Market: Trade Statistics, Trends

Denmark is not traditionally a wine producing country, mainly because of sub-optimal climate conditions. However, this changed in the early 1990 with hobby growers starting to produce wine since which was further facilitated with the August 2000 revision of the EU Wine Regulation that made commercial wine production legal in Denmark. Since then, the Danish wine (or vin) industry increased rapidly, especially with climate change that led to warmer summers, milder winters, and shorter frosty periods in spring. Danish vineyards are widespread in the country but are predominantly close to the coastline and on the islands. According to the New York Times, in 2019, Denmark boasted 90 commercial vineyards up from just 2 in 2014. In 2021, IBISWorld estimated industry revenues from wine production in Denmark at around 1 million USD compared to 16.5 billion USD in France.

Denmark remained one the smallest wine producers in Europe.

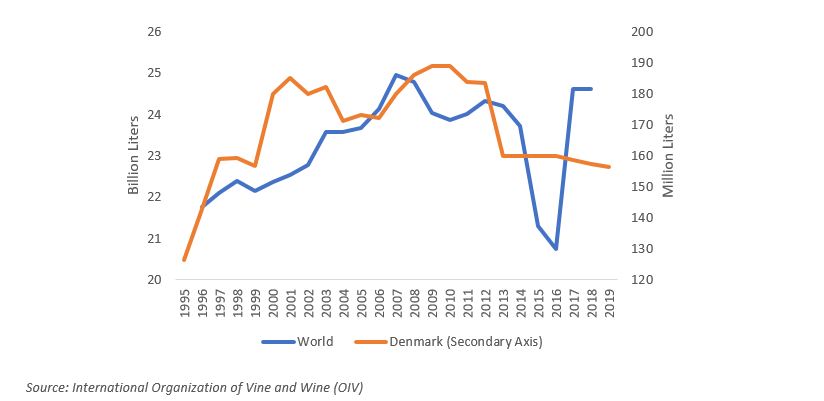

According to the International Organization of Vine and Wine (OIV), Denmark was the 26th largest wine consumer in 2018, consuming around 150 million liters equivalent to a global consumption share of 0.6%. In terms of per capita consumption, Danish people consumed an average of 4.25 liters of pure alcohol from wine in 2019, ranking as the 8th country.

In 2020, Denmark ranked as the 18th largest wine exporter with a global share of 0.53%. Its wine exports grew at a slightly higher CAGR of 6.4% compared to the world average of 4.9% between 2001 and 2020.

Import Trends

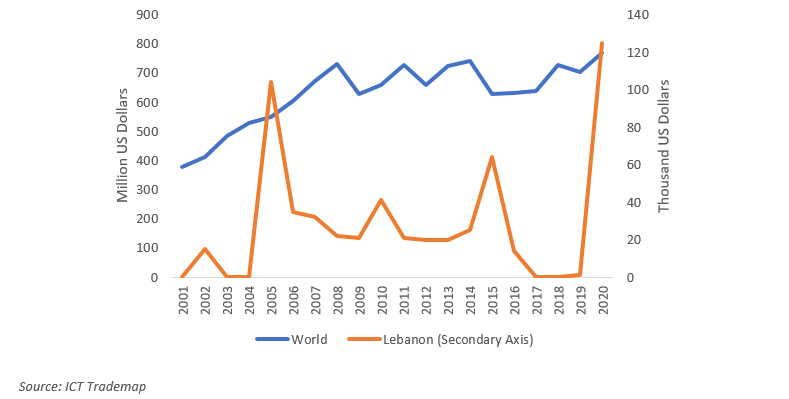

Most of Denmark’s wine is imported from Europe, the United States, South America, Oceania, and South Africa, but the country also imports a small amount from Asian countries. The Danish market is huge, open, and dynamic. Denmark holds the record of the highest number of wine importers per inhabitant, due to the large number of small, part-time importers who import wines from all over the world. Denmark is the 13th largest wine importer worldwide with wine imports amounting to 770 million USD in 2020. Danish wine imports underwent a sharp increase between 2001 and 2008, almost doubling in value. Since 2009, wine imports oscillated reaching the highest value in the last two decades in 2020. Danish wine imports from Lebanon varied considerably from one year to the other, with imports peaking in 2005, 2010 and 2015 at 104, 41 and 64 thousand USD respectively. The highest value of wine exported from Lebanon to Denmark was recorded in 2020 at 125 thousand USD with Lebanon ranking as the 36th largest wine exporter into Denmark. In that year, Lebanese wine constituted 0.02% of all the Danish wine imports. In terms of quantity, Lebanon ranked as the 29th largest wine supplier to Denmark with 29 tons of wine exported to Denmark.

Market Trends

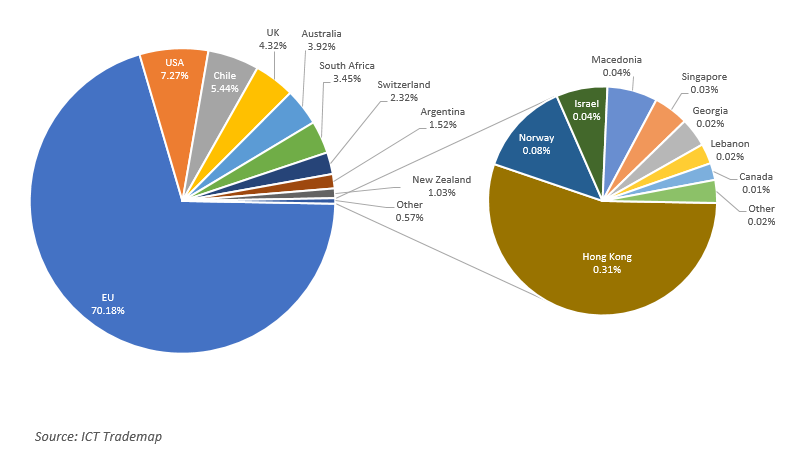

In 2020, more than 70% of Denmark’s wine was imported from the European Union. Almost half of the Danish wine imports were supplied by France (26%) and Italy (22%). Other large EU exporters included Spain (7%), Germany (7%) and Portugal (3%). Another 5% was imported from 21 other EU countries. The United States of America was the largest non-EU wine exporter to Denmark with a share of 7%, followed by Chile (5%), UK (4%), Australia (4%), South Africa (3%), Switzerland (2%), Argentina (2%) and New Zealand (1%). Other supplying countries accounted for 0.6% of total Danish wine imports.

In 2020, the world average imported unit price was $3.95/liter. The average unit value of imports from Italy, Germany, Portugal, Sweden, New Zealand, and Austria exceeded the world average. The unit value of imports from USA, Spain, Chile, and Argentina were lower than the world average. While the unit value of wine imports from Australia, South Africa and Finland were less than half the world average, those from France, Netherlands, Belgium, and Poland were more than double. The unit price of Danish wine imports from Lebanon was $4.31/liter, only slightly higher than the world average one.

Changes in the Danish Market

The Danish wine market flourished due to a series of factors mainly, a world-class restaurant scene, and a high per capita income of Danes. Additionally, Denmark is characterized by a ‘free market’ for alcoholic beverages while the markets of its Northern European neighbors are monopolistically controlled by the government. This allows foreign producers to work with hundreds of highly specialized wine importers.

Red wines continue to dominate demand, with apparent attraction, in the recent years, towards niche red varietals such as Gamay or Grenache. However, it appears the Danish taste is changing. With recent summers being particularly long and hot, Danish consumers are starting to gravitate towards lighter, refreshing styles of wine, particularly rosé, white, and sparkling wines. Gastronomical influences are also greatly contributing to this shift as Danish wine drinkers report that food and wine matching has become significantly more important as a driver of wine choice. Moreover, as Danes are becoming increasingly concerned with health and well-being, lighter wines are providing the ability to moderate alcohol consumption while still enjoying wine. Danes appear to prefer sweet wine over dry wine. Additionally, Copenhagen ranks top of the list of places to drink natural wine, or wine such as was produced in the good old days, before wine producers started adding or removing things during winemaking to create a consistent, commercial product each time.

Another interesting trend on the sparkling wine market is linked with the alternative packaging. There are many companies which are exploring unconventional ways of packaging, including cans and single-serving bottles. Those types are more practical in the summer, as they can be used in outdoor places and events, where glass bottles typically cannot, and are convenient to carry.

Wine consumers appear to be taking a trading-up approach to the wine category, evidenced by a decrease in per capita consumption alongside an increase in both per bottle spend and a corresponding uplift in the value of the category. More specifically, as the price per bottle has steadily increased, along with the high tax on alcohol, Danes have become increasingly willing to spend more in the off trade on a bottle of wine for most drinking occasions than they have done over the past few years.

Looking at the general wine ecosystem, large supermarkets dominate the distribution, and sales by HORECA are solid. However, in the last few years, sales on emerging online wine stores significantly increased.

Small wine exporters who are not able to export large quantities can focus on the large number of small importers in Denmark. They will have to emphasize their uniqueness to distinguish themselves among the wide variety of wines available, such as by supplying sustainably produced wine, which is increasingly popular among Danish consumers.

According to the International Organization of Vine and Wine (OIV), Denmark was the 26th largest wine consumer in 2018, consuming around 150 million liters equivalent to a global consumption share of 0.6%. In terms of per capita consumption, Danish people consumed an average of 4.25 liters of pure alcohol from wine in 2019, ranking as the 8th country.

In 2020, Denmark ranked as the 18th largest wine exporter with a global share of 0.53%. Its wine exports grew at a slightly higher CAGR of 6.4% compared to the world average of 4.9% between 2001 and 2020.

Import Trends

Most of Denmark’s wine is imported from Europe, the United States, South America, Oceania, and South Africa, but the country also imports a small amount from Asian countries. The Danish market is huge, open, and dynamic. Denmark holds the record of the highest number of wine importers per inhabitant, due to the large number of small, part-time importers who import wines from all over the world. Denmark is the 13th largest wine importer worldwide with wine imports amounting to 770 million USD in 2020. Danish wine imports underwent a sharp increase between 2001 and 2008, almost doubling in value. Since 2009, wine imports oscillated reaching the highest value in the last two decades in 2020. Danish wine imports from Lebanon varied considerably from one year to the other, with imports peaking in 2005, 2010 and 2015 at 104, 41 and 64 thousand USD respectively. The highest value of wine exported from Lebanon to Denmark was recorded in 2020 at 125 thousand USD with Lebanon ranking as the 36th largest wine exporter into Denmark. In that year, Lebanese wine constituted 0.02% of all the Danish wine imports. In terms of quantity, Lebanon ranked as the 29th largest wine supplier to Denmark with 29 tons of wine exported to Denmark.

Market Trends

In 2020, more than 70% of Denmark’s wine was imported from the European Union. Almost half of the Danish wine imports were supplied by France (26%) and Italy (22%). Other large EU exporters included Spain (7%), Germany (7%) and Portugal (3%). Another 5% was imported from 21 other EU countries. The United States of America was the largest non-EU wine exporter to Denmark with a share of 7%, followed by Chile (5%), UK (4%), Australia (4%), South Africa (3%), Switzerland (2%), Argentina (2%) and New Zealand (1%). Other supplying countries accounted for 0.6% of total Danish wine imports.

In 2020, the world average imported unit price was $3.95/liter. The average unit value of imports from Italy, Germany, Portugal, Sweden, New Zealand, and Austria exceeded the world average. The unit value of imports from USA, Spain, Chile, and Argentina were lower than the world average. While the unit value of wine imports from Australia, South Africa and Finland were less than half the world average, those from France, Netherlands, Belgium, and Poland were more than double. The unit price of Danish wine imports from Lebanon was $4.31/liter, only slightly higher than the world average one.

Changes in the Danish Market

The Danish wine market flourished due to a series of factors mainly, a world-class restaurant scene, and a high per capita income of Danes. Additionally, Denmark is characterized by a ‘free market’ for alcoholic beverages while the markets of its Northern European neighbors are monopolistically controlled by the government. This allows foreign producers to work with hundreds of highly specialized wine importers.

Red wines continue to dominate demand, with apparent attraction, in the recent years, towards niche red varietals such as Gamay or Grenache. However, it appears the Danish taste is changing. With recent summers being particularly long and hot, Danish consumers are starting to gravitate towards lighter, refreshing styles of wine, particularly rosé, white, and sparkling wines. Gastronomical influences are also greatly contributing to this shift as Danish wine drinkers report that food and wine matching has become significantly more important as a driver of wine choice. Moreover, as Danes are becoming increasingly concerned with health and well-being, lighter wines are providing the ability to moderate alcohol consumption while still enjoying wine. Danes appear to prefer sweet wine over dry wine. Additionally, Copenhagen ranks top of the list of places to drink natural wine, or wine such as was produced in the good old days, before wine producers started adding or removing things during winemaking to create a consistent, commercial product each time.

Another interesting trend on the sparkling wine market is linked with the alternative packaging. There are many companies which are exploring unconventional ways of packaging, including cans and single-serving bottles. Those types are more practical in the summer, as they can be used in outdoor places and events, where glass bottles typically cannot, and are convenient to carry.

Wine consumers appear to be taking a trading-up approach to the wine category, evidenced by a decrease in per capita consumption alongside an increase in both per bottle spend and a corresponding uplift in the value of the category. More specifically, as the price per bottle has steadily increased, along with the high tax on alcohol, Danes have become increasingly willing to spend more in the off trade on a bottle of wine for most drinking occasions than they have done over the past few years.

Looking at the general wine ecosystem, large supermarkets dominate the distribution, and sales by HORECA are solid. However, in the last few years, sales on emerging online wine stores significantly increased.

Small wine exporters who are not able to export large quantities can focus on the large number of small importers in Denmark. They will have to emphasize their uniqueness to distinguish themselves among the wide variety of wines available, such as by supplying sustainably produced wine, which is increasingly popular among Danish consumers.

Figure 1: Wine Consumption (1995 - 2019)

Figure 2: Value of Wine Imports into Denmark, 2001 – 2020

Figure 3: Percentage share of wine Exporters to Denmark in 2020

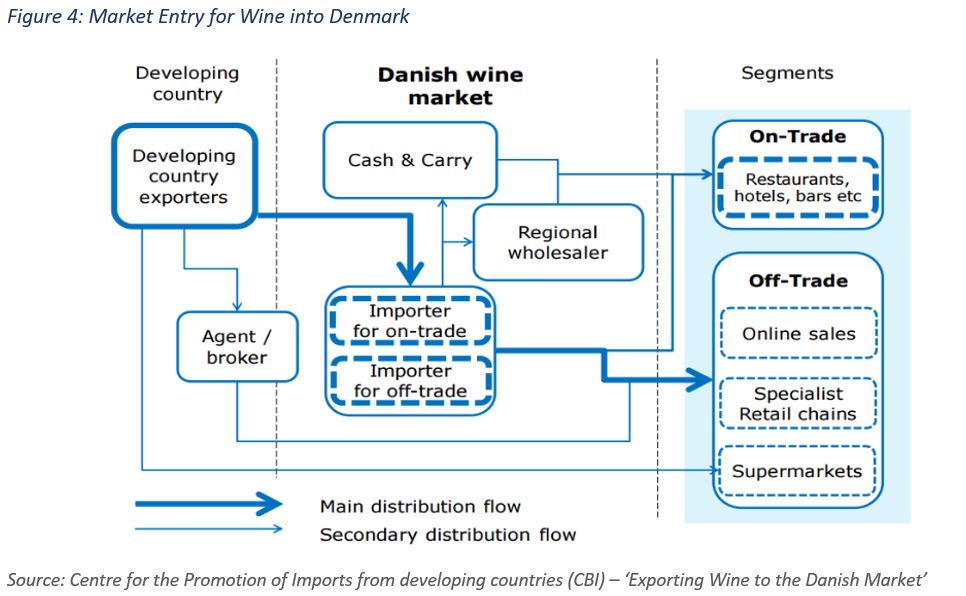

Market Entry: Trade Channels and Segments

Supermarkets and discounters dominate the Danish retail market. The three largest players in the wine trade in Denmark are COOP,

Dansk Supermarked

and SuperGros , together accounting for more than 80% of the market share, which indicates a highly concentrated sector. With their strong purchasing power, these supermarkets can demand very low prices and sell customers at lower-than-market prices.

Supermarkets are increasingly sourcing wine directly from producers, instead of buying from importers. This is most relevant for established wine producers who have a strong reputation as big-volume suppliers of wine with consistent quality. However, they also tend to introduce new wines in small batches of around 6,000 bottles to test if they sell before buying them in large volumes.

Supermarkets primarily focus on price. Their margin in the stores hovers between 15% to 30%. Listing fees for some supermarkets can be problematic, making it difficult for a developing country exporter to successfully target this channel.

Another wine selling channel, especially for premium wines, is through specialist retailers. Danish consumers looking for premium wines for special occasions resort to such retailers who can provide them with detailed information about the wine through trained personnel. Specialist shops usually buy their wines from an importer, specialized in the off trade. This channel, therefore, can only be reached indirectly by developing country exporters. Their margin on the selling price is 30% or higher. Sales by specialist retailers are expected to decrease in the coming years, as supermarkets become more competitive within the off-trade market.

Online wine retail in Denmark is still relatively underdeveloped: less than 10% of wine consumers order or have ordered online. In general, retailers with physical stores lead the development of online sales as consumers want to know the retailer before they rely on information provided in the online store; but still some small Danish premium wine importers without physical stores offer their wines through a web shop. Premium wines sell well online as consumers are willing to pay more for less usual wine which they cannot buy at the supermarket.

Online market development can be interesting for new market entrants from developing countries, as they can use the online space to provide more information on their products. This serves as an instrument to convince consumers of the value of their products. The importance of e-commerce is expected to grow significantly in the future.

Developing country exporters which produce smaller volumes of wine, higher quality wine, or unknown types of wine are strongly advised to use an importer/distributor to enter the Danish wine market. Also, for organic, ethnic and Fair Trade products, importers are the main trade channel. Importers can advise exporters on many issues, including legal and quality requirements, market trends and packaging.

Importers buy goods, of which they then take ownership and distribute to retailers, the on-trade sector, or re-export them to other countries. Importers are either specialized in selling to the on-trade sector or the off-trade sector. Retailers often use an importer for less known wines since importers then take care of the quality control. Importers generally add a mark-up to cover commissions, credit risk, after-sales service, and the cost of carrying a local inventory to meet small orders. Their margin generally ranges from 15-25% of the selling price but can go down to 10% when supplying supermarkets.

Developing country exporters willing to supply importers/distributors or retailers can use an agent to link them up with a trading partner. Agents are independent companies who negotiate on behalf of their clients and act as intermediaries between buyer and seller. They do not take ownership of the products, nor keep stock. Agents are still active in the Danish market, but their role is diminishing. The commission of a sales agent varies from 3-5% for large volume supplies to 10% for smaller quantities. Nevertheless, once an agent has been used, direct trade with an importer or retailer afterwards is difficult due to legislative issues, where the agent must be compensated for the commission he misses, so the content of the contract with an agent is very important.

Cash & Carries are a type of wholesaler that supplies the on-trade sector. They sell wines from their warehouse where customers pay on the spot and carry the goods away themselves. Developing country exporters which produce (smaller volumes of) higher quality wine, or unknown/specialty types of wine can target the on-trade sector and thereby choose for a cash & carry to reach this segment.

The COVID-19 pandemic caused a shift to the off-trade sector with many consumers eating out less and drinking more wine at home instead. As the pandemic subsides, consumers will spend more money on eating out again leading to a switch back to the on-trade sector.

Supermarkets are increasingly sourcing wine directly from producers, instead of buying from importers. This is most relevant for established wine producers who have a strong reputation as big-volume suppliers of wine with consistent quality. However, they also tend to introduce new wines in small batches of around 6,000 bottles to test if they sell before buying them in large volumes.

Supermarkets primarily focus on price. Their margin in the stores hovers between 15% to 30%. Listing fees for some supermarkets can be problematic, making it difficult for a developing country exporter to successfully target this channel.

Another wine selling channel, especially for premium wines, is through specialist retailers. Danish consumers looking for premium wines for special occasions resort to such retailers who can provide them with detailed information about the wine through trained personnel. Specialist shops usually buy their wines from an importer, specialized in the off trade. This channel, therefore, can only be reached indirectly by developing country exporters. Their margin on the selling price is 30% or higher. Sales by specialist retailers are expected to decrease in the coming years, as supermarkets become more competitive within the off-trade market.

Online wine retail in Denmark is still relatively underdeveloped: less than 10% of wine consumers order or have ordered online. In general, retailers with physical stores lead the development of online sales as consumers want to know the retailer before they rely on information provided in the online store; but still some small Danish premium wine importers without physical stores offer their wines through a web shop. Premium wines sell well online as consumers are willing to pay more for less usual wine which they cannot buy at the supermarket.

Online market development can be interesting for new market entrants from developing countries, as they can use the online space to provide more information on their products. This serves as an instrument to convince consumers of the value of their products. The importance of e-commerce is expected to grow significantly in the future.

Developing country exporters which produce smaller volumes of wine, higher quality wine, or unknown types of wine are strongly advised to use an importer/distributor to enter the Danish wine market. Also, for organic, ethnic and Fair Trade products, importers are the main trade channel. Importers can advise exporters on many issues, including legal and quality requirements, market trends and packaging.

Importers buy goods, of which they then take ownership and distribute to retailers, the on-trade sector, or re-export them to other countries. Importers are either specialized in selling to the on-trade sector or the off-trade sector. Retailers often use an importer for less known wines since importers then take care of the quality control. Importers generally add a mark-up to cover commissions, credit risk, after-sales service, and the cost of carrying a local inventory to meet small orders. Their margin generally ranges from 15-25% of the selling price but can go down to 10% when supplying supermarkets.

Developing country exporters willing to supply importers/distributors or retailers can use an agent to link them up with a trading partner. Agents are independent companies who negotiate on behalf of their clients and act as intermediaries between buyer and seller. They do not take ownership of the products, nor keep stock. Agents are still active in the Danish market, but their role is diminishing. The commission of a sales agent varies from 3-5% for large volume supplies to 10% for smaller quantities. Nevertheless, once an agent has been used, direct trade with an importer or retailer afterwards is difficult due to legislative issues, where the agent must be compensated for the commission he misses, so the content of the contract with an agent is very important.

Cash & Carries are a type of wholesaler that supplies the on-trade sector. They sell wines from their warehouse where customers pay on the spot and carry the goods away themselves. Developing country exporters which produce (smaller volumes of) higher quality wine, or unknown/specialty types of wine can target the on-trade sector and thereby choose for a cash & carry to reach this segment.

The COVID-19 pandemic caused a shift to the off-trade sector with many consumers eating out less and drinking more wine at home instead. As the pandemic subsides, consumers will spend more money on eating out again leading to a switch back to the on-trade sector.

Finding Potential Buyers

In 2014, the Danish tax authorities had 1,798 registered wine importers. Denmark has several associations of Danish wine importers, distributors, and wholesalers. The associations are a valuable source of information about the Danish market. Their websites include a list of their members which can be potential buyers. Members of these associations can range from small wine producers to multinational wine traders.

Vin & Spiritus Organisationen i DanmarkForeningen af Danske Vinimportører or the Association of Danish Wine Importers has more than 150 small and medium-sized wine importer members.

More wine companies in Denmark can be found on EUROPAGES,Beverage Trade Network, Wine-Searcher , and Kompass. LinkedIn can be used to look up and contact professionals who work for companies in Denmark specialized in wine. Information about wine companies in Denmark can also be found on webpages specialized in exhibitions, trade fairs, F&B events and competitions such as World Leading Wines – Copenhagen (annual wine event series aimed at introducing a selection of acclaimed wines new to Copenhagen to Danish importers – attendance by personal invite only) and FoodExpo(bi-annual food trade fair held in Herning, Denmark – with a section dedicated for WineExpo and Wine Market Place).

International wine fairs are valuable platforms to develop contact base, meet buyers and build brand recognition. At these trade fairs exporters can exhibit their wine at their stand and play host for important representatives from importers, distributors and retailers from across the world. This can give them a big boost in finding interested buyers for their wine. Prowein (Düsseldorf, Germany)

is the largest annual wine trade fair for professionals from viticulture, production, trade and gastronomy. Vinexpo (Bordeaux, France) is a bi-annual wine trade fair that plays a significant role in the popularization of the wine industry and culture in Asia and Africa. Biofach (Nuremberg, Germany) is the most important international exhibition for organic food and fair-trade products, held every February. It is an important niche trade fair for companies that sell natural wines. Details of other wine trade shows can be found on Trade Fair Dates.

The best way to understand the Danish market is to visit and speak to local stakeholders and prepare an entry strategy for the wine product. Almost all wine buyers prefer personal meetings to emails. If contact with potential buyers is done via email, a personalized one is most suitable as generic emails are perceived as unreliable or as spam. Such emails should explain how the wine product adds value to the importer’s portfolio and request connection with the right contact person.

When checking the portfolios of Danish wine importers, take into consideration their headquarters and operation locations, their size (including financial strength, number of employees, number of brands and suppliers and numbers of bottles shipped) and their specialization or focus (region, wine variety, etc.).

Vin & Spiritus Organisationen i Danmark

More wine companies in Denmark can be found on EUROPAGES,Beverage Trade Network, Wine-Searcher , and Kompass. LinkedIn can be used to look up and contact professionals who work for companies in Denmark specialized in wine. Information about wine companies in Denmark can also be found on webpages specialized in exhibitions, trade fairs, F&B events and competitions such as World Leading Wines – Copenhagen (annual wine event series aimed at introducing a selection of acclaimed wines new to Copenhagen to Danish importers – attendance by personal invite only) and FoodExpo(bi-annual food trade fair held in Herning, Denmark – with a section dedicated for WineExpo and Wine Market Place).

International wine fairs are valuable platforms to develop contact base, meet buyers and build brand recognition. At these trade fairs exporters can exhibit their wine at their stand and play host for important representatives from importers, distributors and retailers from across the world. This can give them a big boost in finding interested buyers for their wine. Prowein (Düsseldorf, Germany)

is the largest annual wine trade fair for professionals from viticulture, production, trade and gastronomy. Vinexpo (Bordeaux, France) is a bi-annual wine trade fair that plays a significant role in the popularization of the wine industry and culture in Asia and Africa. Biofach (Nuremberg, Germany) is the most important international exhibition for organic food and fair-trade products, held every February. It is an important niche trade fair for companies that sell natural wines. Details of other wine trade shows can be found on Trade Fair Dates.

The best way to understand the Danish market is to visit and speak to local stakeholders and prepare an entry strategy for the wine product. Almost all wine buyers prefer personal meetings to emails. If contact with potential buyers is done via email, a personalized one is most suitable as generic emails are perceived as unreliable or as spam. Such emails should explain how the wine product adds value to the importer’s portfolio and request connection with the right contact person.

When checking the portfolios of Danish wine importers, take into consideration their headquarters and operation locations, their size (including financial strength, number of employees, number of brands and suppliers and numbers of bottles shipped) and their specialization or focus (region, wine variety, etc.).

Export Promotional Activities

Denmark is considered as one the freest countries with respect to alcohol advertising. TV advertising of alcoholic beverages in Denmark was liberalized in 2003 as the ban had no tangible effect on consumption but hurt the media. However, ads still must respect youth protection policies and content restrictions as alcohol marketing directed at children and young people was banned in 2006 and the link between alcoholic beverages and active sports exercise was prohibited in 2010. Additionally, importers and wholesalers can actively promote their products in restaurants and hotels, at wine tastings, and through professional periodicals. Exporters can promote their products in international trade events or exhibitions in the targeted market.

International wine magazines are a good opportunity to promote wines and wineries.

The unique selling points can be communicated through an article to a wide public within the wine industry, ranging from wine experts to wine importers and wine specialty shops. Promotion works best when unique characteristics of the region or country of production are highlighted. Branding the production origin generates interest and recognition of the wine’s region which could of be used in other marketing tools. VINBLADET is a popular wine e-magazines that features tastings, reviews and information about wines, wineries and hotels and restaurants that serve the best wines. Star Wine List has a section on wine stories, guides and tastings in Copenhagen and Aarhus in Denmark. Additionally, it advertises for events and competitions related to wines and features the Star Wine List of the Year.

Natural wine may still be a niche market, representing only about 2% of the world’s total production, but it represents a considerable share of the market in Denmark, especially in Copenhagen which is the third-biggest natural wine market in the world after Paris and Tokyo.

In the research paper ‘Danish Consumer Preferences for Wine and the Impact of Involvement’, Polymeros Chrysochou and Jacob Brunbjerg Jørgensen report that the results of their study show that Danish wine consumers mainly rely on previous experience when choosing wine. Wine characteristics are important but mostly among the highly involved consumers. Danish consumers are extremely price sensitive and are used to promotional offers. Strong and mature wine suppliers with much experience are active in the Danish market. This makes it difficult for new entrants to gain market share.

To be attractive to younger consumers, wine should be marketed as a trendy desirable product. Young consumers look for fun, trendy and desirable drinks, such as popular pre-mixed drinks and alco-pops (i.e. easy-to-drink alcoholic beverages). The use of fashionable packaging and single-serving packaging which can be positioned next to premixed drinks in supermarkets could help new entrants penetrate the market and makes it increasingly difficult for substitution by other wines from competitors. The wide variety of wines already available on the Danish market complicates product distinction and establishing brand awareness. The increase in global sourcing only adds to the diversity of wines in the Danish market.

Wine producers can resort to online marketing to establish and spread brand awareness of their wines. A wine brand’s promotional website should be mobile-friendly, optimized for Google (Search Engine Optimization - SEO) and straightforward and easy to navigate. Opting for paid advertising or the retarget option is helpful in increasing the visibility of the website. Another option is to generate organic traffic from content which could be increased through email marketing, blogs (such as free recipes and engaging video tutorials), and SEO-optimized website.

A strong social media presence is essential for a business nowadays as it is increasingly being used as a medium to discuss wine among wine consumers. Social media platforms such as YouTube, Facebook, Twitter, LinkedIn and Instagram offer ways to establish a personal and corporate image online and generate support for the wine brand. These platforms provide a direct link between the seller and the customer and can be highly effective tools for building brand awareness. Posting regularly using consistent branding and information across social media platforms with linked profiles enhances the brand’s visibility. Creativity in posts such as running contests or giving cooking advice to keep users engaged is invaluable. Social media platforms are essential for interacting with customers, advertising promotions and helping locate the nearest retail store with the wine product. Instagram is suitable for showcasing the wine product in an attractive photo or a useful video and convenient to partner with influencers. It is important to accentuate the brand’s Unique Selling Points while using social media as well.

Additionally, wine applications such as Vivino and wine searcher, are becoming more popular among wine consumers to find a specific wine and/or to find additional information. Presenting wines in these apps helps the seller gain feedback from consumers and increases the brand’s visibility.

The unique selling points can be communicated through an article to a wide public within the wine industry, ranging from wine experts to wine importers and wine specialty shops. Promotion works best when unique characteristics of the region or country of production are highlighted. Branding the production origin generates interest and recognition of the wine’s region which could of be used in other marketing tools. VINBLADET is a popular wine e-magazines that features tastings, reviews and information about wines, wineries and hotels and restaurants that serve the best wines. Star Wine List has a section on wine stories, guides and tastings in Copenhagen and Aarhus in Denmark. Additionally, it advertises for events and competitions related to wines and features the Star Wine List of the Year.

Natural wine may still be a niche market, representing only about 2% of the world’s total production, but it represents a considerable share of the market in Denmark, especially in Copenhagen which is the third-biggest natural wine market in the world after Paris and Tokyo.

In the research paper ‘Danish Consumer Preferences for Wine and the Impact of Involvement’, Polymeros Chrysochou and Jacob Brunbjerg Jørgensen report that the results of their study show that Danish wine consumers mainly rely on previous experience when choosing wine. Wine characteristics are important but mostly among the highly involved consumers. Danish consumers are extremely price sensitive and are used to promotional offers. Strong and mature wine suppliers with much experience are active in the Danish market. This makes it difficult for new entrants to gain market share.

To be attractive to younger consumers, wine should be marketed as a trendy desirable product. Young consumers look for fun, trendy and desirable drinks, such as popular pre-mixed drinks and alco-pops (i.e. easy-to-drink alcoholic beverages). The use of fashionable packaging and single-serving packaging which can be positioned next to premixed drinks in supermarkets could help new entrants penetrate the market and makes it increasingly difficult for substitution by other wines from competitors. The wide variety of wines already available on the Danish market complicates product distinction and establishing brand awareness. The increase in global sourcing only adds to the diversity of wines in the Danish market.

Wine producers can resort to online marketing to establish and spread brand awareness of their wines. A wine brand’s promotional website should be mobile-friendly, optimized for Google (Search Engine Optimization - SEO) and straightforward and easy to navigate. Opting for paid advertising or the retarget option is helpful in increasing the visibility of the website. Another option is to generate organic traffic from content which could be increased through email marketing, blogs (such as free recipes and engaging video tutorials), and SEO-optimized website.

A strong social media presence is essential for a business nowadays as it is increasingly being used as a medium to discuss wine among wine consumers. Social media platforms such as YouTube, Facebook, Twitter, LinkedIn and Instagram offer ways to establish a personal and corporate image online and generate support for the wine brand. These platforms provide a direct link between the seller and the customer and can be highly effective tools for building brand awareness. Posting regularly using consistent branding and information across social media platforms with linked profiles enhances the brand’s visibility. Creativity in posts such as running contests or giving cooking advice to keep users engaged is invaluable. Social media platforms are essential for interacting with customers, advertising promotions and helping locate the nearest retail store with the wine product. Instagram is suitable for showcasing the wine product in an attractive photo or a useful video and convenient to partner with influencers. It is important to accentuate the brand’s Unique Selling Points while using social media as well.

Additionally, wine applications such as Vivino and wine searcher, are becoming more popular among wine consumers to find a specific wine and/or to find additional information. Presenting wines in these apps helps the seller gain feedback from consumers and increases the brand’s visibility.

Doing Business: Business Culture

Culture is defined as the collective attitudes and behavior which distinguishes one group of people from another. It is the patterns of thinking which are reflected in the meaning people attach to various aspects of life and which become crystallized in the institutions of a society. However, this does not mean that everyone in a given society is programmed in the same way.

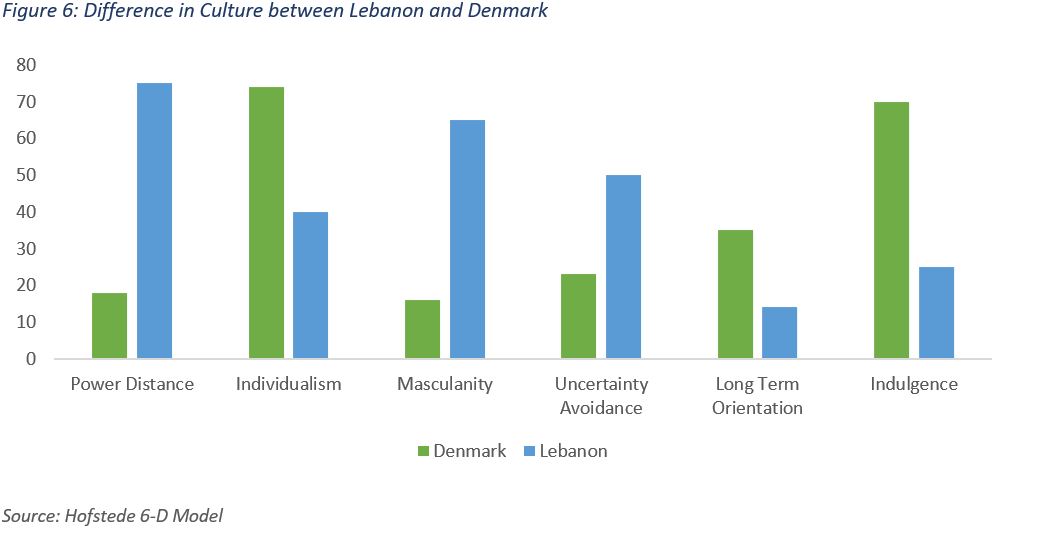

Power Distance: the extent to which the less powerful members of institutions and organizations within a country expect and accept that power is distributed unequally.

There is a large gap in the score of Lebanon and Denmark on power distance. While Lebanon follows a hierarchical and centralized system, Denmark is highly decentralized, ranking the highest among EU27 in terms of employee autonomy. Danes do not lead, they coach. They believe in independency, respect, equal rights, accessible superiors and that management facilitates and empowers. Danish work places have a very informal atmosphere with direct and involving communication and works on a first name basis.

Individualism: the degree of interdependence a society maintains among its members. While Lebanon scores low on individualism reflecting its collectivistic society, Denmark scores high echoing a loosely-knit social framework. It is relatively easy to start doing business with the Danes as there is no need to create relationship first. Danes are very direct in their communication. Masculinity: whether society is driven by competition, achievement and success (masculine) or dominant values in society are caring for others and quality of life (feminine).

While Lebanon scores high on masculinity highlighting its masculine society, Denmark scores low indicating its feminine society. Unlike masculine societies, feminine ones stress the work/ life balance. In the former, managers are expected to be decisive and assertive while in the latter, effective managers are supportive and decision making is achieved through involvement and consensus. Masculine societies emphasize equity, competition and performance unlike feminine societies which value equality, solidarity and quality. Feminine societies resolve conflicts by compromise and negotiation while masculine ones fight them out.

Uncertain Avoidance: the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these. Lebanon scored midway and thus, shows no clear preference. Denmark, however, scored low indicating the Dane’s comfort with unpredictability and ambiguity and their adaptability to change. Denmark encourages curiosity and embraces innovation and creativity. It thrives in advertising, marketing and financial engineering.

Long Term Orientation: how every society has to maintain some links with its own past while dealing with the challenges of the present and future. Both Lebanon and Denmark score low on long-term orientation indicating normative rather than pragmatic societies. People in both societies exhibit great respect for traditions, a relatively small propensity to save for the future, and a focus on achieving quick results.

Indulgence: the extent to which people try to control their desires and impulses Lebanon scores low on indulgence indicating a restraint culture, while Denmark scores high highlighting an indulgent country. Restrained societies have a tendency to cynicism and pessimism. They have the perception that their actions are restrained by social norms and that self-indulgence is wrong. Restrained societies do not put much emphasis on leisure time and control the gratification of their desires. Meanwhile, members of indulgent societies exhibit willingness to realize their impulses and desires in enjoying life. They are optimistic and value leisure time.

According to Business Culture, the Danish business culture is ranked as the least complex in the world. Everyone in the team is treated equally; team members are reliable, responsible, honest and independent. Punctuality is very important because Danes are hardworking and each minute needs to be productive and effective. The informal attitude of the Danes is expressed in a relaxed but still conservative dress code.

Appointments with Danish business partners should be arranged in advance avoiding the months of July and August as they are the most common holiday months. Additionally, as Danes treasure leisure time, they do not work on weekends, national holidays, or after 4 pm on weekdays. A confirmation call prior to the meeting is advisable. An agenda should be sent in advance of the meeting. Meeting might begin with small-talk then Danes like to get straight to the point. Meetings should be well-structured and followed by minutes of meeting clearly stating the most important agreements and points of action. Danes are easy-going, flexible, good-listeners and patient in negotiations. They are good listeners known for their ability to secure good deals without making enemies. They also value a critical approach and will not hesitate to express their dissenting opinions. This is not considered rude or offensive in Denmark. Criticism is regarded as something that has to do with one’s work and is not a personal attack.

It is not common – as it is in the US and the UK – to resolve matters by vote. Rather, people discuss in order to achieve consensus and to see matters from all possible perspectives.

There is a large gap in the score of Lebanon and Denmark on power distance. While Lebanon follows a hierarchical and centralized system, Denmark is highly decentralized, ranking the highest among EU27 in terms of employee autonomy. Danes do not lead, they coach. They believe in independency, respect, equal rights, accessible superiors and that management facilitates and empowers. Danish work places have a very informal atmosphere with direct and involving communication and works on a first name basis.

Individualism: the degree of interdependence a society maintains among its members. While Lebanon scores low on individualism reflecting its collectivistic society, Denmark scores high echoing a loosely-knit social framework. It is relatively easy to start doing business with the Danes as there is no need to create relationship first. Danes are very direct in their communication. Masculinity: whether society is driven by competition, achievement and success (masculine) or dominant values in society are caring for others and quality of life (feminine).

While Lebanon scores high on masculinity highlighting its masculine society, Denmark scores low indicating its feminine society. Unlike masculine societies, feminine ones stress the work/ life balance. In the former, managers are expected to be decisive and assertive while in the latter, effective managers are supportive and decision making is achieved through involvement and consensus. Masculine societies emphasize equity, competition and performance unlike feminine societies which value equality, solidarity and quality. Feminine societies resolve conflicts by compromise and negotiation while masculine ones fight them out.

Uncertain Avoidance: the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these. Lebanon scored midway and thus, shows no clear preference. Denmark, however, scored low indicating the Dane’s comfort with unpredictability and ambiguity and their adaptability to change. Denmark encourages curiosity and embraces innovation and creativity. It thrives in advertising, marketing and financial engineering.

Long Term Orientation: how every society has to maintain some links with its own past while dealing with the challenges of the present and future. Both Lebanon and Denmark score low on long-term orientation indicating normative rather than pragmatic societies. People in both societies exhibit great respect for traditions, a relatively small propensity to save for the future, and a focus on achieving quick results.

Indulgence: the extent to which people try to control their desires and impulses Lebanon scores low on indulgence indicating a restraint culture, while Denmark scores high highlighting an indulgent country. Restrained societies have a tendency to cynicism and pessimism. They have the perception that their actions are restrained by social norms and that self-indulgence is wrong. Restrained societies do not put much emphasis on leisure time and control the gratification of their desires. Meanwhile, members of indulgent societies exhibit willingness to realize their impulses and desires in enjoying life. They are optimistic and value leisure time.

According to Business Culture, the Danish business culture is ranked as the least complex in the world. Everyone in the team is treated equally; team members are reliable, responsible, honest and independent. Punctuality is very important because Danes are hardworking and each minute needs to be productive and effective. The informal attitude of the Danes is expressed in a relaxed but still conservative dress code.

Appointments with Danish business partners should be arranged in advance avoiding the months of July and August as they are the most common holiday months. Additionally, as Danes treasure leisure time, they do not work on weekends, national holidays, or after 4 pm on weekdays. A confirmation call prior to the meeting is advisable. An agenda should be sent in advance of the meeting. Meeting might begin with small-talk then Danes like to get straight to the point. Meetings should be well-structured and followed by minutes of meeting clearly stating the most important agreements and points of action. Danes are easy-going, flexible, good-listeners and patient in negotiations. They are good listeners known for their ability to secure good deals without making enemies. They also value a critical approach and will not hesitate to express their dissenting opinions. This is not considered rude or offensive in Denmark. Criticism is regarded as something that has to do with one’s work and is not a personal attack.

It is not common – as it is in the US and the UK – to resolve matters by vote. Rather, people discuss in order to achieve consensus and to see matters from all possible perspectives.

Tips

- Check the websites of European trade shows and exhibitions to discover the newest trends. If you produce organic/ natural wine, check the world’s largest organic event, Biofach in Germany. Participate in international competitions if you aim to place your wine in the premium segment. When choosing a competition, select those that have respected, reliable and independent judges. Consider placing a label on your wine showing the awards.

- Promote your wine as being exclusive. One option for making your wine appear more exclusive is the creation of a limited or special edition of your wine.

- When talking about your product remember that the quality and the effort you spent making it are usually less important than other aspects. Think about benefits that your competition doesn’t have – quality-to-price ratio, a special production technique, the terroir or your unique location, your winery’s history and prestige. You must identify a unique selling proposition, a thing that sets you apart from other similar wineries. What do you bring new or special to the game?

- When approaching an importer, always think in terms of what that importer has to gain if he decides to work with you and what are his needs (such as a wine product that fits their portfolio and do not have proper coverage so far; and unique, revolutionary or trendsetter wine products that could benefit their overall image.)

- Make use of the arising opportunities in the on-trade sector and the trading-up approach of Danes to higher-quality and higher-priced wines.

- If you supply small volumes of premium wine, find an importer with an online shop which offers wines from less usual origins.

- Provide a quality consistency guarantee in the form of ISO quality management certificates or similar guarantees. Control quality consistency by setting up long-term contracts with grape suppliers and monitoring during their harvest or set up your own vineyards.

- Use the membership lists of wine associations to find potential buyers and source important information on the Danish market players.

- Reduce your risks associated with supplying supermarkets by supplying through importers. This reduces risks related to strict contract conditions of supermarkets, such as supply guarantees which require warehousing of wine in Europe. Read about how to identify and approach potential wine importers.