Which Markets Offer Most Opportunities For Avocados From Lebanon?

Interestingly, Lebanon has a great opportunity to increase its market share in Europe and the Middle East.

This report provides an overview of Lebanon’s current production and exports of avocados, its position in the international markets, and the available opportunities to enhance the country’s export potential with an overall aim of strengthening Lebanese exporters’ capacities and competitiveness.

Product Definition

Avocados are cultivated in tropical and Mediterranean climates of many countries.

Hass avocados is at the top of the list of products with the most potential in 2020-2021.

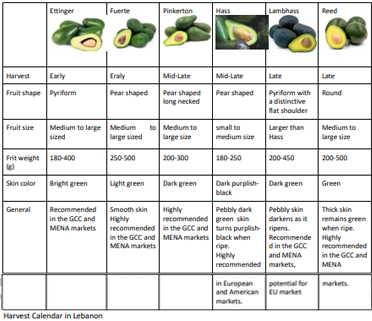

Avocado varieties available in Lebanon are :

Where Do Lebanese Avocados Currently Go To?

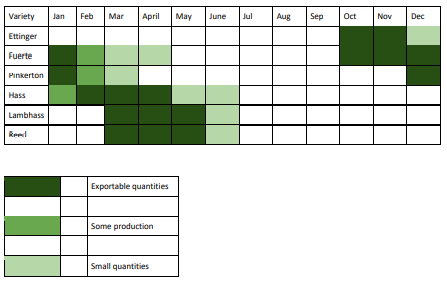

Table 1 shows that most destination countries in recent years for Lebanese exported avocados are in the Middle Eastern region. Jordan and KSA top the list followed by Egypt, Kuwait, Iraq, Qatar, UAE and Oman.

European countries still lag at the slight exception of Ukraine. Shy attempts have been made to progress entry into markets such as Germany, Russian Federation, Sweden or UK and France. As such, these countries could offer potential in the coming years.

What Is Lebanon’s Position In The International Market?

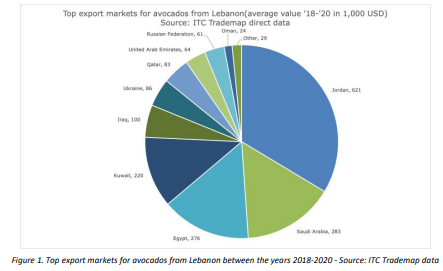

Lebanon's exports represent about 0.04% of world exports for this product, its ranking in world exports is 20 (trade hubs excluded).

Lebanon is mainly in competition with the other supplying countries from the Middle East and in terms of import tariffs applied worldwide, avocados trade can be considered as a level playing field. There is one main exception: Israel’s zero tariff access to the European Union, against 5-8% for other supplying countries from the Middle East.

Largest Avocados producers

By far, the largest producer and exporter of avocado globally is Mexico, with 3 times the production and exports of its closest rival, Peru. The top six producers, namely Mexico, Peru, Spain, Chile, Kenya, Colombia account for 50% of global production volumes).

Largest producers in the Mediterranean region

The three largest avocado producers in the Mediterranean region are Spain (approximately 94,000 tonnes), Morocco (approximately 54,000 tonnes) and Israel (approximately 100,000 tonnes). Turkey, the top regional producer for most fruit crops, has limited avocado production (approximately 4,000 tonnes) due to its climate conditions. Lebanon for example produces 8,000 tonnes of avocados, double the output of Turkey.

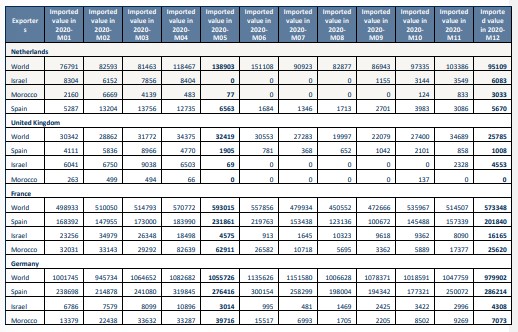

1. Table 2 List of supplying markets for a product imported by the most potential European markets in 2020

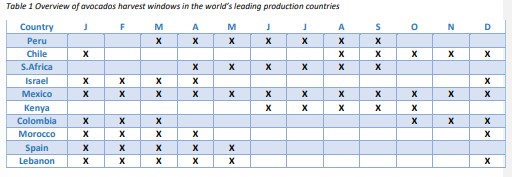

2. Lebanon’s avocados harvest season is from December till May as shown in Table 1, whereas in the regional competitive countries it’s from January till May in Spain and from December till April in Morocco and Israel. Thus, there is a window for the Lebanese avocados in December and May. Furthermore, if we analyze the import of avocados in the top importers EU countries, in Table 2 we can spot a decrease in import from Morocco and Israel starting May.

What Are The Trends In Trade In The 20 Largest Importing Countries?

- What Are What Are The Trends In Trade In The 20 Largest Importing Countries?

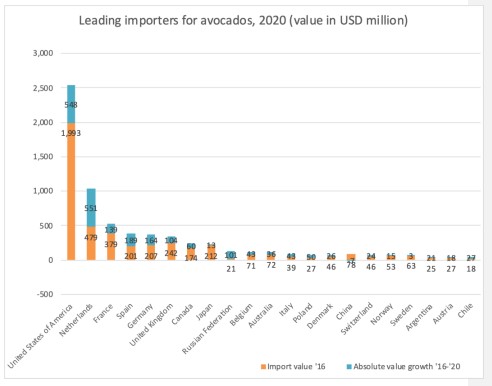

The world total import value of avocados has been steadily increasing during the period 2016 to 2020 reaching almost USD 7.2 billion in 2020. As the figure below shows, the United States is by far the largest importer in the world and its import value increased by 28% in the period 2016-2020. Canada is also a prominent avocado importer internationally.

The European region is one of the largest importing market of avocados after the US. The main importers in the EU are:

Netherlands, France, Spain, Germany and UK.

As for the Asian market, Japan is the main importer of avocado, followed by Russia and China.

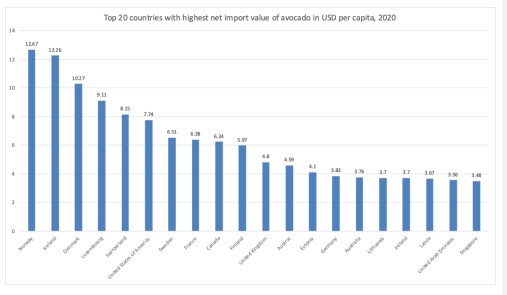

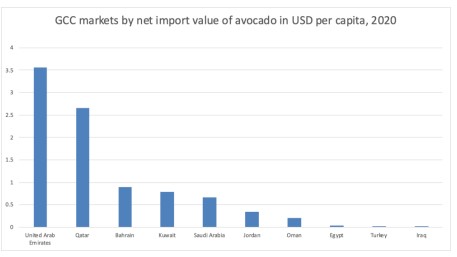

Interestingly, the per capita imports statistics of 2020 (see Figure 4, below) showed that Norway, Iceland, Denmark, Luxembourg and Switzerland topped in avocado consumption. It also shows the huge potential for growth in countries with still low per capita consumption, such as France, the United Kingdom, Germany, or United Arab Emirates.

Avocados is a promising product. For the next years, the avocado market is expected to grow, reaching a total market size of USD18 billion by 2025. Besides, the price for avocados has continued to rise and is expected to stay high. It is estimated that the per capita consumption of avocado will experience a further growth in the years to come, with notable potential for growth in several European markets. Even in the USA, given that only about 50% of North Americans consume avocados, experts assume that it is still possible that import volumes will double, provided the market attains supply chain and price stability. - What Are The Trends In Trade In The Gcc?

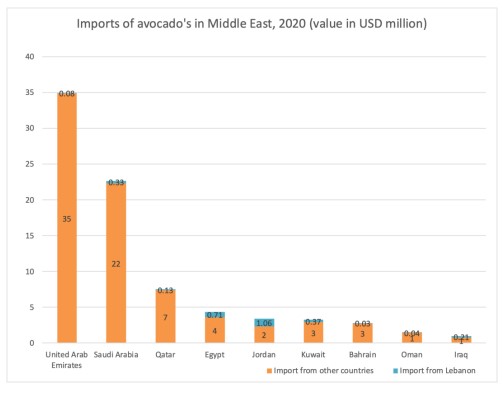

Though the GCC markets do not compare to the mass of North America and Europe, the small market experienced increases in demand during the period 2016-2019. However, the imported value decreased in 2020, caused by the persisting COVID-19 pandemic on both the production and distribution channels. Lebanon mainly exports its avocados to Egypt, Jordan and GCC (primarily Saudi Arabia and UAE).

In terms of per capita consumption, the UAE and Qatar stand out with more than twice the consumption of the other countries such as Bahrain and Kuwait. The Figure 6 below shows there is still a lot of growth possible in many of the GCC markets.

What Are Interesting Markets For The Future?

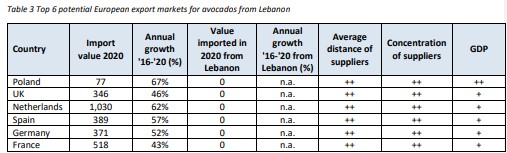

Based on the calculation and analysis of the figures, 6 countries in Europe were identified as promising and offering great opportunities for Lebanese exporters of avocadoes. These countries include Netherlands, Poland, Germany, Spain, United Kingdom and France. They are all white spots for Lebanese avocado exporters, as until 2020 no Lebanese avocados were exported to these countries. Table 3 below provides an overview of these potential export markets including the main used indicators.

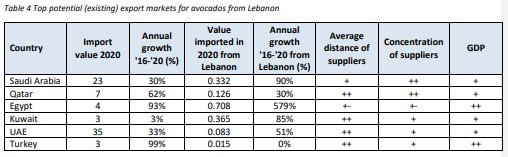

As for the markets in the Middle East and North Africa, including GCC, the potential is shown in Table 4. Here, the countries Saudi Arabia, Qatar, Egypt, Kuwait, UAE and Turkey all already import avocado’s from Lebanon. Based on the analysis of indicators listed in the table, these countries will offer potential for more supply of Lebanese avocado’s in the years to come.

Tips

- Given that Europe is a large and growing market for avocados, Lebanon has a great opportunity to increase its market share in this region. With the Netherlands being the hub for Avocados in Europe, enhancing linkages between Lebanese exporters and distributers in Netherlands is a recommended distribution strategy.

- In the GCC, the UAE and Saudi Arabia are relatively large importers where Lebanon has limited market share. Low-priced, non-commercial “green” Kenyan avocados dominate these markets. For Lebanon to capture market share from Kenya, it would have to take advantage of Kenyan supply shortfalls between October and February, or increase demand for the higher quality avocados from Lebanon.

- Even though Lebanese avocados can be on the market from September to May, competitiveness in terms of quality and prices compared to other suppliers is the best in the first months of the year when the demand is high and the supply from main competitors is limited.

- In addition to European markets, Lebanon has the potential to enlarge its market shares in the Middle East.