Overview

Lebanon is relatively a large exporter of sauces and mixed condiments and mixed seasoning, worldwide over the past two decades and among the top 60 exporters of such products in 2020. Exports have been growing at a CAGR of 21.3% from $518,000 in 2001 to $20.2m in 2020. In the coming years, promising opportunities can be found in the United States and in the United Kingdom for Lebanese sauces and seasonings producers. This document gives an overview about the sauces market, takes a closer look at Lebanon’s exports and worldwide imports, and highlights potential growth opportunities of Lebanon’s exports of sauces, mixed condiments and seasonings.

Product Definition

Sauces and pastes mainly consist of a combination of ingredients to form a harmonious taste. A sauce changes a dish by adding flavors, texture, viscosity and moistness to food. It can be based on (or include) a variety of ingredients such as the juice of fruits and vegetables, vegetable oil, herbs, wine, aromatics, dairy, honey, vinegar, nuts and molasses.

The sauce can balance the flavors between salt, bitter, sweet, sour and umami, depending on the dish that is being prepared. Also the sauces can differ based on the texture and consistency ranging from thin sauces to thickened sauces.

Sauces include ready-to-eat sauces, gravies, and dressings, and mixes to be reconstituted before consumption. The ready-to-eat products are divided into subcategories for emulsified and non-emulsified products, whereas the mixes are divided into subcategories that encompass both emulsified and non-emulsified sauce mixes:

Clear sauces (e.g., fish sauce) include thin, non-emulsified clear sauces that may be water based and used as condiments or ingredients rather than as finished gravy. Examples include oyster sauce and Thai fish sauce (nam pla).

The most known dips in Lebanon include Hummus, Mutabal, Garlic paste, Muhamarra, Tarator, Labneh-based dip, while sauces may be concentrated around lemon, olive oil, pomegranate molasses, yogurt, tomato, honey, vinegar, pepper and herbs among others. This report uses the combined nomenclature code 2103 ‘Sauces and preparations therefor; mixed condiments and mixed seasonings; mustard flour and meal and prepared mustard’.

The sauce can balance the flavors between salt, bitter, sweet, sour and umami, depending on the dish that is being prepared. Also the sauces can differ based on the texture and consistency ranging from thin sauces to thickened sauces.

Sauces include ready-to-eat sauces, gravies, and dressings, and mixes to be reconstituted before consumption. The ready-to-eat products are divided into subcategories for emulsified and non-emulsified products, whereas the mixes are divided into subcategories that encompass both emulsified and non-emulsified sauce mixes:

- Emulsified sauces and dips (e.g., mayonnaise, salad dressing, onion dips), such as sauces, gravies, dressing-based sauces and dips, at least in part, in a fat- or oil-in-water emulsion—examples include salad dressing (e.g., French, Italian, Greek, ranch style), fat-based sandwich spreads (e.g., mayonnaise with mustard), salad cream, and fatty sauces and snack dips (e.g., bacon and cheddar dip, onion dip).

- Non-emulsified sauces (e.g., ketchup, cheese sauce, cream sauce, brown gravy) include water, coconut milk, and milk-based sauces, gravies, and dressings, such as barbecue (BBQ) sauce, tomato ketchup, cheese sauce, Worcestershire sauce, Asian thick Worcestershire sauce (tonkatsu sauce), chili sauce, sweet and sour sauce, and white sauce (milk-based sauce, with little added fat and flour)

- Mixes for sauces and gravies are concentrated products, usually in powdered form, to be mixed with water, milk, oil, or other liquid to prepare a finished sauce or gravy, including mixes for cheese sauce, hollandaise sauce, and salad dressing (e.g., Italian or ranch dressing)

Clear sauces (e.g., fish sauce) include thin, non-emulsified clear sauces that may be water based and used as condiments or ingredients rather than as finished gravy. Examples include oyster sauce and Thai fish sauce (nam pla).

The most known dips in Lebanon include Hummus, Mutabal, Garlic paste, Muhamarra, Tarator, Labneh-based dip, while sauces may be concentrated around lemon, olive oil, pomegranate molasses, yogurt, tomato, honey, vinegar, pepper and herbs among others. This report uses the combined nomenclature code 2103 ‘Sauces and preparations therefor; mixed condiments and mixed seasonings; mustard flour and meal and prepared mustard’.

Where Are Lebanon’s Sauces and Pastes Currently Exported to?

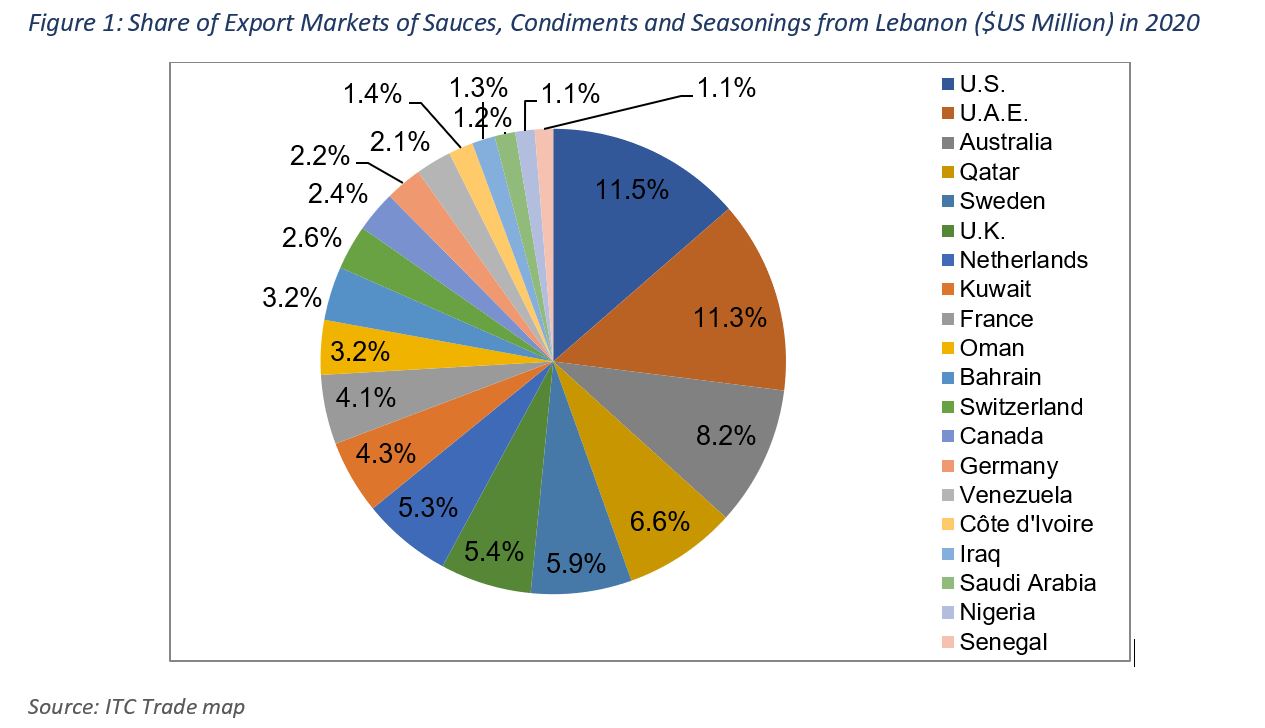

In 2020, 11.5% of Lebanon’s sauces, condiments and seasonings were exported to the United States and around 11.3% to the U.A.E., 8.2% to Australia, 6.6% to Qatar, 5.9% to Sweden, 5.4% to the United Kingdom, 5.3% to the Netherlands, 4.3% to Kuwait, 4.1% to France, 3.2% to each of Oman and Bahrain, 2.6% to Switzerland, 2.4% to Canada, 2.2% to Germane, 2.1% to Venezuela, 1.4% to Côte d'Ivoire, 1.3% to Iraq, 1.2% to Saudi Arabia and 1.1% to each of Nigeria and Senegal (Figure 1).

What Is Lebanon’s Position in the International Market?

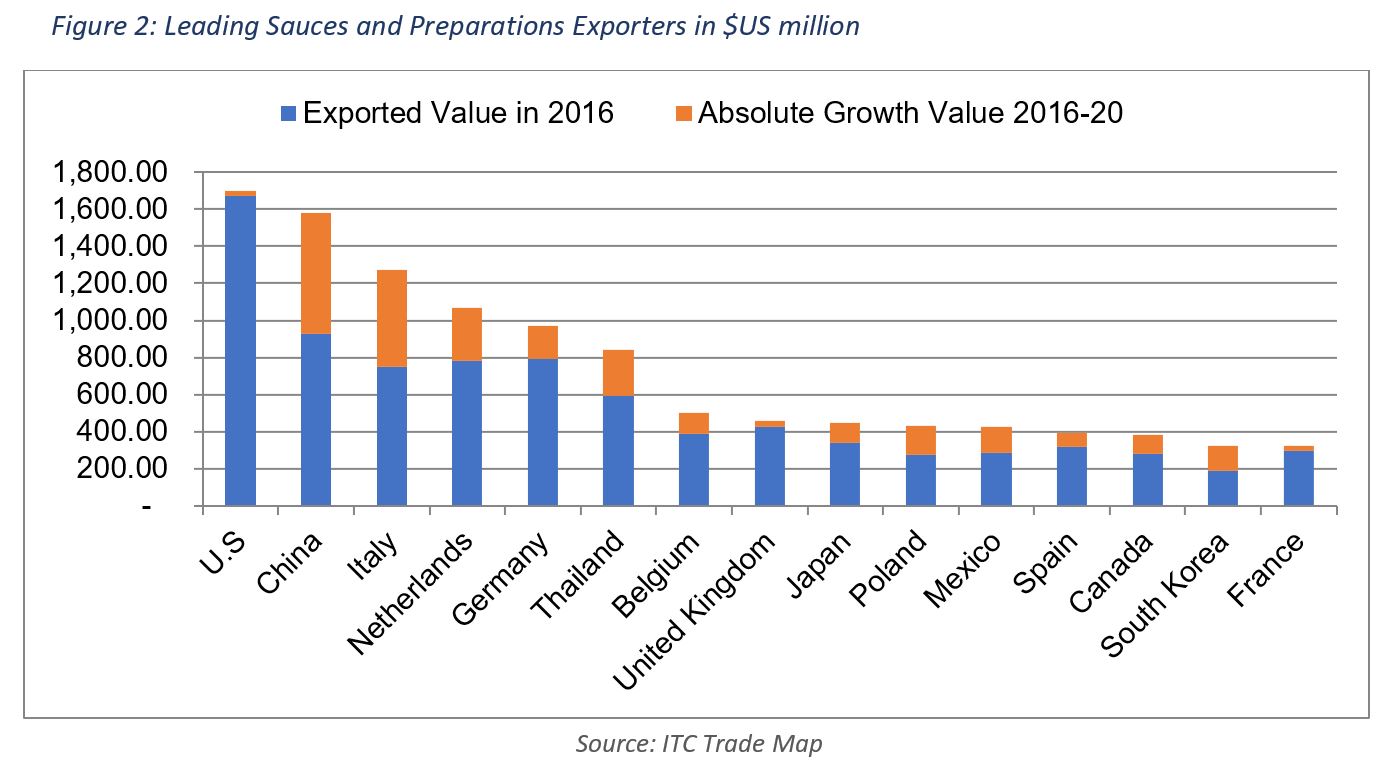

The top 21 countries in exports of sauces, condiments and seasonings represent 82.2% of the total globally exported value of $14.9bn in 2020. The U.S. has recently been the top exporter of sauces worldwide, with a share of 11.4% of total exported sauces and condiments in 2020. China followed with 10.6%, then Italy with 8.5%, the Netherlands with 7.1%, Germany with 6.5%, Thailand with 5.6%, Belgium with 3.4%, the United Kingdom with 3.1%, Japan with 3%, Poland with 2.9%, Mexico with 2.8%, Spain and Canada with 2.6% each, South Korea and France with 2.2%, Indonesia with 1.5%, Austria with 1.4%, Hong Kong with 1.3%, Malaysia with 1.2%, and Sweden and Russia with 1.1%. After the top 21 exporting countries, 41 countries have shares that range between 0.1% and 0.9%. Lebanon has a share of 0.14%, making it the 58th largest exporter of sauces, condiments and seasonings in 2020. The 60 largest exporters of these products represented a share of 98.4% of total exported products in 2020.

It is worth mentioning that countries of the Mediterranean Basin exported around 15.3% of the globally exported value in 2020. Lebanon was the eighth largest exporter of such products among Mediterranean countries in the same year.

In 2020, the total value of sauces and dips exports from Lebanon stood at $20.2 million, a 56% drop compared to 2014 levels — the highest export value recorded at $46m. The quantity of exported sauces and condiments was at 15 million tons in 2014 and peaked at 17.7 million tons in 2017 before declining to 7.8 million tons in 2019, as per the Lebanese Customs.

Lebanon’s share in the imports of most countries is low, which leaves room for future market share expansion. Among the countries that imported more than $0.5m of Lebanese sauces, Lebanon’s share in the countries’ imports of sauces are relatively elevated in Qatar at 2.9%, in Bahrain at 2.7%, in the UAE at 1.4% and in Kuwait at 1.1%. Among countries that imported more than $200,000 of Lebanese sauces, the share of imports of sauces from Lebanon are relatively elevated in Côte d'Ivoire at 5.3%, in Venezuela at 4.5% and in Senegal at 3.1%. Still, these shares remain low in terms of market concentration compared to other products such as pickles.

In terms of duties, Lebanon benefits from several trade agreements that raise the competitiveness of Lebanese Sauces internationally:

These free-trade agreements and reduced custom duties provide Lebanon with a competitive advantage in the main markets for Lebanese sauces, condiments and seasonings. The other markets include Australia, with an applied tariff of 0% on Lebanese sauces and preparations products in 2022. In parallel, tariffs in Canada on Lebanese sauces and preparations reached 9.5% for soya sauce, 12.5% for tomato ketchup, 3% for mustard flour and meal, 9.5% on prepared mustard, 11% on mayonnaise and salad dressing, 8% on mixed condiments and seasonings (excl. soya sauce, tomato ketchup and other tomato sauces, mustard, and mustard flour and meal) and 9.5% on other sauces, condiments and seasonings.

It is worth mentioning that countries of the Mediterranean Basin exported around 15.3% of the globally exported value in 2020. Lebanon was the eighth largest exporter of such products among Mediterranean countries in the same year.

In 2020, the total value of sauces and dips exports from Lebanon stood at $20.2 million, a 56% drop compared to 2014 levels — the highest export value recorded at $46m. The quantity of exported sauces and condiments was at 15 million tons in 2014 and peaked at 17.7 million tons in 2017 before declining to 7.8 million tons in 2019, as per the Lebanese Customs.

Lebanon’s share in the imports of most countries is low, which leaves room for future market share expansion. Among the countries that imported more than $0.5m of Lebanese sauces, Lebanon’s share in the countries’ imports of sauces are relatively elevated in Qatar at 2.9%, in Bahrain at 2.7%, in the UAE at 1.4% and in Kuwait at 1.1%. Among countries that imported more than $200,000 of Lebanese sauces, the share of imports of sauces from Lebanon are relatively elevated in Côte d'Ivoire at 5.3%, in Venezuela at 4.5% and in Senegal at 3.1%. Still, these shares remain low in terms of market concentration compared to other products such as pickles.

In terms of duties, Lebanon benefits from several trade agreements that raise the competitiveness of Lebanese Sauces internationally:

- Lebanon benefits from the Greater Arab Free Trade Area (GAFTA), which allows exports from Lebanon that receive a certificate of origin to enter 17 other Arab countries, including the Gulf Cooperation Council countries.

- The EFTA-Lebanon Free Trade Agreement allows Lebanese agri-food products, including sauces, to enter the European market without paying duties, on the condition of presenting a certificate of origin.

- Lebanese sauces are also eligible for the Generalized System of Preferences (GSP) when entering the U.S.; however, the GSP is currently on hold.

These free-trade agreements and reduced custom duties provide Lebanon with a competitive advantage in the main markets for Lebanese sauces, condiments and seasonings. The other markets include Australia, with an applied tariff of 0% on Lebanese sauces and preparations products in 2022. In parallel, tariffs in Canada on Lebanese sauces and preparations reached 9.5% for soya sauce, 12.5% for tomato ketchup, 3% for mustard flour and meal, 9.5% on prepared mustard, 11% on mayonnaise and salad dressing, 8% on mixed condiments and seasonings (excl. soya sauce, tomato ketchup and other tomato sauces, mustard, and mustard flour and meal) and 9.5% on other sauces, condiments and seasonings.

What Are the Trends in Trade in the 20 Largest Importing Markets?

The global value of imported sauces and preparations grew significantly from $3.7bn in 2002 to $14bn in 2020, increasing by a compounded annual growth rate of 7.6% over the covered period. More recently, they grew from $10bn in 2012 to $11.4bn in 2014, then declined to about $10.7bn in 2015, and then grew gradually to $14bn in 2020. The growth in sauces globally reflects consumers’ demand for a wider range of flavours. In addition, the increased demand for ready-to-eat meals and convenience food is raising the demand for seasonings, condiments and sauces.

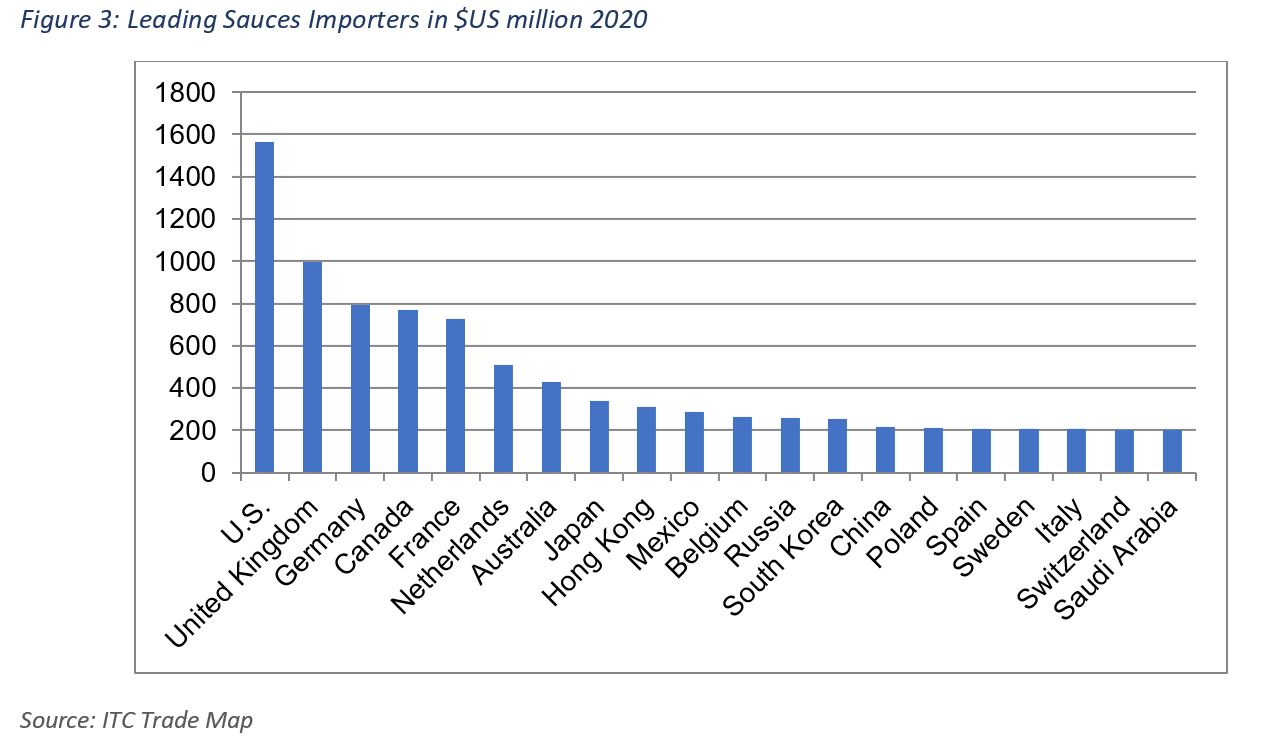

The top 20 sauces and condiments importers constituted almost 64% of worldwide imports in 2020. For the past two decades, the U.S. was largely the leading sauces importer with a 11.2% share of total sauces imports in 2020. The quantity of its imports of sauces grew by 164% from 296,826 tons in 2002 to 784,000 tons in 2020. Coincidently, the average unit price of sauces imports in the U.S. grew by 14.8% from $1,740/ton in 2002 to $1,998/ton in 2020.

Meanwhile, the United Kingdom retained its second place, over the same period, and made it to the first place in 2008, 2009 and 2010, it had a share of 7.1% in 2020. The value of such imports grew by about 200% between 2002 and 2020, while the quantities imported grew by 116% over the same period to 576,571 tons in 2019. The value of imports of sauces of Germany, France and Canada has been relatively close. Germany came in the third place between 2004 and 2006, however France imports exceeded the latter; Canada’s imports of sauces also become the fourth largest, exceeded Germany in 2014, and then became the third largest importer after the United Kingdom between 2015 and 2019. In 2020, Germany was the third largest importer, followed by Canada and France. Canada and France’s shares of imported sauces were equivalent to 5.5% and 5.2%, respectively, in 2020.

In the Middle East, the imported value of sauces, condiments and mixed seasonings products grew from $80.2m in 2002 to $769.9m in 2020. Saudi Arabia was the largest importer of sauces in the Middle East with a share of 26.2% of total imports in the region, followed by the UAE (21.9%), Kuwait (10.5%), Iraq (6.8%), Qatar (6%), Morocco (5.6%) and Oman (5.1%).

The top 20 sauces and condiments importers constituted almost 64% of worldwide imports in 2020. For the past two decades, the U.S. was largely the leading sauces importer with a 11.2% share of total sauces imports in 2020. The quantity of its imports of sauces grew by 164% from 296,826 tons in 2002 to 784,000 tons in 2020. Coincidently, the average unit price of sauces imports in the U.S. grew by 14.8% from $1,740/ton in 2002 to $1,998/ton in 2020.

Meanwhile, the United Kingdom retained its second place, over the same period, and made it to the first place in 2008, 2009 and 2010, it had a share of 7.1% in 2020. The value of such imports grew by about 200% between 2002 and 2020, while the quantities imported grew by 116% over the same period to 576,571 tons in 2019. The value of imports of sauces of Germany, France and Canada has been relatively close. Germany came in the third place between 2004 and 2006, however France imports exceeded the latter; Canada’s imports of sauces also become the fourth largest, exceeded Germany in 2014, and then became the third largest importer after the United Kingdom between 2015 and 2019. In 2020, Germany was the third largest importer, followed by Canada and France. Canada and France’s shares of imported sauces were equivalent to 5.5% and 5.2%, respectively, in 2020.

In the Middle East, the imported value of sauces, condiments and mixed seasonings products grew from $80.2m in 2002 to $769.9m in 2020. Saudi Arabia was the largest importer of sauces in the Middle East with a share of 26.2% of total imports in the region, followed by the UAE (21.9%), Kuwait (10.5%), Iraq (6.8%), Qatar (6%), Morocco (5.6%) and Oman (5.1%).

What Are Interesting Markets for the Future?

Global trade in sauces, condiments and seasonings products surged significantly over the past 20 years. The rise in the

consumption of ethnic food as well as fusion tastes and flavors is pushing the demand for taste-enhancing products,

including spicy, sour and sweet sauces. In addition, the pandemic drove consumers towards healthy food, building a

demand for organic and natural sauces and seasonings. Seeking a healthier lifestyle often leads to consumption of

salads, mixes of fruits and vegetables, which usually require seasonings. Also, eating at home during the lockdowns

bolstered home-cooking habits, pushing consumers towards trying new sauces while preparing different dishes.

As these trends remain strong, they will provide much room for growth of sauces demand. The aforementioned of healthier food, multiculturalism and ethnic foods, as well as fusions tastes typically can be easily found in Western countries such as the U.S., Canada the United Kingdom and some European countries. In addition, countries in the GCC provide a good market for Lebanese sauces due to the proximity, the Greater Arab Free Trade Area (GAFTA), and the position of most of these countries as net importers of sauces, condiments and seasonings.

The methodology includes a calculation based on the total sauces import value in 2020, the annual growth value, the value of imported sauces from Lebanon, and the growth in the value of imported sauces from Lebanon over the past four years, among other indicators.

As these trends remain strong, they will provide much room for growth of sauces demand. The aforementioned of healthier food, multiculturalism and ethnic foods, as well as fusions tastes typically can be easily found in Western countries such as the U.S., Canada the United Kingdom and some European countries. In addition, countries in the GCC provide a good market for Lebanese sauces due to the proximity, the Greater Arab Free Trade Area (GAFTA), and the position of most of these countries as net importers of sauces, condiments and seasonings.

Most Promising Markets for Sauces from Lebanon

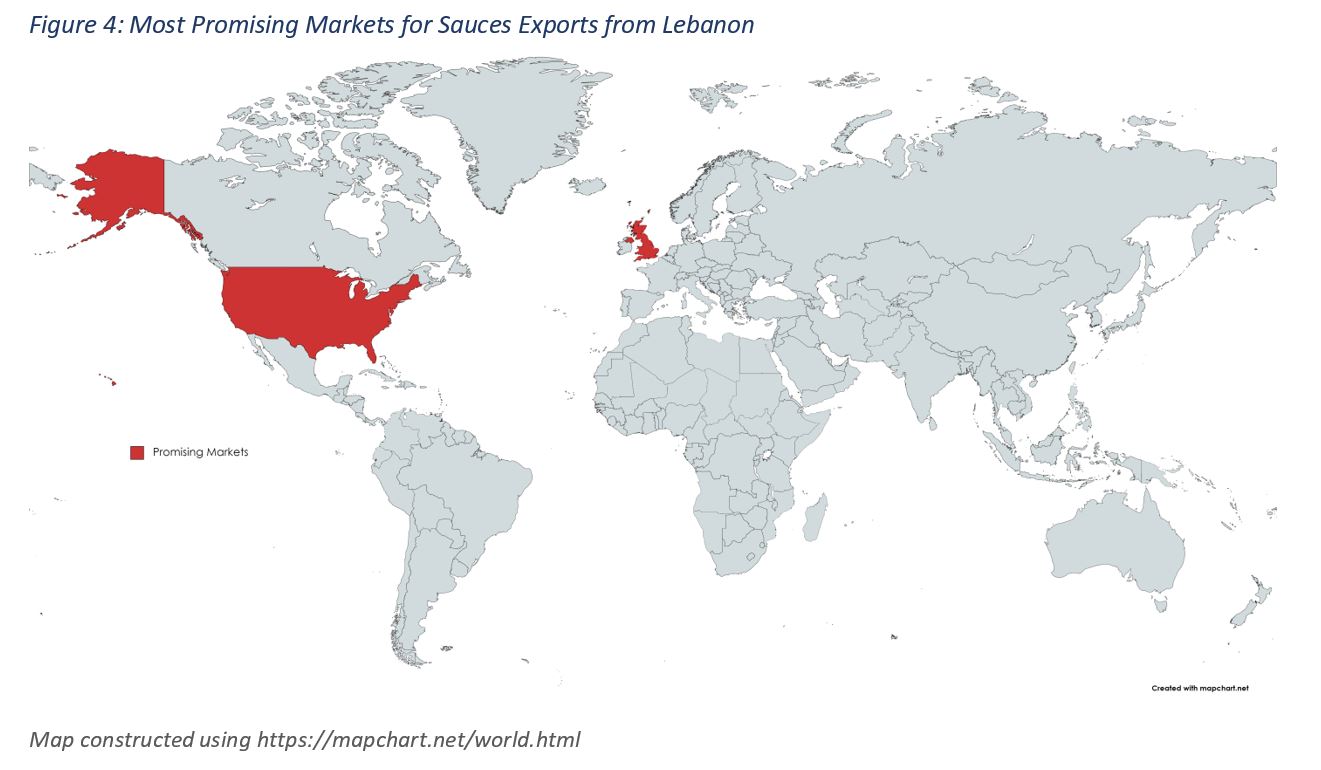

Following a model based on trade statistics and other variables, the U.S. and the United Kingdom were identified as potential markets for sauces exports from Lebanon (Figure 4). The US was the biggest destination for Lebanese sauces exports, accounting for 11.5% of total sauces exports, and the United Kingdom was the sixth largest market for Lebanese exporters.The methodology includes a calculation based on the total sauces import value in 2020, the annual growth value, the value of imported sauces from Lebanon, and the growth in the value of imported sauces from Lebanon over the past four years, among other indicators.

Tips

- Focus your marketing and sales efforts on a limited range of countries, ideally in one region, after having analyzed several indicators such as the demand for the product, the imports, the outlook for coming years, and other trade-related indicators (tariffs and distance, among others).

- Assess the potential export market

- Start with a market segmentation to estimate the potential market for your products.

- Identify competitors and similar products in order to differentiate.

- Check for emerging trends on the consumers’ side as well as on the suppliers’ side.

- Check legal and quality requirements to see if your product fits, or if it is possible to do some adjustments to be able to enter the market. Make sure that you can abide by potential quantity requirements of the potential distribution channels. Are there other barriers to entry and risks?

- Build a market entry strategy (possibly through a cost/benefit analysis)

- Choose a pricing strategy

- Establish the right position for the product

- Select the proper distribution channels

- Build your export plan