Overview

Lebanon has witnessed vast improvements in its exports of table grapes over the years especially with Lebanese grapes being renowned globally for their quality, flavor and taste. In fact, the country’s exports of table grapes have grown from USD 6.7 million in 2012 to 21 million in 2020, presenting a great opportunity to satisfy the remaining untapped potential and to enter new promising markets.

Interestingly, Lebanon has a great opportunity to increase its market share in Europe and the GCC. This report provides an overview of Lebanon’s current production and exports of table grapes, its position in the international markets, and the available opportunities to enhance the country’s export potential with an overall aim of strengthening Lebanese exporters’ capacities and competitiveness.

Product definition

Common commercially available table grape varieties such as Thompson Seedless and Flame Seedless are favoured by growers for their high yield and relative resistance to damage during shipment. Other less common varietals such as Cotton Candy, Kyoho or Pione are custom hybrids bred for size, appearance and specific flavour characteristics.

Delving into the Lebanese market, main table grapes varieties include Baytamouni, Tfeifihi, Maghdushi, Jbaai, Globe seedless, Early Superior seedless, Black Pearl, Red Globe. The most important areas of production are the Bekaa and Akkar where cultivation is facilitated by the local climate, including a long period of sunny days over the year, fertile soil and adequate averages of rainfall, which ensure the appropriate Brix degree. According to the Ministry of Agriculture, seasonal availability extends from June to February.

Where do Lebanese table grapes currently go to?

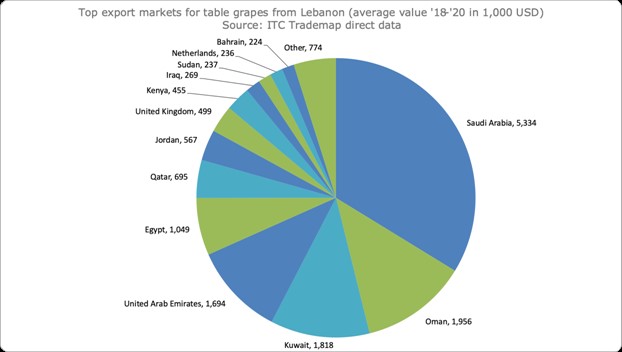

European countries still lag at the slight exception of the United Kingdom. Shy attempts have been made to progress entry into other European markets and the Russian Federation. As such, these countries could offer potential in the coming years.

Figure 1. Top export markets for table grapes from Lebanon between the years 2018-2020 - Source: ITC Trademap data

What is Lebanon's position in the international market?

Largest Table Grapes Producers

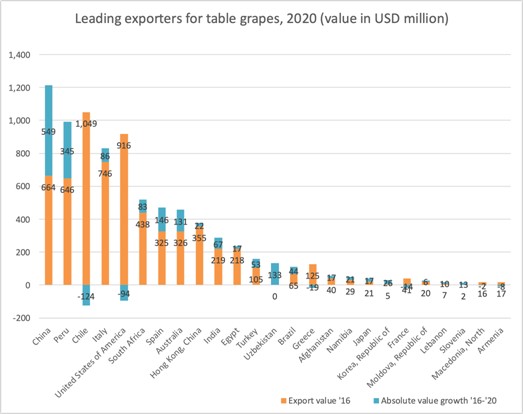

By far, the largest producer and exporter of table grapes globally is China, and the top six producers, namely China, Peru, Chile, South Africa, USA and India account for more than 50% of global production volumes.

Largest producers in the Mediterranean region

The largest table grape producer in the Mediterranean region is Turkey (approximately 2 million tonnes), followed by Italy with production reaching almost 1 million tonnes.

Lebanon’s table grapes harvest season is from June till February as shown in Table 1, whereas in the European competitive countries it’s from June till November in Spain and from July till November in Italy. Thus, there is a window for the Lebanese table grapes in December and February.

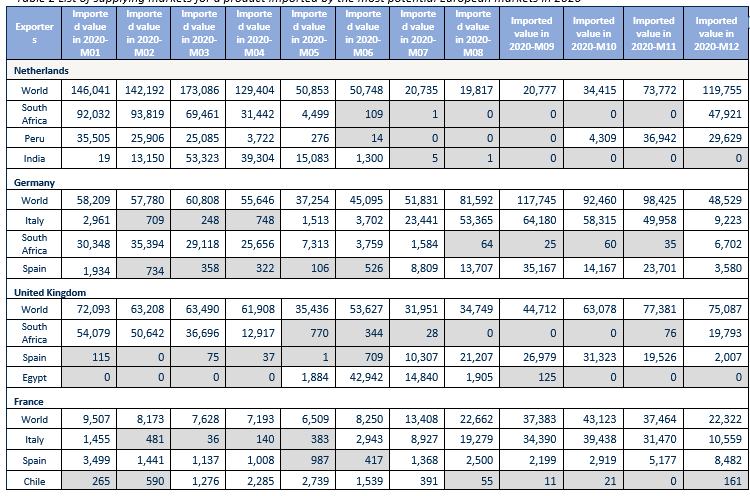

South Africa, on the other hand, notably appears as a top exporter to several EU countries with the harvest season appearing at its peak during the period between December and April. However, it is worth noting that exports from South Africa – during the harvest season – are the highest in January and February, and the lowest in April. Delving deeper into the EU markets, several countries appear particularly interesting for Lebanon, during the latter’s harvest season and in reference to the supply by top exporters, as follows:

- The Netherlands, during the months of December and January given the drastic drop in the supply of table grapes by India.

- Germany, during the months of December, January and February, given the drop in the supply by Italy and Spain

- The United Kingdom, during the months of December, January and February, given the drop in the supply by Spain and Egypt

- France, during the months of December, January and February, given the drop in the supply by Italy, Spain and mainly Chile.

Figure 2. Leading Exporters for table grapes 2020

Table 1 Overview of table grapes harvest windows in the world’s leading production countries

Table 2 List of supplying markets for a product imported by the most potential European markets in 2020

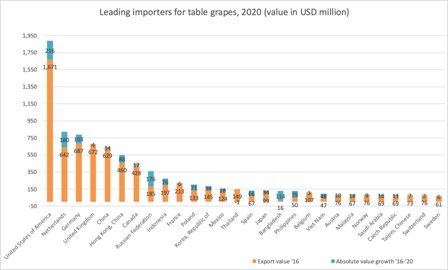

What are the trends in trade in the 20 largest importing countries?

The European region is the second largest importing market of table grapes after the US. The main importers in the EU are: Germany, Netherlands, UK, France, Poland and Spain. As for the Asian market, China is the main importer of table grapes, followed by Hong Kong China and Russia.

The table grapes market is projected to reach a total market size of USD 86 billion in 2024 from USD 50 billion in 2018. Prices have also been witnessing increases coupled with an increase in the per capita consumption of table grapes in the years to come.

5.2 WHAT ARE THE TRENDS IN TRADE IN THE GCC? The demand for grapes in all GCC markets is typically year round. Despite the fact that these markets do not compare to the mass of North America and Europe, the small market experienced a remarkable increase in demand in 2020, with the exception of Bahrain that witnessed a 26% drop in table grapes imports in that year.

Lebanon’s top GCC destination for table grapes is Saudi Arabia, followed by Oman, Kuwait and UAE.

What are interesting markets for the future?

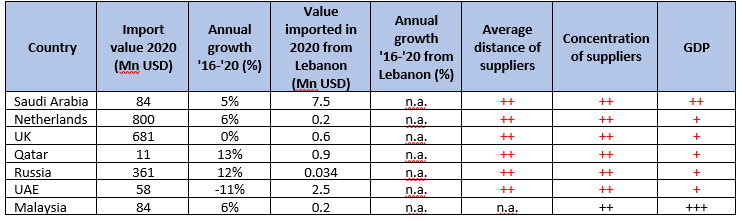

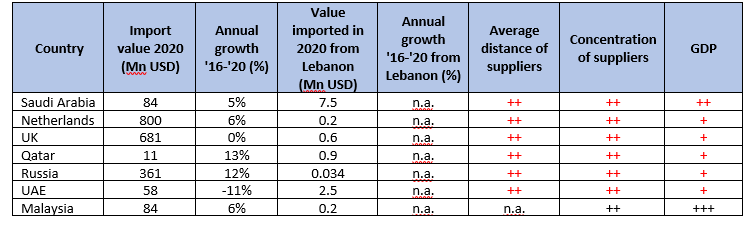

Based on the calculation and analysis of the figures, 7 countries were identified as promising and offering great opportunities for Lebanese exporters of table grapes. These countries include Saudi Arabia, Netherlands, UK, Qatar, Russia, UAE, and Malaysia. Table 3 below provides an overview of these potential export markets including the main used indicators.

Table 3 Top 7 potential export markets for table grapes from Lebanon

Markets with Highest Export Potential

Tips

- Given the fierce competition from European suppliers, good quality, adequate packaging in punnets as needed for supermarkets and compliance with various certifications, are preconditions for market entry of Lebanese grapes to the European market.