Overview

Cherry is a relatively expensive stone fruit. It is on average 3-4 times more expensive than peach, plum and apricot. Cherry accounts for about 46% of all world trade in stone fruit in value although the share of cherries in exports quantity is much more modest – only 19%. Despite that, the world export value growth of cherries has significantly outstripped the growth of the other stone fruits trade. On average, the world exports of cherries has grown by on average about USD360 thousand every year in the period 2016-2020. It shows that the global cherries trade is a vibrant market.

Lebanon has a wide assortment of fruits, nuts and vegetables with potential for high-end markets, either in the region or in Europe. Lebanese traders exporting table grapes, avocados, citrus fruit or potatoes, usually also export other products. Taking into consideration the obstacles in the value chains that have to be solved and the impact thereof on the sector, cherries have opportunities.

Lebanon export of cherries have seen a slow but gradual upward trend in the past decade. While until 2015 exports did not go much beyond USD 1 million, in 2015 it reached more than USD2 million and in 2016 it peaked at more than USD 3 million. Since then, exports have reached at least USD2.4 million per year.

This report provides an overview of Lebanon’s current production and exports of cherries, its position in the international markets, and the available opportunities to enhance the country’s export potential with an overall aim of strengthening Lebanese exporters’ capacities and competitiveness.

Product definition

Lebanon is considered one of the major producers of sweet cherry in the Mediterranean region. The country is doted by exceptional optimal conditions for cherry production. It is cultivated between 900 and 2000m altitude, giving it a distinguished flavor, color and texture.

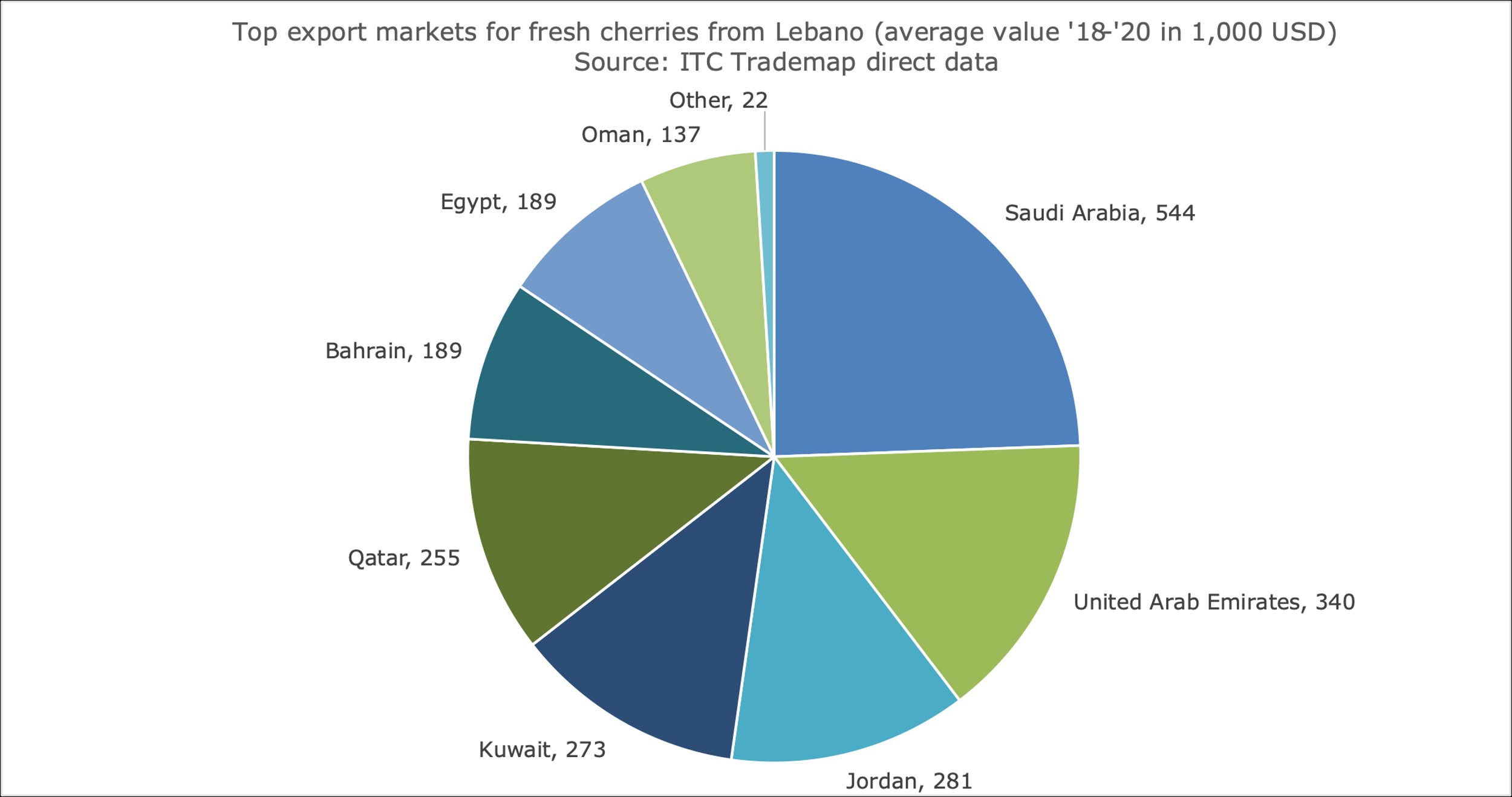

Where do Lebanese cherries currently go to?

Figure 1. Top export markets for cherries from Lebanon between the years 2018-2020 - Source: ITC Trademap data

What is Lebanon's position in the international market?

Largest Cherries producers

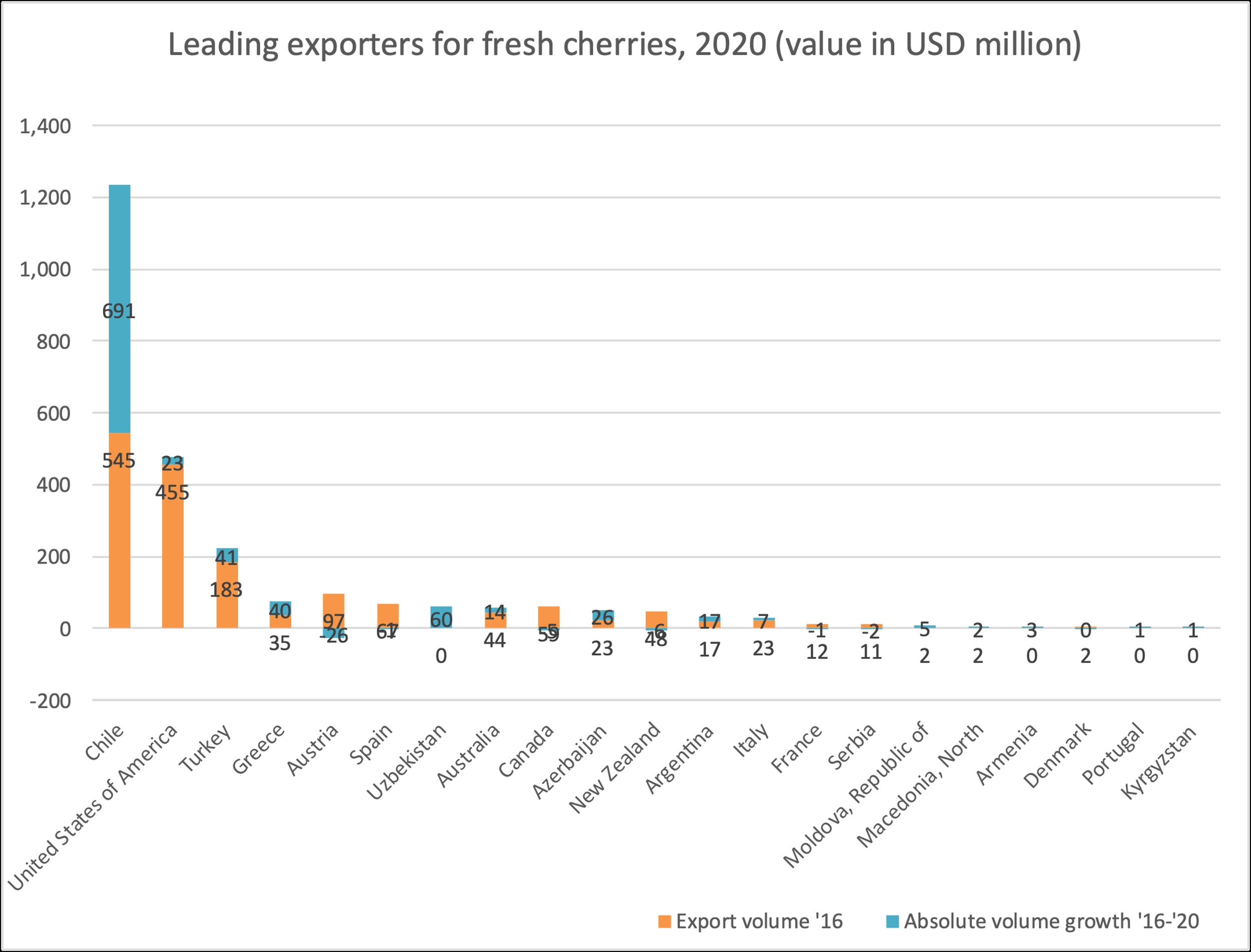

By far, the largest producer and exporter of cherries globally is Chile, by a long way followed by USA, Turkey, Greece and Spain as shown in figure 2.

Chile exported 352,474 tons of cherries in 2020 mainly to the Far East, and to a lesser extent to Latin America, North America, Europe and Middle East. The total export volume of Chilean cherries (HS 080929) in 2019 was much lower, 259,886 MT, and the main importers were China (91%), South Korea (1.8%), The US (1.7%), Taipei (1.0%), and Brazil (0.8%).

Chile was the world leader in cherry exports in 2019, being responsible for one third of total traded volume, followed by Hong Kong (22%), The US and Turkey (both 10%), and Spain (3.4%). Chile shall remain the world leader for cherry exports in season 2020/21 and Turkey will most likely surpass the US’s export volume since Turkey had a bumper crop and the US had a decrease in production due to the severe droughts.

Largest producers in the Mediterranean region

The three largest cherries producers in the Mediterranean region are Turkey (approximately 865,000 tonnes), Greece (approximately 91,000 tonnes) and Spain (approximately 107,000 tonnes). Lebanon for instance produces 25,000 tonnes of cherries.

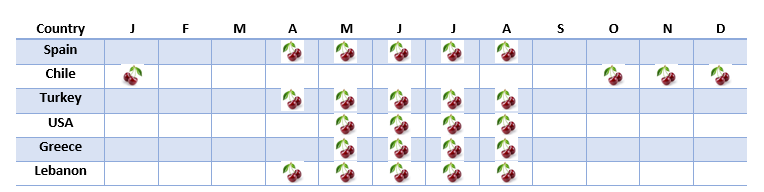

As shown in Table 1 the supply season in Lebanon is between April and August. Lebanese cherries have strong domestic demand and have been exported for years to regional markets, where they still have growth potential. There is also an opportunity for high quality cherries in Europe, especially in the early season in May.

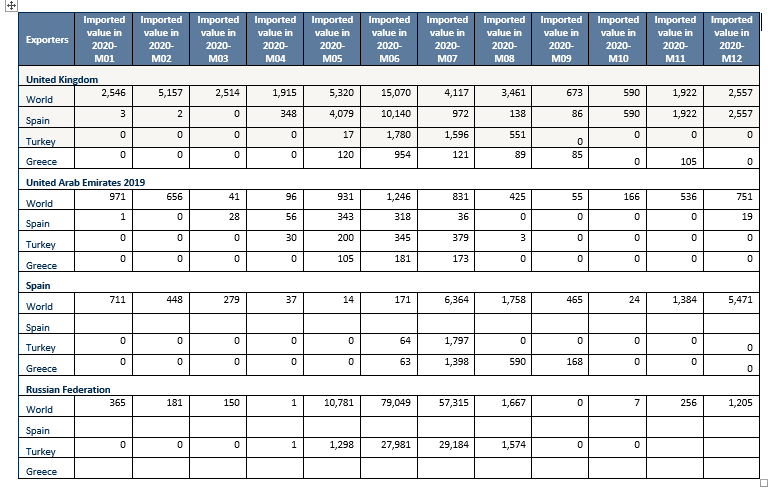

The top regional cherries importers UK, UAE, Spain and Russian Federation import the most between May and August as shown in Table 2.

Figure 2. Leading Exporters for Cherries 2020

Table 2 Overview of cherries harvest windows in the world’s leading production countries

Table 3 List of supplying markets for a product imported by the most potential European markets in 2020

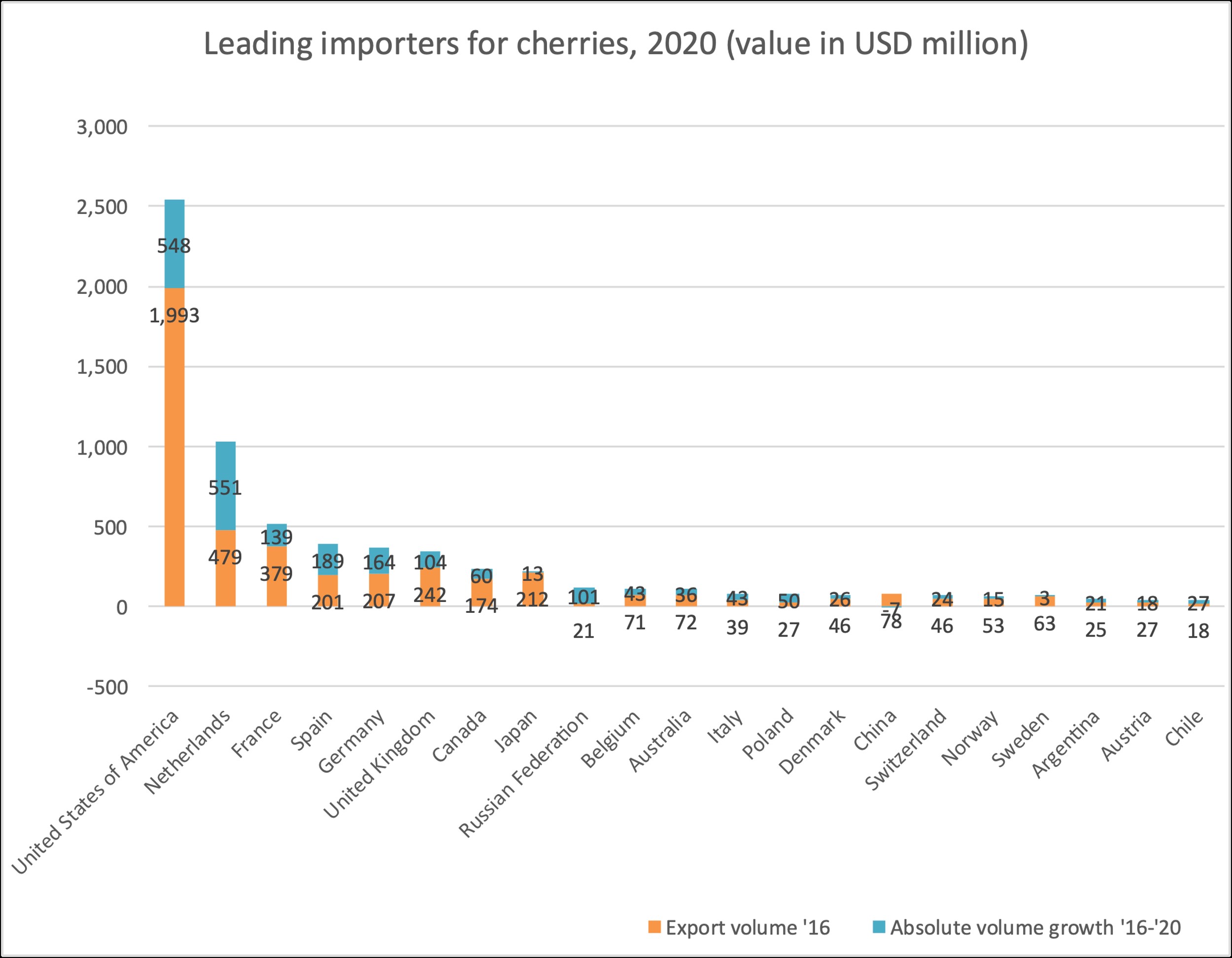

What are the trends in trade in the 20 largest importing countries?

The Netherlands, France, Spain, Germany and UK are the largest markets in Europe. Two countries dominate the supply of cherries to the European market: Spain and Turkey. In Europe, the season starts early May with premium prices, peaking in June and July at 25% to 35% lower prices.

Volumes go down and prices go up in August when the Lebanese cherries have a window. In the last few years, there have been indications of supply from Greece and Turkey falling back, while Spain and Italy have been getting stronger.

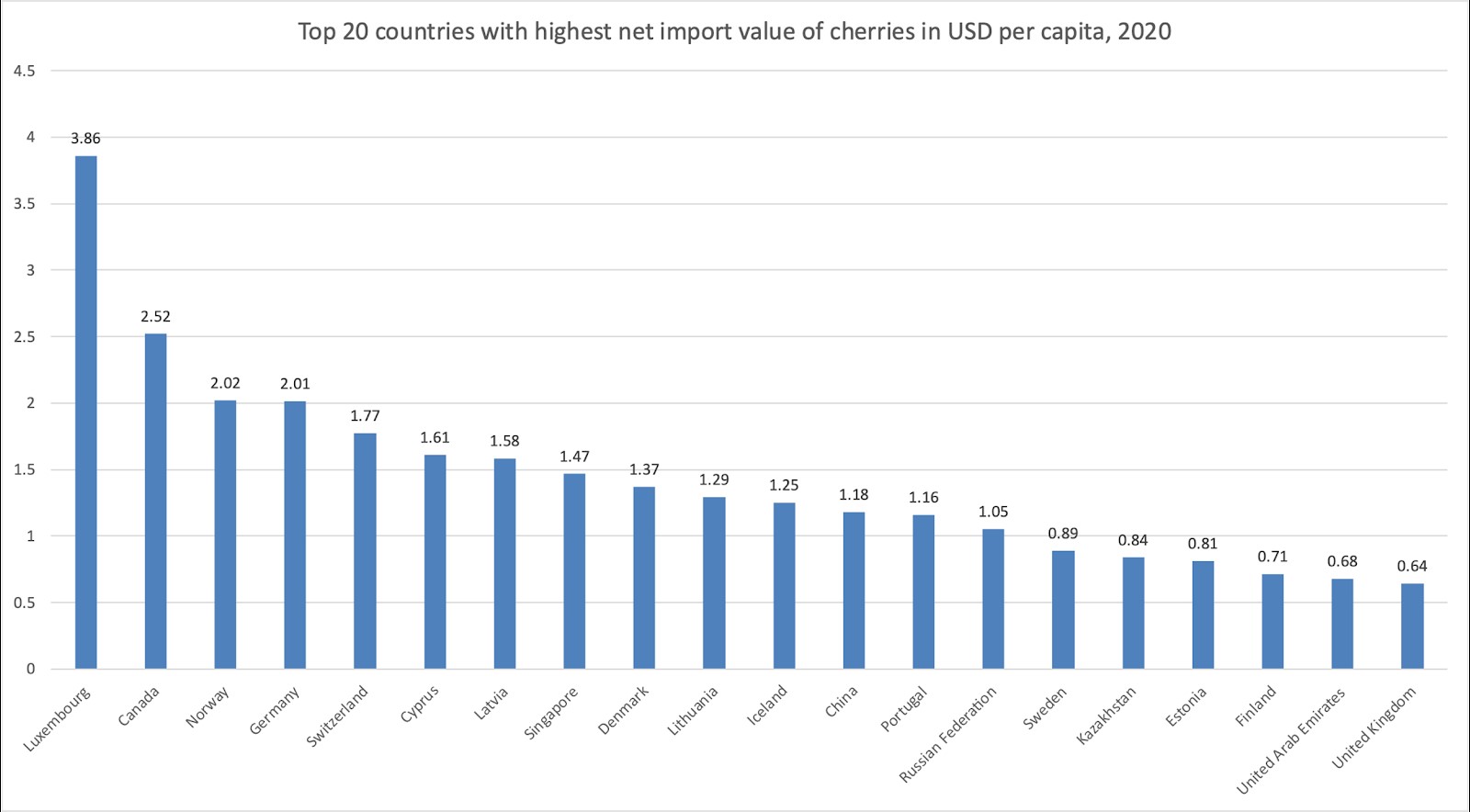

Consumers in Europe generally prefer dark and big cherries. There is room for loose cherries in cartons, although retail packing in punnets is favourable. Interestingly, the per capita imports statistics of 2020 (see Figure 4, above) showed that Luxembourg, Canada, Norway, Germany, Switzerland and Cyprus topped in cherries consumption.

It also shows the huge potential for growth in countries with still low per capita consumption, such as China, Russia, the United Kingdom, Portugal, or United Arab Emirates.

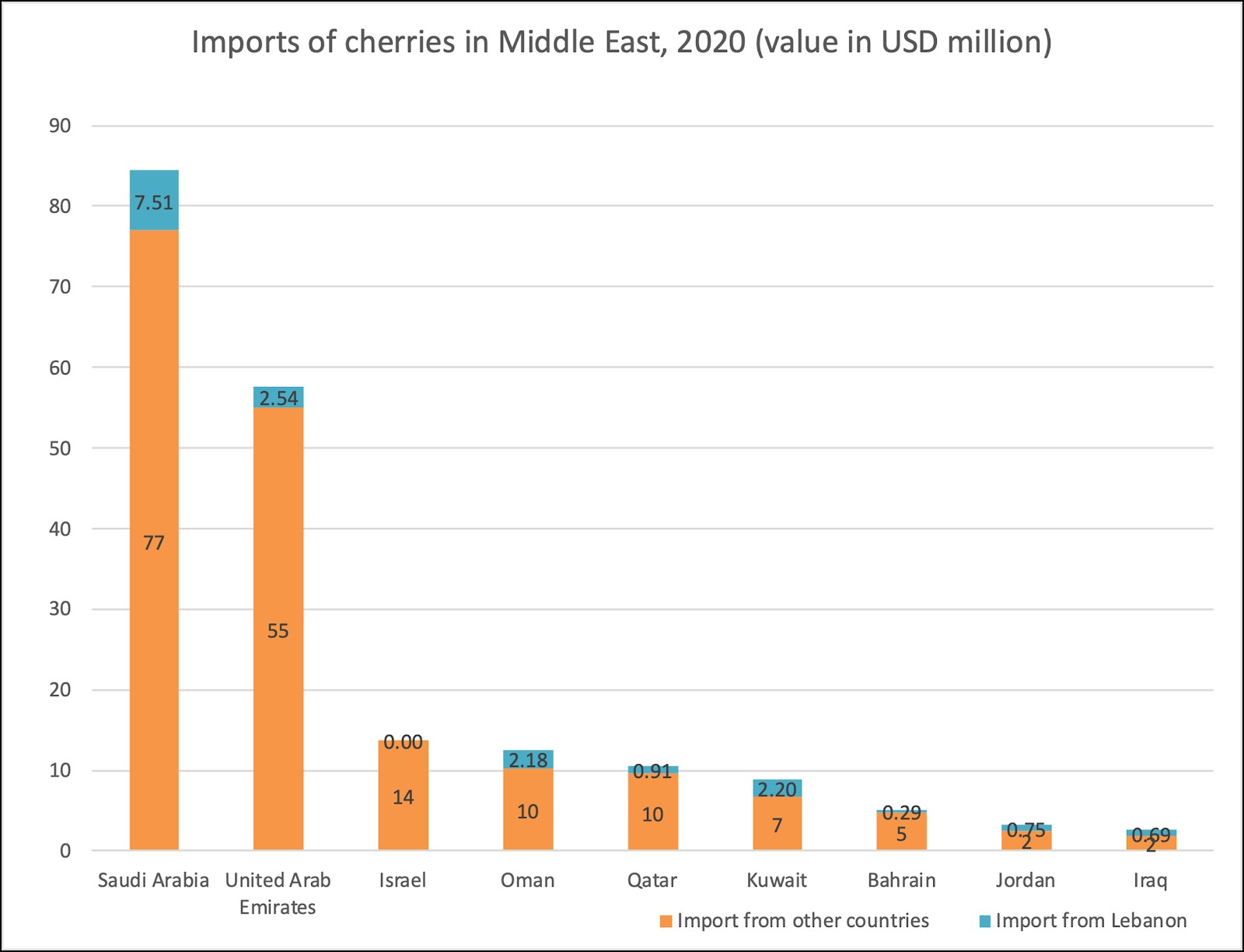

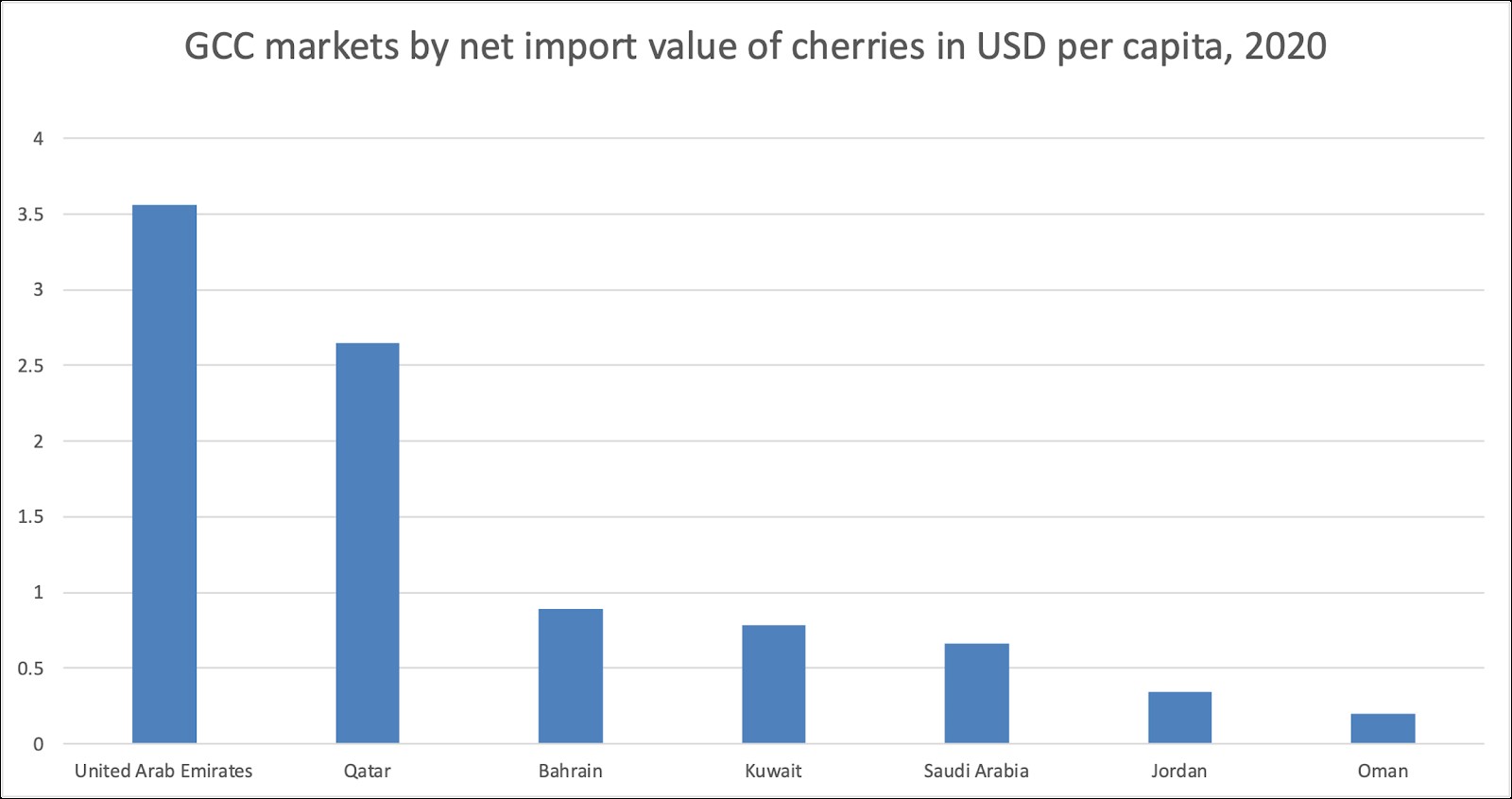

WHAT ARE THE TRENDS IN TRADE IN THE GCC? Though the GCC markets do not compare to the mass of North America and Europe, the small market experienced increases in demand during the period 2016-2019. However, the imported value decreased in 2020, caused by the persisting COVID-19 pandemic’s impact on both the production and distribution channels. Lebanon mainly exports its cherries to Saudi Arabia, UAE, Qatar, Kuwait, Jordan and Iraq.

In terms of per capita consumption, the UAE and Qatar stand out with more than twice the consumption of the other countries such as Bahrain and Kuwait. The Figure 6 below shows there is still a lot of growth possible in many of the GCC markets.

What are interesting markets for the future?

Cherries are primarily consumed fresh, but they are also used in cakes and bakeries, sweets and snacks, jams and juice, alcoholic beverages, and so on. The map below shows the most interesting markets for Lebanese cherries; the 7 highlighted countries are Spain, UAE, Bahrain, Poland, Russia, Saudi Arabia, and the UK.

For the purpose of identifying potential markets for Lebanese exports of cherries, a model was built to include indicators such as worldwide imports, exports and export growth from Lebanon, a comparison between tariffs faced by Lebanon and the leading competitors in the market, average distance and concentration of suppliers, import trade windows, GDP and others.

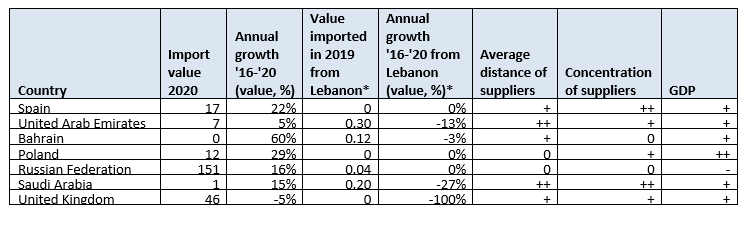

Based on the calculation and analysis of the figures, 6 countries in Europe and the GCC region were identified as promising and offering great opportunities for Lebanese exporters of cherries. These countries include Spain, UAE, Bahrain, Poland, Russia, KSA and UK. Table 3 below provides an overview of these potential export markets including the main used indicators.

Table 4 – Top 7 potential export markets for cherries from Lebanon.

Tips

- Currently the Ministry of Agriculture is working on removing the European ban on Lebanese cherries so that in 2022 Lebanese cherries can enter EU markets. (Waiting for further details from the ministry of Agriculture)

- The top importers of Lebanese cherries are the GCC countries. The highest untapped potential for Lebanese cherries is seen in the UAE, followed by Bahrain and Saudi Arabia.

- Even though Lebanese cherries can be on the market from May to August, competitiveness in terms of quality and prices compared to other suppliers is the best in August when the demand is high and the supply from main competitors is limited.