UK.

These organizations aim to promote bilateral trade and help in putting in contact business to business meetings. Contacting such organization could help the exporter in some cases of fraud and misrepresentation, which can be a risk when looking for potential buyers on social media and through other online resources. Some of these organizations provide support to companies in terms of trade, ranging from visa services, business briefing, specialized research, networking events, improve access to markets and documentation. In addition, producers can get in touch with industry-related organizations such as the British Food Importers & Distributors Association to understand market requirements and trends, as well as to connect with potential importers or distributors who are possibly looking for new products.

Trade directories can be helpful, as they are paid online databases that provide business contacts by searching through several criteria including country, state or city. Several platforms provide information on potential buyers like Eworldtrade and TradeKey, also online information on e-commerce, e-marketing and online marketplaces can be found on Web Directories. In addition, there are new platforms, such as and Shelfnow, which provide producers with the possibility to showcase their products online, which facilitate the selection process for retailers who visit these platforms, offering visibility and new distribution channels for producers. In parallel, the producer can get in touch with the Seasoning and Spice Association for guidance on standards as well as trends and innovation in the sector, as well as to meet other processors in the UK. Also, exporters can also approach potential customers on social media and online trade marketplaces. However, they must do due diligence to know if the they are dealing with a legitimate business. They can reach out to companies in the UK through direct (e-)mail with follow-up through personal visits or invitations of potential customers to visit in their country. They may also meet with potential buyers by visiting international trade fairs.

In addition, producers of sauces in Lebanon can benefit from the UK Trade Info, which provides data on all traders in the UK. In fact, all importers of sauces, seasonings and condiments under HS Code 2103 can be found on the UK Trade Info, along with details about their address, Postal Code and HS8 classification of the products they import. This can help Lebanese producers finding new leads.

LinkedIn can be used to look up and contact professionals who work at companies in food retail or distribution channels in the UK.

Export Promotional Activities

If you are aiming to go beyond the Arab and Mediterranean communities and reach a larger base of consumers you might want to consider looking at the main trends in the market, as well as flavors requested by consumers in the UK.

According to Uber Eats, 61% of consumers in the UK in 2019 considered that it is acceptable to take their own condiments with them when leaving their house, and about half of the country assumed that every meal has to be complemented by a condiment. Ketchup, Mayonnaise, sweet chilli and brown sauces were among the most demanded sauces in the UK. However, less mainstream sauces are becoming essential for UK consumers, those include the curry sauce, Piri Piri sauce and garlic mayo. Also, vinegar, Mustard and Burger sauce remained among the top 10 sauces favorite condiments in the UK.

In parallel, according to the Grocer’s magazine, the British people are shifting from traditional sauces to versatile, such as hot chilli sauces and flavored mayonnaise, such as Nando’s Peri-Peri mayos. Mayonnaise posted the largest growth of about 10% in terms of sales in the UK in the year ending May 2019, followed by Mint sauces (5.1%), pourable dressings (5.1%), Soy sauce (3.7%), Mustard (2.9%), Ketchup (0.2%), Salad cream (0.1%) and Brown sauces (-2.8%). Also, branded labels grew at a faster pace (4.8%) than own label (2.5%). In terms of sales value, Mayo and Ketchup remain the most consumed products, followed by salad cream, brown sauce, pourable dressing, mustard, soy sauce and mint sauce. Flavored mayonnaise as well as vegan mayo contributed to the growth in this segment. In terms of condiments, Mint and Hollandaise were the leading items in terms of growth in sales. In addition, premium Ketchups were introduced to the market in the past couple of years, with new mixes that included sundried tomatoes, roasted garlic, herbs, honey-sweetened, among others combinations. Also, new Asian sauces were introduced to the market; consumers and shoppers are swayed by experiences they had in street food as well as in holidays, which are flavors that bring more excitement to their experience.

In the year to April 2021, the total sauces segment grew by ₤97.2m in value (20%), with mayonnaise (20.1%) posting the largest increase in value at ₤37.2m (20.1%), tomato ketchup followed with ₤34.6m (21.9%), salad cream (₤9.4m or 16.5%), brown sauce (₤8.2m or 16.3%), salad dressing (₤7.8m or 20.9%), Mustard (₤7.8m or 22.7%), tartare sauce (₤5.5m or 37.1%), Mint sauce (₤3m or 17.6%), cranberry sauce (₤2.5m or 18.5%), apple sauce (₤2.2m or 16.7%), seafood sauce (₤1m or 11%), horseradish sauce (₤0.5m or 5.4%) and redcurrant sauce (₤0.5m or 19.5%). The significant increase in the growth rate of sauces was mainly due to the higher prices, as supermarkets started to end promotions. The consumption of sauces was boosted by the pandemic, especially during summer, which drove barbecuing habits, and in turn the purchasing of BBQ sauces, Ketchup and Mayonnaise. Mayo continues to dominate the market in terms of sales, driven by new products such as a chilli and garlic flavors. As consumers become more price sensitive due to the economic recession, companies will need to innovate to remain in the market, as well as to be price competitive.

Restaurant brands are also witnessing success in the market, as they add a new experience to foods, pushing consumers towards classify their dishes as main and side. In addition, some consumers are now targeting ethnic stores to get the authentic taste when trying new cuisines like Asian food or Mediterranean According to a survey conducted by Shopper Intelligence brand loyalty remains high overall in the UK, however it varies across age brackets. About 38% of consumers aged 55 or more are interested in trying new products, while 64% of those between 18 and 34 years old are prepared to try new items. The aforementioned trends and market dynamics provide Lebanese producers with a range of opportunities in the sauces, seasonings and condiments market. Marketing strategies of Lebanese SMEs should consider the flavors mentioned above when tackling the UK market of sauces and condiments.

Mainstream products like Ketchup, Mayo and BBQ sauces are dominated by large companies, with a well established reputation, a substantial production capacity and a known quality, such as Unilever and Heinz among others. Also, these companies are continuously innovating, adding a variety of items to their product range. As such, Lebanese producers should target specific consumers or specialize in specific niche products. Lebanese companies have expertise in producing sauces that rely on vegetables including garlic, tomatoes and radish, fruits such as citrus, pomegranate, avocadoes, apples, and other agri-food products including vinegar, oil, aromatic herbs, mustard, and spices. Most of innovations in sauce currently taking place in the UK include at least one of the fruits and vegetables or condiments mentioned before.

As such, it is important to know the flavors requested by the consumers in the UK, especially the segment you are targeting, and compare these flavors with the products you already have and produce, so that you try, if possible, to adjust your products to fit the new market.

Innovations in the Lebanese garlic sauce, tomato-based sauces (incorporating an aspect of sundried tomatoes), as well as the usage of aromatic herbs and spices could prove interesting in the UK market. Also, the usage of Lebanese vinegar, apple-based sauces and pomegranate molasses could possibly unlock potential innovations for salad dressings in the UK. In addition, despite being labeled as a ready-to-eat meal, innovation in hummus dips, including beetroot, garlic or adding new features to the product, could find potential in the UK, driven by the interest in ethnic and authentic food, as well as in the flavors that are found typically in the street food category. A twist in tahini-based sauces is equally interesting in the destination country.

It is important to mention that there are opportunities for the incorporation of honey, as a sweetener in several sauces, and other animal-based products, especially in the diary segment, such as yogurt-based sauces or labneh as a dip. However, currently all food products of animal origin such as dairy, meat, honey, eggs among others, are not allowed to enter the UK from Lebanon.

The most consumed sauces brands in the UK include Heinz, Hellman’s, HP, Colman’s, Nando’s, Lea & Perrins, Blue Dragon, Encona, Maille and Tabasco. In terms of cooking sauces, the brands that had the largest number of users in the UK included Sharwoods, Pataks, Tesco, Homepride, Schwartz, Asda, Old El Paso, Sainsburry’s, Loyd Grossman, Maggi, Knorr Chicken Tonight, Amoy, and Morrisons, among others.

While the competition might be fierce as huge multinationals are competing on the market, smaller businesses can gain a foothold in the market if they target a specific segment among consumers. Brand messaging, online presence, the packaging and the labels are very important factors to attract consumers. The packaging is the first thing that customers see on the shelf, that is, the first impression of the sauces brand. When branding, marketers should determine the drivers of the brand, and incorporate brand associations with those drivers. Most of the producers of sauces package their products in plastic or glass bottles and glass or plastic jars. Stand up pouch bags are currently trendy, as they are suitable for liquids and fun to use. The sensory appeal is critical for customers, as the product should look nice and tasty. You should highlight the unique value of the sauces you are offering to the clients. An illustration of the taste and the characteristics of the sauces package are central in the brand’s marketing strategy. A statement of identity is also important as it is one of the first things customers identify on the package. While several ingredients can be commonly used among competing companies, highlighting some of these ingredients can prove interesting for consumers, as they become picky about some components of your product. A strong marketing story could be one of brand drivers too; it can possibly be a personal story that can create a connection with consumers, or even a recipe. This can take place on the package and online through social media and the company’s website and more. The brand and label design should reflect the taste of the bottle and be aligned with the story you associate with the product.

Prices are a very important factor for UK grocery shoppers. As such, a competitive pricing strategy could prove important to gain market share, unless you are able to position your brand as unique specialty food, which can prove beneficial for small producers, rather than competing with large corporations on the basic commercial segments.

It is important to mention health benefits or include indications that show that the product is healthy given the rising health concerns and awareness among consumers in the UK. Also, other statements and certificates which could show how the producer shares environmental concerns with consumers are an advantage in reaching a larger crowd.

Consumers are looking for healthy choices, which are reflected by the demand of vegan sauces, or products with natural ingredients and no-added sugar.

A personal narrative can also attract consumers through advertisements and trade shows. This can cover the origin of the ingredients used, the production methods (especially if they are traditional), and environmental and social impact (substantiated with certificates).

If your sauces brand has a promotional website make sure it is mobile-friendly, it is optimized for Google (Search Engine Optimization - SEO) and it is straightforward and easy to navigate. You can also opt for paid advertising to increase visibility of your website and consider the retarget option. Another option is to generate organic traffic from content which could be increased through email marketing, blogs (such as free recipes and engaging video tutorials), and SEO-optimized website.

A strong social media presence is essential for a business nowadays. Work on posting regularly using consistent branding and information across social media platforms using linked profiles. Be creative in your posts by running contests or provide food pairing suggestions that go along with your products. Use Facebook to interact with customers, advertise promotions and help locate nearest retail store with your product. Use Instagram to showcase your sauces in an attractive photo or a useful video and to partner with influencer chefs. Check the websites of trade shows and exhibitions in the UK to keep up with the newest trends. Some of the known trade shows include the Food & Drink Expo, International Food & Drink Event, FOODEX, The Ingredients Show, The National Convenience Show, Farm Shop & Deli Show and the Specialty & Fine Food Fair.

It is also important to have a distributor. Promoting your brands without being able to distribute it in the target market may harm sales.

You can also contact the Lebanese Food and Drink Association, established by the Economic Attaché, Mr. Ralph Nehme in the Embassy of Lebanon in London. The association aims to facilitate market entry for Lebanese companies in the industry.

According to Uber Eats, 61% of consumers in the UK in 2019 considered that it is acceptable to take their own condiments with them when leaving their house, and about half of the country assumed that every meal has to be complemented by a condiment. Ketchup, Mayonnaise, sweet chilli and brown sauces were among the most demanded sauces in the UK. However, less mainstream sauces are becoming essential for UK consumers, those include the curry sauce, Piri Piri sauce and garlic mayo. Also, vinegar, Mustard and Burger sauce remained among the top 10 sauces favorite condiments in the UK.

In parallel, according to the Grocer’s magazine, the British people are shifting from traditional sauces to versatile, such as hot chilli sauces and flavored mayonnaise, such as Nando’s Peri-Peri mayos. Mayonnaise posted the largest growth of about 10% in terms of sales in the UK in the year ending May 2019, followed by Mint sauces (5.1%), pourable dressings (5.1%), Soy sauce (3.7%), Mustard (2.9%), Ketchup (0.2%), Salad cream (0.1%) and Brown sauces (-2.8%). Also, branded labels grew at a faster pace (4.8%) than own label (2.5%). In terms of sales value, Mayo and Ketchup remain the most consumed products, followed by salad cream, brown sauce, pourable dressing, mustard, soy sauce and mint sauce. Flavored mayonnaise as well as vegan mayo contributed to the growth in this segment. In terms of condiments, Mint and Hollandaise were the leading items in terms of growth in sales. In addition, premium Ketchups were introduced to the market in the past couple of years, with new mixes that included sundried tomatoes, roasted garlic, herbs, honey-sweetened, among others combinations. Also, new Asian sauces were introduced to the market; consumers and shoppers are swayed by experiences they had in street food as well as in holidays, which are flavors that bring more excitement to their experience.

In the year to April 2021, the total sauces segment grew by ₤97.2m in value (20%), with mayonnaise (20.1%) posting the largest increase in value at ₤37.2m (20.1%), tomato ketchup followed with ₤34.6m (21.9%), salad cream (₤9.4m or 16.5%), brown sauce (₤8.2m or 16.3%), salad dressing (₤7.8m or 20.9%), Mustard (₤7.8m or 22.7%), tartare sauce (₤5.5m or 37.1%), Mint sauce (₤3m or 17.6%), cranberry sauce (₤2.5m or 18.5%), apple sauce (₤2.2m or 16.7%), seafood sauce (₤1m or 11%), horseradish sauce (₤0.5m or 5.4%) and redcurrant sauce (₤0.5m or 19.5%). The significant increase in the growth rate of sauces was mainly due to the higher prices, as supermarkets started to end promotions. The consumption of sauces was boosted by the pandemic, especially during summer, which drove barbecuing habits, and in turn the purchasing of BBQ sauces, Ketchup and Mayonnaise. Mayo continues to dominate the market in terms of sales, driven by new products such as a chilli and garlic flavors. As consumers become more price sensitive due to the economic recession, companies will need to innovate to remain in the market, as well as to be price competitive.

Restaurant brands are also witnessing success in the market, as they add a new experience to foods, pushing consumers towards classify their dishes as main and side. In addition, some consumers are now targeting ethnic stores to get the authentic taste when trying new cuisines like Asian food or Mediterranean According to a survey conducted by Shopper Intelligence brand loyalty remains high overall in the UK, however it varies across age brackets. About 38% of consumers aged 55 or more are interested in trying new products, while 64% of those between 18 and 34 years old are prepared to try new items. The aforementioned trends and market dynamics provide Lebanese producers with a range of opportunities in the sauces, seasonings and condiments market. Marketing strategies of Lebanese SMEs should consider the flavors mentioned above when tackling the UK market of sauces and condiments.

As such, it is important to know the flavors requested by the consumers in the UK, especially the segment you are targeting, and compare these flavors with the products you already have and produce, so that you try, if possible, to adjust your products to fit the new market.

Innovations in the Lebanese garlic sauce, tomato-based sauces (incorporating an aspect of sundried tomatoes), as well as the usage of aromatic herbs and spices could prove interesting in the UK market. Also, the usage of Lebanese vinegar, apple-based sauces and pomegranate molasses could possibly unlock potential innovations for salad dressings in the UK. In addition, despite being labeled as a ready-to-eat meal, innovation in hummus dips, including beetroot, garlic or adding new features to the product, could find potential in the UK, driven by the interest in ethnic and authentic food, as well as in the flavors that are found typically in the street food category. A twist in tahini-based sauces is equally interesting in the destination country.

It is important to mention that there are opportunities for the incorporation of honey, as a sweetener in several sauces, and other animal-based products, especially in the diary segment, such as yogurt-based sauces or labneh as a dip. However, currently all food products of animal origin such as dairy, meat, honey, eggs among others, are not allowed to enter the UK from Lebanon.

The most consumed sauces brands in the UK include Heinz, Hellman’s, HP, Colman’s, Nando’s, Lea & Perrins, Blue Dragon, Encona, Maille and Tabasco. In terms of cooking sauces, the brands that had the largest number of users in the UK included Sharwoods, Pataks, Tesco, Homepride, Schwartz, Asda, Old El Paso, Sainsburry’s, Loyd Grossman, Maggi, Knorr Chicken Tonight, Amoy, and Morrisons, among others.

While the competition might be fierce as huge multinationals are competing on the market, smaller businesses can gain a foothold in the market if they target a specific segment among consumers. Brand messaging, online presence, the packaging and the labels are very important factors to attract consumers. The packaging is the first thing that customers see on the shelf, that is, the first impression of the sauces brand. When branding, marketers should determine the drivers of the brand, and incorporate brand associations with those drivers. Most of the producers of sauces package their products in plastic or glass bottles and glass or plastic jars. Stand up pouch bags are currently trendy, as they are suitable for liquids and fun to use. The sensory appeal is critical for customers, as the product should look nice and tasty. You should highlight the unique value of the sauces you are offering to the clients. An illustration of the taste and the characteristics of the sauces package are central in the brand’s marketing strategy. A statement of identity is also important as it is one of the first things customers identify on the package. While several ingredients can be commonly used among competing companies, highlighting some of these ingredients can prove interesting for consumers, as they become picky about some components of your product. A strong marketing story could be one of brand drivers too; it can possibly be a personal story that can create a connection with consumers, or even a recipe. This can take place on the package and online through social media and the company’s website and more. The brand and label design should reflect the taste of the bottle and be aligned with the story you associate with the product.

Prices are a very important factor for UK grocery shoppers. As such, a competitive pricing strategy could prove important to gain market share, unless you are able to position your brand as unique specialty food, which can prove beneficial for small producers, rather than competing with large corporations on the basic commercial segments.

It is important to mention health benefits or include indications that show that the product is healthy given the rising health concerns and awareness among consumers in the UK. Also, other statements and certificates which could show how the producer shares environmental concerns with consumers are an advantage in reaching a larger crowd.

Consumers are looking for healthy choices, which are reflected by the demand of vegan sauces, or products with natural ingredients and no-added sugar.

A personal narrative can also attract consumers through advertisements and trade shows. This can cover the origin of the ingredients used, the production methods (especially if they are traditional), and environmental and social impact (substantiated with certificates).

If your sauces brand has a promotional website make sure it is mobile-friendly, it is optimized for Google (Search Engine Optimization - SEO) and it is straightforward and easy to navigate. You can also opt for paid advertising to increase visibility of your website and consider the retarget option. Another option is to generate organic traffic from content which could be increased through email marketing, blogs (such as free recipes and engaging video tutorials), and SEO-optimized website.

A strong social media presence is essential for a business nowadays. Work on posting regularly using consistent branding and information across social media platforms using linked profiles. Be creative in your posts by running contests or provide food pairing suggestions that go along with your products. Use Facebook to interact with customers, advertise promotions and help locate nearest retail store with your product. Use Instagram to showcase your sauces in an attractive photo or a useful video and to partner with influencer chefs. Check the websites of trade shows and exhibitions in the UK to keep up with the newest trends. Some of the known trade shows include the Food & Drink Expo, International Food & Drink Event, FOODEX, The Ingredients Show, The National Convenience Show, Farm Shop & Deli Show and the Specialty & Fine Food Fair.

It is also important to have a distributor. Promoting your brands without being able to distribute it in the target market may harm sales.

You can also contact the Lebanese Food and Drink Association, established by the Economic Attaché, Mr. Ralph Nehme in the Embassy of Lebanon in London. The association aims to facilitate market entry for Lebanese companies in the industry.

Doing Business: Business Culture

Culture is defined as the collective attitudes and behavior which distinguishes one group of people from another. It is the patterns of thinking which are reflected in the meaning people attach to various aspects of life and which become crystallized in the institutions of a society. However, this does not mean that everyone in a given society is programmed in the same way.

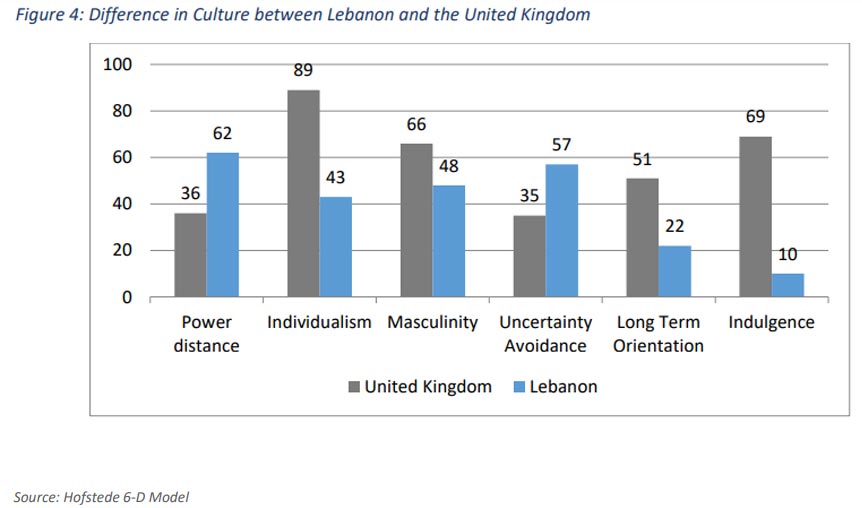

Power Distance: the extent to which the less powerful members of institutions and organizations within a country expect and accept that power is distributed unequally.

There is a large gap in the score of Lebanon and the UK on power distance. While Lebanon follows a hierarchical and centralized system, the score of the UK shows that the British society believes that inequalities should be minimized.

Individualism: the degree of interdependence a society maintains among its members.

While Lebanon scores low on individualism reflecting its collectivistic society, the UK people are among the most individualistic cultures. For the British people happiness tends to be through personal fulfillment, with rampant consumerism and a strengthened “ME” culture.

Masculinity: whether society is driven by competition, achievement and success (masculine) or dominant values in society are caring for others and quality of life (feminine).

While Lebanon has an average score on masculinity, the UK score reflects masculine society, highly success oriented. Foreigners tend to confuse between the British culture of modesty. It is important to differentiate these traits, as the UK people tend to live to work and have a clear performance ambition.

Uncertainty Avoidance: the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these.

Lebanon has a preference for avoiding uncertainty, and prefers to have rigid code of belief and an emotional need for rules. People tend to work hard, but innovation might be resisted among populations with such a score. The UK, however, is more uncertainty accepting, indicating that the British people tends to be comfortable in ambiguous situations.

Planning tends to be more short-term oriented, and the people may not be detail-oriented. However, their goals remain clear. A combination of individualism and being curious about change pushes the nation towards a strong need for innovation.

Long Term Orientation: how every society has to maintain some links with its own past while dealing with the challenges of the present and future.

Lebanon scores low on this indicator reflecting a culture that is considered normative, and prefer to maintain time-honored traditions and norms, while viewing societal change with suspicion. The UK has an average score on this dimension which does not reflect any dominant aspect.

Indulgence: the extent to which people try to control their desires and impulses

Lebanon scores low on this dimension indicating that its culture is rather restrained in nature. Such societies have a tendency to cynicism and pessimism. They have the perception that their actions are restrained by social norms and that self-indulgence is wrong. In contrast, the UK scores high on this dimension meaning that its culture is classified as indulgent, showing a willingness to realize their desire and impulses related to enjoying life. The UK people place a higher degree of importance on leisure time and spend money as they wish.

According to Cultural Atlas, for the British people, punctuality is highly appreciated in meetings. It can be helpful start with a few minutes of social conversation, without entering any personal topics. The British use humor sometimes throughout dealings, as such you may want to reciprocate to lighten the setting and build a good atmosphere for future discussion. Try to give the impression that your business is well managed, despite the current situation in your country, as the British prefer to feel comfortable about business. It is important to avoid any exaggerated claims, try to back your claims with facts and figures.

The British tend not to rush into a deal, or take immediate decisions. If you want a timely decision, try to suggest a timeframe or ask about a suitable timing for their answer in order to provide them with a timeframe. Keep all agreed-upon commitments in writing. Try to be patient and respect the processes in place.

If possible aim to find a familiar third party introduction or stakeholder to start the business discussion, as the British appreciate working with people who they are familiar with. Try not to be extremely critical in public, as they don’t like harsh confrontation.

Power Distance: the extent to which the less powerful members of institutions and organizations within a country expect and accept that power is distributed unequally.

There is a large gap in the score of Lebanon and the UK on power distance. While Lebanon follows a hierarchical and centralized system, the score of the UK shows that the British society believes that inequalities should be minimized.

Individualism: the degree of interdependence a society maintains among its members.

While Lebanon scores low on individualism reflecting its collectivistic society, the UK people are among the most individualistic cultures. For the British people happiness tends to be through personal fulfillment, with rampant consumerism and a strengthened “ME” culture.

Masculinity: whether society is driven by competition, achievement and success (masculine) or dominant values in society are caring for others and quality of life (feminine).

While Lebanon has an average score on masculinity, the UK score reflects masculine society, highly success oriented. Foreigners tend to confuse between the British culture of modesty. It is important to differentiate these traits, as the UK people tend to live to work and have a clear performance ambition.

Uncertainty Avoidance: the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these.

Lebanon has a preference for avoiding uncertainty, and prefers to have rigid code of belief and an emotional need for rules. People tend to work hard, but innovation might be resisted among populations with such a score. The UK, however, is more uncertainty accepting, indicating that the British people tends to be comfortable in ambiguous situations.

Planning tends to be more short-term oriented, and the people may not be detail-oriented. However, their goals remain clear. A combination of individualism and being curious about change pushes the nation towards a strong need for innovation.

Long Term Orientation: how every society has to maintain some links with its own past while dealing with the challenges of the present and future.

Lebanon scores low on this indicator reflecting a culture that is considered normative, and prefer to maintain time-honored traditions and norms, while viewing societal change with suspicion. The UK has an average score on this dimension which does not reflect any dominant aspect.

Indulgence: the extent to which people try to control their desires and impulses

Lebanon scores low on this dimension indicating that its culture is rather restrained in nature. Such societies have a tendency to cynicism and pessimism. They have the perception that their actions are restrained by social norms and that self-indulgence is wrong. In contrast, the UK scores high on this dimension meaning that its culture is classified as indulgent, showing a willingness to realize their desire and impulses related to enjoying life. The UK people place a higher degree of importance on leisure time and spend money as they wish.

According to Cultural Atlas, for the British people, punctuality is highly appreciated in meetings. It can be helpful start with a few minutes of social conversation, without entering any personal topics. The British use humor sometimes throughout dealings, as such you may want to reciprocate to lighten the setting and build a good atmosphere for future discussion. Try to give the impression that your business is well managed, despite the current situation in your country, as the British prefer to feel comfortable about business. It is important to avoid any exaggerated claims, try to back your claims with facts and figures.

The British tend not to rush into a deal, or take immediate decisions. If you want a timely decision, try to suggest a timeframe or ask about a suitable timing for their answer in order to provide them with a timeframe. Keep all agreed-upon commitments in writing. Try to be patient and respect the processes in place.

If possible aim to find a familiar third party introduction or stakeholder to start the business discussion, as the British appreciate working with people who they are familiar with. Try not to be extremely critical in public, as they don’t like harsh confrontation.

Main References

- United Kingdom: Sauces and Condiments Market to Grow at CAGR of 1.72% until 2025, WM-Strategy

- UK Cooking Sauces and Pasta Sauces Market Report 2022, MINTEL

- Sales value of sauces* manufactured in the United Kingdom (UK) from 2008 to 2020, Statista

- Our Industry at a Glance 2021, Food and Drink Federation

- Retail Food United Kingdom, USDA 2021

- www.fas.usda.gov/

- A starring role, focus on… sauces & condiments, the Grocer

- The Great British Sauce Revival?, focus on… sauces & condiments, the Grocer

- Brands of cooking sauces* ranked by number of users in Great Britain from 2018 to 2020, Statista

- UK's favourite condiments revealed - with some rather bizarre choices, Mirror

- British Culture, Cultural Atlas

- Country Comparison, Hofstede Insights

- ITC Trade Map

- Glassnow Marketing Guide: Hot Sauce, Glassnow blog

Tips

- Familiarize yourself with the sauces market in the UK and get to know more your competitors.

- Study carefully the target market for your products, and what adjustments to do in order to reach a wider crowd

- Keep up with the trends of the British consumers

- Study you market entry options to select from an appropriate pool of buyers.

- Make use of available trade fairs and exhibitions to promote your product. Find the right fairs for your products (organic, gluten free and vegan among others).

- Shed light on specific features of your product, such as ethical production methods, traditional methods, and health-related characteristics of your products, as well as taste and flavors.

- Remember that the packaging of your product gives the first impression to the customer. Use attractive packaging; add your story and origins of your product, as the British appreciate multiculturalism and the diversity behind your products.

- Take advantage of your website and social media to promote your product and keep your customers engaged through promotions and useful videos.

- When dealing with the British, remember the cultural differences and respect their way of doing business.