Market: Trade Statistics, Trends

Production, Consumption, and Exportation Trends

Pickles are considered one of the most popular condiments in the United States. Today, pickles are becoming ubiquitous due to their widespread presence as craft brands all over the markets. On average, each American citizen is consuming 9 pounds of pickles per year (reference) . In terms of market size, the U.S. pickle industry was valued at over USD 2.3 billion in 2011 and was forecasted to reach USD 2.4 billion by 2015(Euromonitor International, July 2011) . In 2011, Euromonitor published the figures below( Euromonitor International, July 2011) :- On average, Americans consumed around 2.9 pounds of pickled products per capita on an annual basis between 2008 and 2011.

- Pickles were eaten with a homemade meal (for 87% of food consumption), and homemade snack (for 7.8% of the time).

- Pickles were frequently used as a finger-food (for 69.1% of food consumption), as an accompaniment (6.3%), and as a main course (2.7%).

- Pickles were mostly consumed at dinner (45.7%), followed by lunch (41.0%), and breakfast (0.4%).

- People mostly consumed pickles in the fall (28.2%), followed by winter (26.9%), summer (23.6%), and spring (21.3%).

- Pickles were eaten without any preparation (60% of the time) and chilled (35.2%).

- Pickles were more commonly carried away from home as a meal or snack (5.1% of the time).

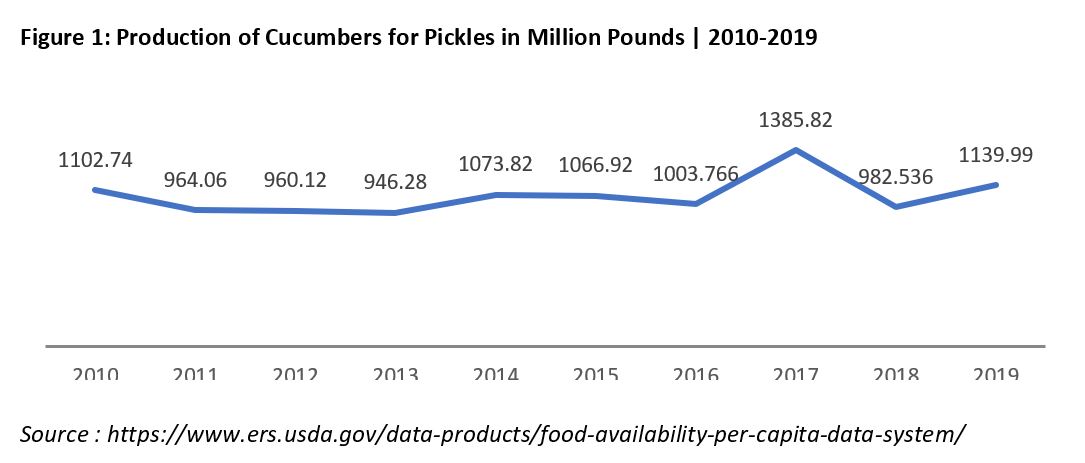

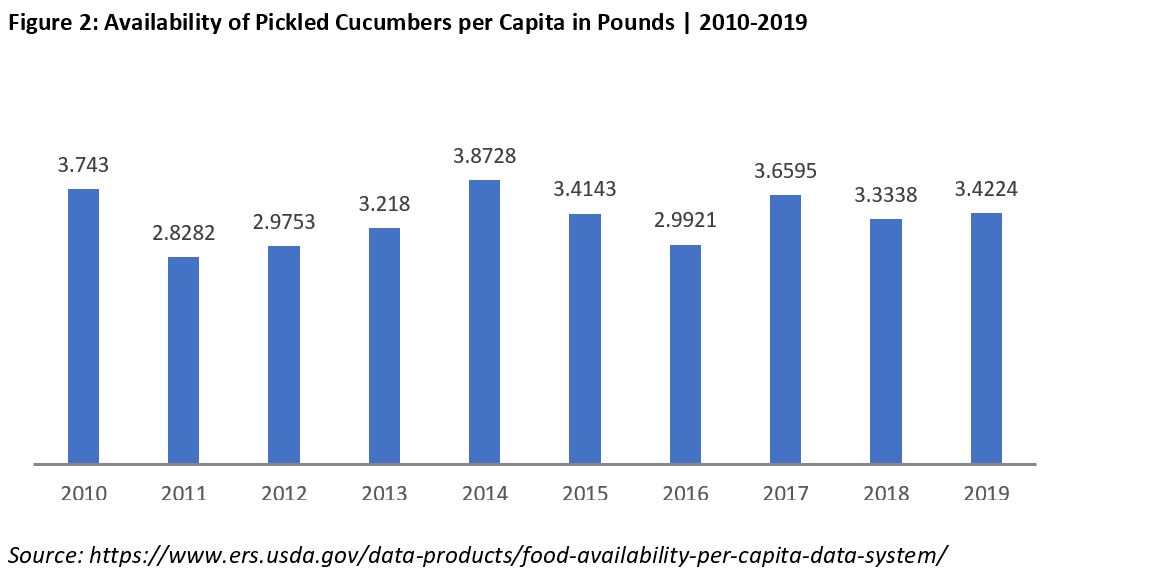

However, based on the latest releases of the U.S. Agriculture Department, around 1,140 million pounds of cucumbers were produced in 2019 for the making of pickles. Nonetheless, this category is limited to pickled cucumbers and does not include the various types of pickles that are available in the market. It’s worth noting that the production of cucumbers for pickles has been somewhat steady during the years, with a minimum average growth of 0.02% annually (figure 1). As for the availability per capita, it stood at 3.4 pounds per capita in 2019, spanning between 2.8 pounds as the lowest in 2010 and 3.9 pounds as the peak in 2014 (figure 2).

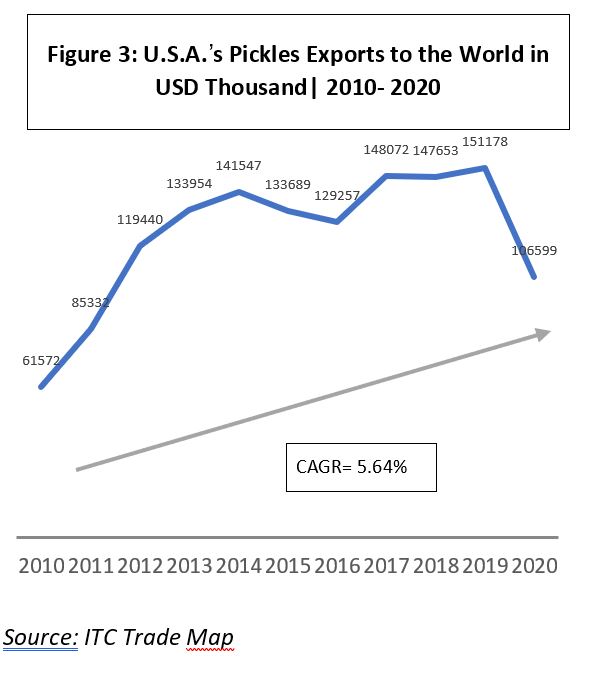

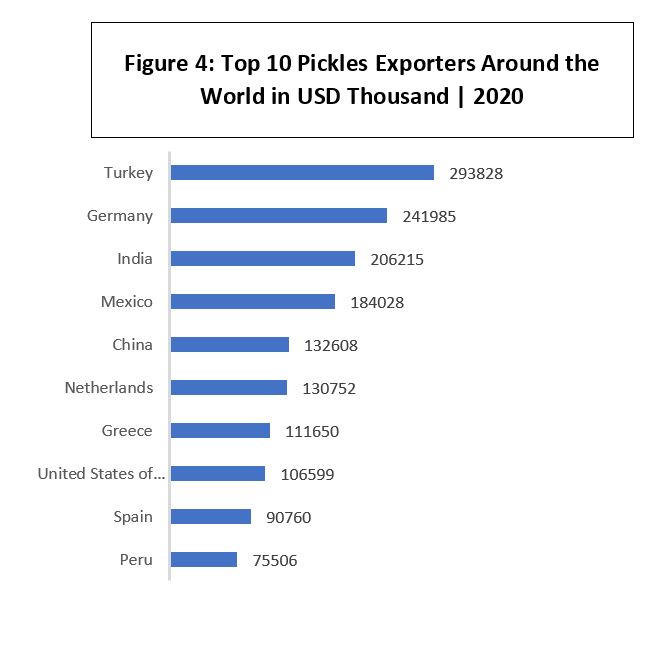

In 2020, the U.S. was ranked among the top 10 exporters of pickles around the world, with USD 106.6 million worth of pickle exports in 2020. The market has also witnessed export growth between 2010 and 2020, rising at a CAGR of 5.64% during this period.

Import Trends

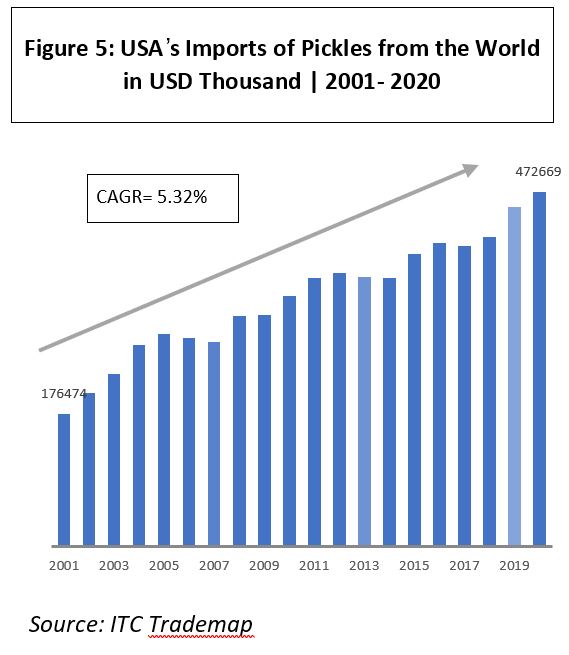

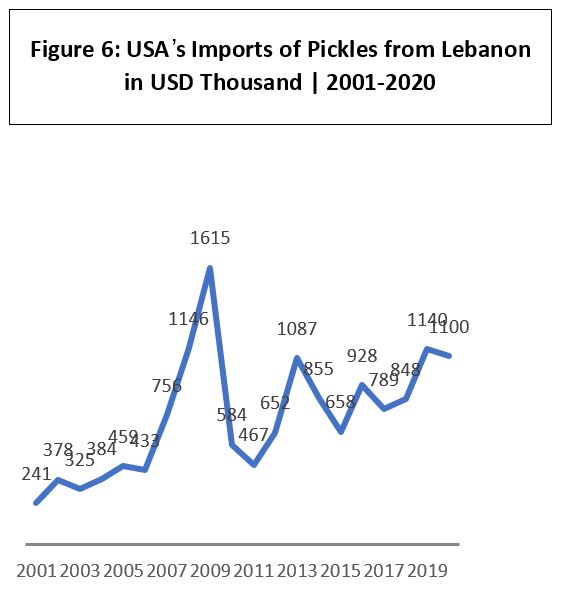

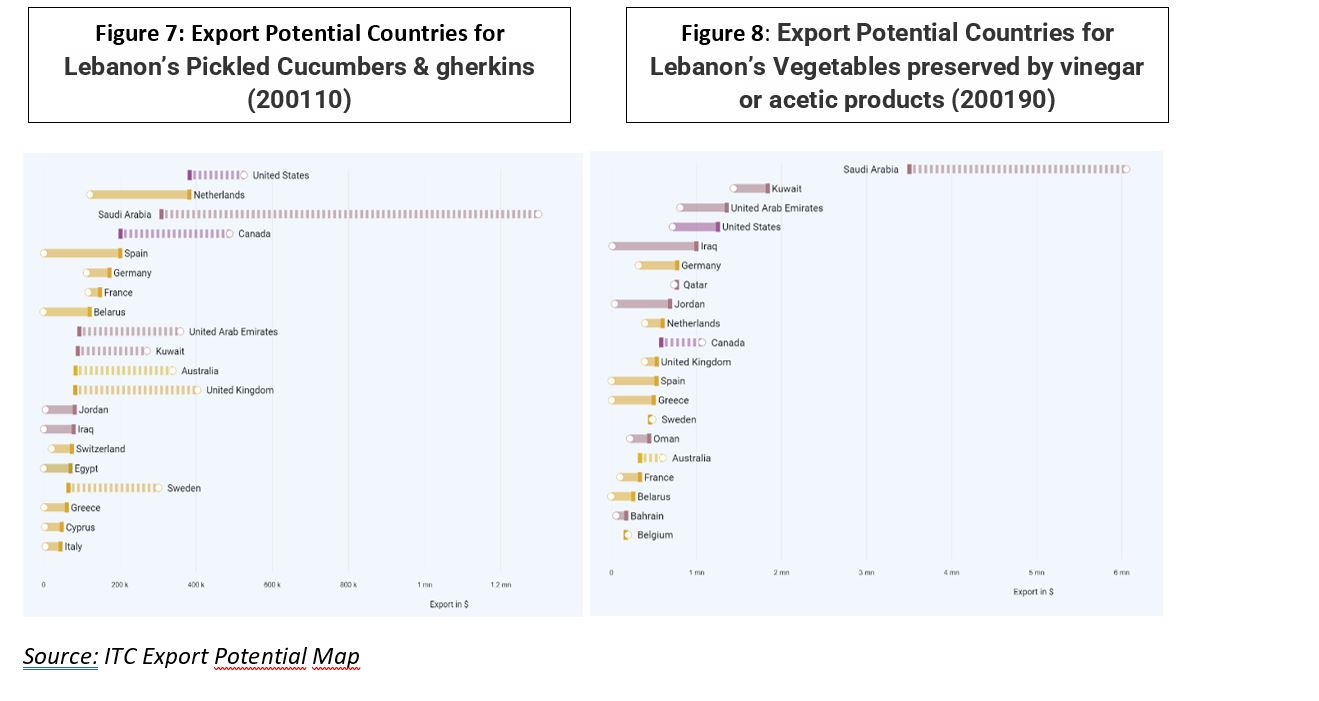

The U.S. is the biggest importer of pickles around the world, followed by Germany and the UK. In 2020, pickle exports totaled USD 472,669 thousand, growing at a CAGR of 5.32% between 2001 and 2020. The main U.S. countries for pickle imports are Mexico and India, contributing to more than 50% of the total U.S. imports of pickles. In parallel, the U.S. imports of pickles from Lebanon have been on the rise, increasing at a CAGR of 8.52% between USD 241 thousand in 2001 and USD 1,140 thousand in 2020. It’s worth mentioning that Lebanon benefits from the U.S. Generalized System of Preferences (GSP) program that offers duty-free tariffs to specific products imported to the U.S., including pickles (HS 2001).As per the ITC export potential map, the U.S. is one of the main potential markets for Lebanese pickles (cucumbers & gherkins (200110) and vegetables preserved by vinegar or acetic products (200190)) (figure 7 & 8). However, the U.S. shows an untapped potential of USD 475 thousand for Lebanon’s exports of vegetables, preserved by vinegar or acetic products (200190).

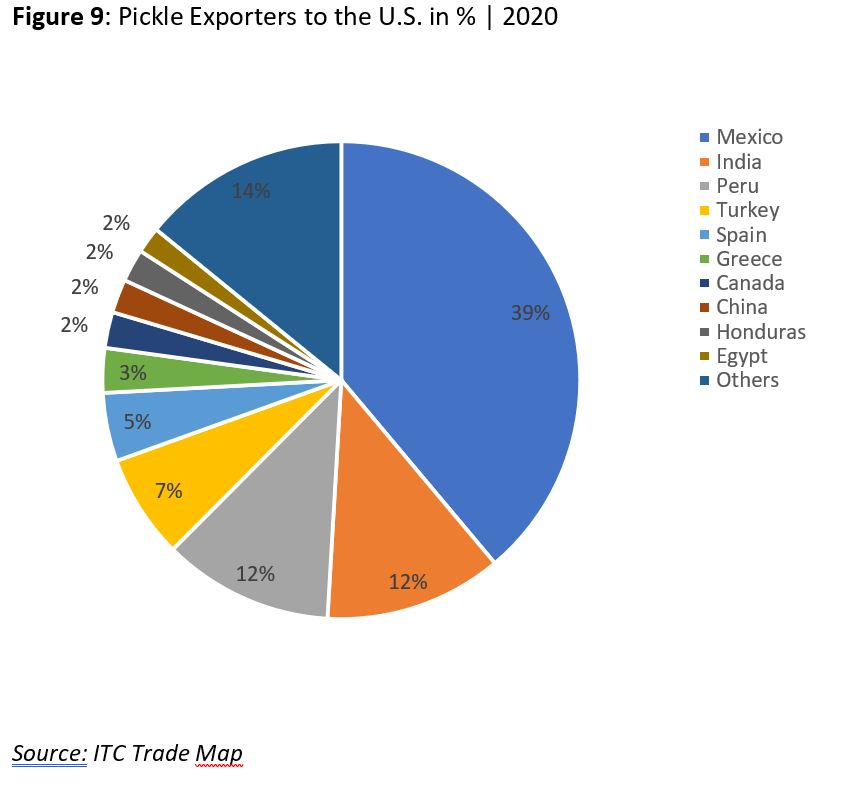

Share of Imports and Unit Price in 2020

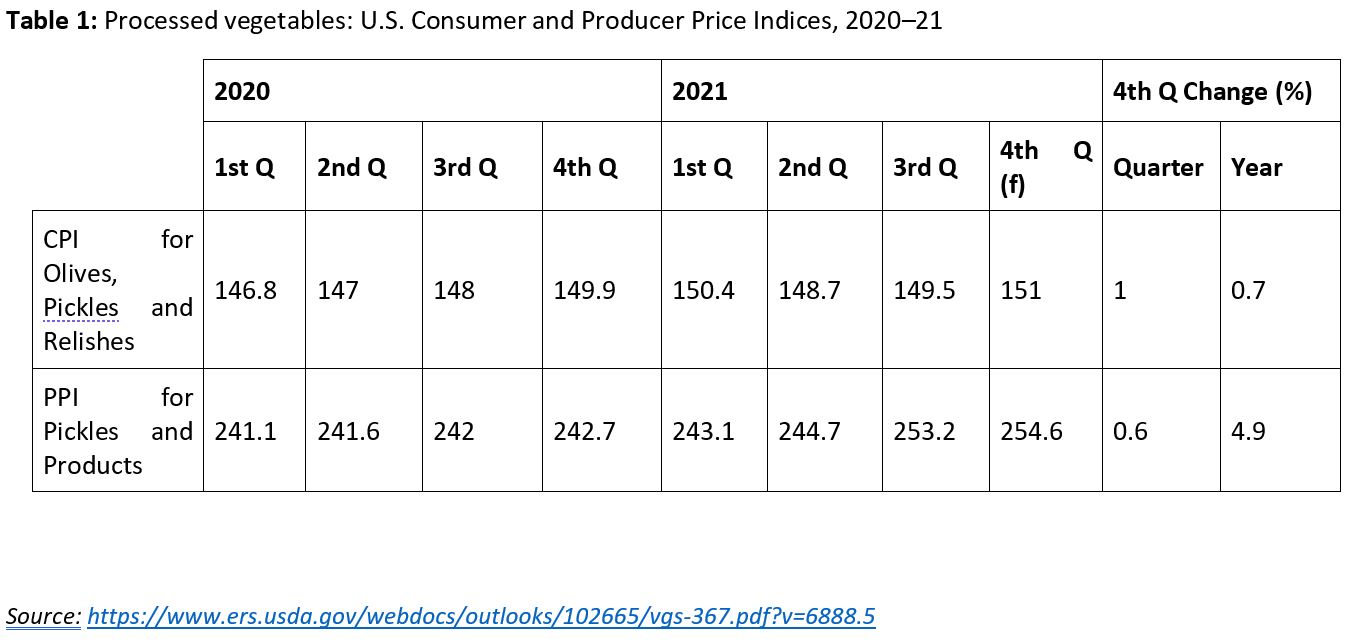

The consumer price index (CPI) for olives, pickles, and relishes has slightly changed between 2020 and 2021, averaging at 0.7%. While the producer price index (PPI) for pickles and products recorded a higher growth of 4.9% change.More than 50% of imported pickles to the U.S. were supplied by Mexico (39%) and India (12%). Other major exporters are Peru (12%), Turkey (7%), Spain (5%), Greece (3%), Canada (2%), China (2%), Honduras (2%), and Egypt (2%).

Changes in the American Market

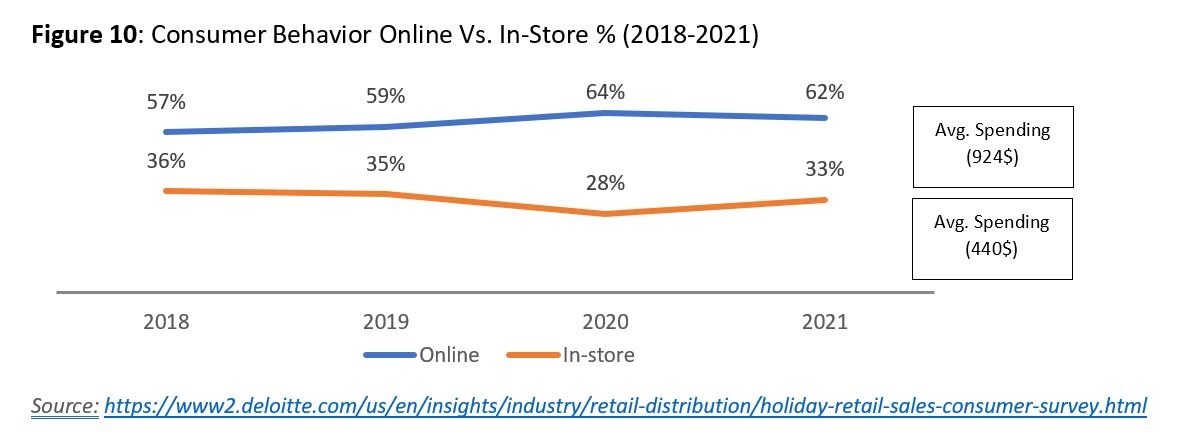

Many changes have occurred since the start of the pandemic, mainly reflected in the consumer behavior and purchase preferences with the increased health concerns and travel restrictions. However, trends are taking the lead towards digitalization, mainly online shopping and delivery to your doorstep. The COVID-19 crisis has sped up the technological inclusion of the different generations around the world, especially since consumers have prioritized their wellbeing while purchasing any product. Based on the latest figures published by Deloitte from their annual holiday survey, the average online spending standing at USD 924 between 2018 and 2021 was double the average of in-store spending at USD 440 during the same period. Whilst online spending has increased by 5% between 2018 and 2021, physical spending has dropped by 3% (figure 10).In light of these sharp changes, any product targeting the U.S. market should bring the consumer’s online experience to the fore, especially with the global expansion of the COVID-19 pandemic and its new variants. However, the importance of the e-commerce market will be emphasized in the market entry section (Check Section 2).

Besides the swelling preference for online shopping, consumers are focusing on their personal health and basic hygiene, which is manifested in the accelerated demand for organic, natural, and fresh goods. As per McKinsey’s report on “ how COVID-19 is changing [how] consumers behave across all spheres of life”, e-commerce, health, and wellbeing are the main emerging trends in consumer behavior after the pandemic outbreak. Therefore, it’s highly recommended that you chase the newest trends and needs in terms of packaging, hygiene, health, organic, fresh, and safety, especially when forging new partnerships in foreign countries

Market Entry: Trade Channels and Segments, Selection of Channels

Several approaches exist to set your foot in the U.S. market, all gathered into 3 different strategies:

However, based on the latest releases of the U.S. Agriculture Department, around 1,140 million pounds of cucumbers were produced in 2019 for the making of pickles. Nonetheless, this category is limited to pickled cucumbers and does not include the various types of pickles that are available in the market.

It is worth mentioning that since 2009, the U.S. retail channel has been depending more on distributors in order to reduce their workload in terms of invoices and papers, as well as to reach further discounts. According to the National Association for the Specialty Food Trade Inc. (NASFT), more than 180,000 specialty food products are available in different selling stations including supermarkets, specialty food stores, natural food products, corner shops, retail outlets, and drugstores.

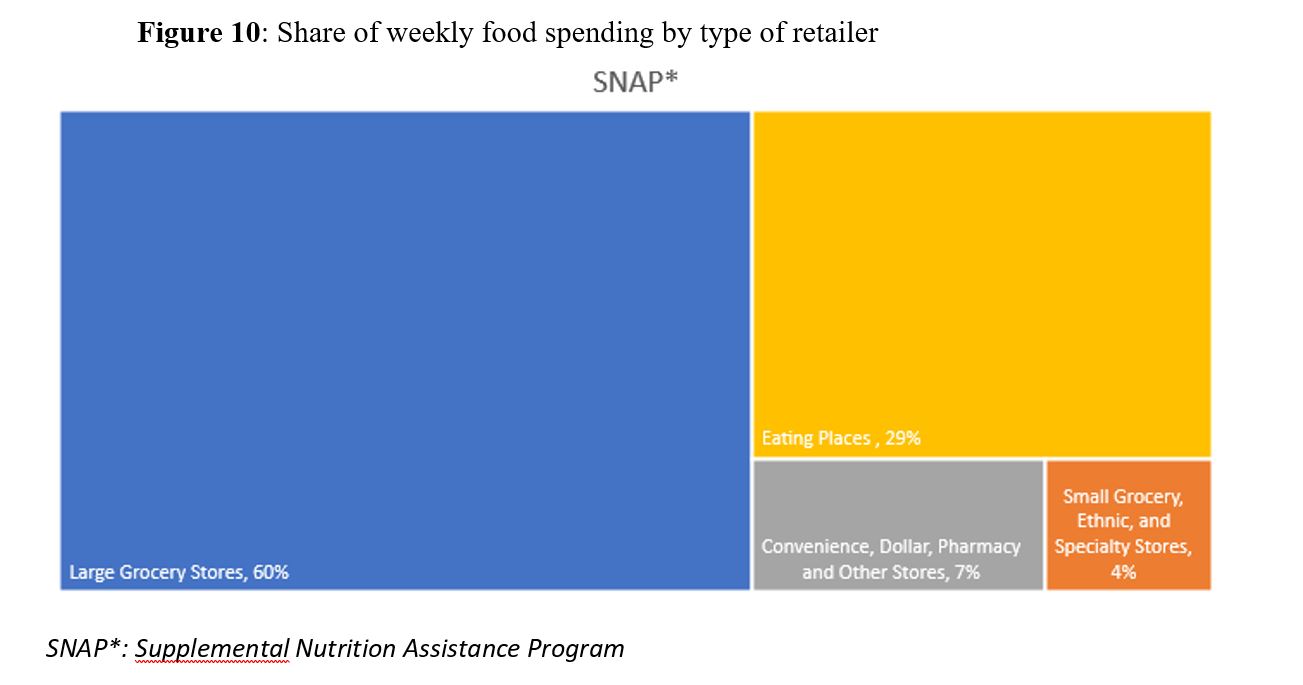

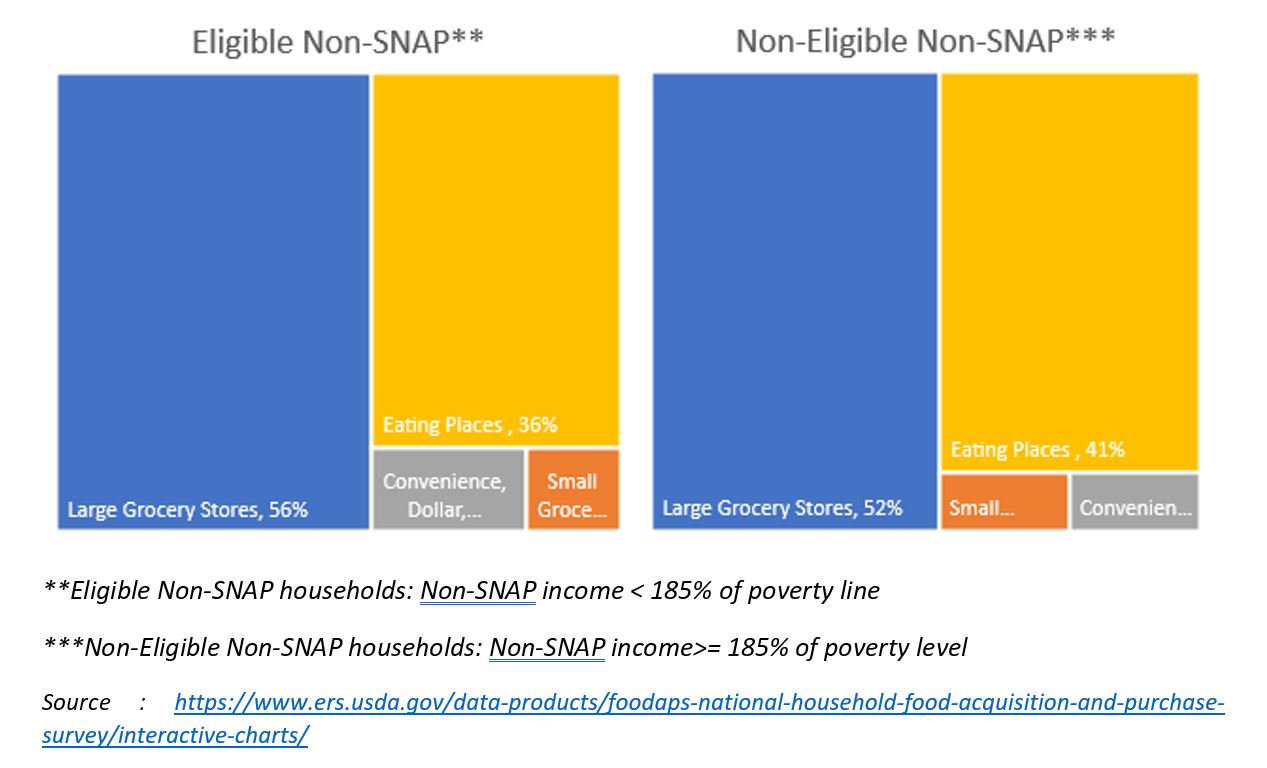

Main Supermarket Chains: The U.S. food and beverages retail sector is well-established and diversified, including hypermarkets, supermarkets, corner shops, specialty food stores, food markets, and other retail outlets. Large grocery stores are leading the market with a range of 52% up to 60% of weekly food spending, followed by eating places (figure 10). Major grocers in the U.S. include WALMART INC, THE KROGER CO., ALBERTSONS COS. INC., AHOLD DELHAIZE U.S.A., PUBLIX SUPER MARKETS INC. H.E. BUTT GROCERY CO., MEIJER INC., WAKEFERN FOOD CORP., ALDI INC., and WHOLE FOODS MARKET. Based on Statista’s latest figures, Kroger Co. is the leading supermarket in the U.S. with retail sales amounting to USD 131.57 billion in 2020 and the second biggest retailer after Walmart

E-commerce: Recently, American consumers are heavily relying on online grocery shopping with the current unprecedented health crisis, recording a 17-percentage-point surge . Online shopping is forecasted to grow in the upcoming years to reach around USD 60 billion in sales by 2023. Top e-commerce stores in the U.S. Food & Beverages industry in 2020 in terms of net sales comprise Kroger.com (USD 4,687 million), followed by Walmart.com (USD 3,289 million), Amazon.com (USD 2,643 million), Freshdirect.com (USD 830 million), and others .

- Directly selling to the client/customer (shipping to the end-user without any intermediary). In other words, the exporter will be responsible for shipping the merchandise and collecting the money unless they have another agreement.

- Indirectly selling through Export Intermediaries (distributors, buyers, brokers, agents…)

- Partnering up with a company abroad (which will facilitate access to the market). This step will reduce major expenses, since the producer will benefit from the existing partner’s resources. Another opportunity could be establishing a business presence in the U.S. market, such as a commercial hub or marketing office.

However, based on the latest releases of the U.S. Agriculture Department, around 1,140 million pounds of cucumbers were produced in 2019 for the making of pickles. Nonetheless, this category is limited to pickled cucumbers and does not include the various types of pickles that are available in the market.

It is worth mentioning that since 2009, the U.S. retail channel has been depending more on distributors in order to reduce their workload in terms of invoices and papers, as well as to reach further discounts. According to the National Association for the Specialty Food Trade Inc. (NASFT), more than 180,000 specialty food products are available in different selling stations including supermarkets, specialty food stores, natural food products, corner shops, retail outlets, and drugstores.

Main Supermarket Chains: The U.S. food and beverages retail sector is well-established and diversified, including hypermarkets, supermarkets, corner shops, specialty food stores, food markets, and other retail outlets. Large grocery stores are leading the market with a range of 52% up to 60% of weekly food spending, followed by eating places (figure 10). Major grocers in the U.S. include WALMART INC, THE KROGER CO., ALBERTSONS COS. INC., AHOLD DELHAIZE U.S.A., PUBLIX SUPER MARKETS INC. H.E. BUTT GROCERY CO., MEIJER INC., WAKEFERN FOOD CORP., ALDI INC., and WHOLE FOODS MARKET. Based on Statista’s latest figures, Kroger Co. is the leading supermarket in the U.S. with retail sales amounting to USD 131.57 billion in 2020 and the second biggest retailer after Walmart

E-commerce: Recently, American consumers are heavily relying on online grocery shopping with the current unprecedented health crisis, recording a 17-percentage-point surge . Online shopping is forecasted to grow in the upcoming years to reach around USD 60 billion in sales by 2023. Top e-commerce stores in the U.S. Food & Beverages industry in 2020 in terms of net sales comprise Kroger.com (USD 4,687 million), followed by Walmart.com (USD 3,289 million), Amazon.com (USD 2,643 million), Freshdirect.com (USD 830 million), and others .

Finding Potential Buyers

Brokers/Export Mediators: These export intermediaries will assess and evaluate the company’s products to access the U.S. market by providing them with consultancy and guidance, and ensure a wide exposure to buyers, distributors, industry professionals, associations, related businesses along the entire supply chain, and other potential stakeholders and connections. It will facilitate market entry, ease access to compliance procedures, and provide needed information to create business deals. This will be the first stage for any company to enter the U.S. market.

International Fairs and Exhibitions: The participation in international fairs and exhibitions, while targeting B2B meetings, is identified as a priority to find potential buyers. Various projects are being implemented in Lebanon under international, non-governmental, and public entities to increase the marketing exposure of Local manufacturers at overseas trade shows. The support comprises sponsoring and organizing the participation of Lebanese SMEs that are already exporting or willing to export to leading international fairs and exhibitions; this step offers an opportunity to meet buyers, build connections, and go international. The Investment Development Authority of Lebanon (IDAL) covers part of the exporters’ participation fees in key international fairs that are beneficial for Lebanese exporters. However, the Productive Sectors Development Programme (PSDP) is currently providing institutional support for IDAL in order to achieve its export support activities. It’s worth mentioning that being members of any of the following entities will help you to exhibit your products in international fairs: Association of Lebanese Industrialists (ALI), Qoot Cluster (Berytech), Fair Trade Lebanon (BIEEL Initiative), and Oxfam. For more info on the list of fairs and exhibitions check Section 4.

Other Indirect Connections: e-commerce platforms are thriving in the U.S., especially after the boom induced by the pandemic. Amazon, eBay, Alibaba, Walmart, and others offer several options to distribute your product by either distributing it directly to consumers or receiving orders; in this case, the seller will be responsible for shipping their orders. In addition, connecting with the Lebanese diaspora could be another way to reach out to importers in the U.S. who are of Lebanese origin and are already bringing Lebanese products to the country.

For the list of buyers, importers, and distributors check here.

International Fairs and Exhibitions: The participation in international fairs and exhibitions, while targeting B2B meetings, is identified as a priority to find potential buyers. Various projects are being implemented in Lebanon under international, non-governmental, and public entities to increase the marketing exposure of Local manufacturers at overseas trade shows. The support comprises sponsoring and organizing the participation of Lebanese SMEs that are already exporting or willing to export to leading international fairs and exhibitions; this step offers an opportunity to meet buyers, build connections, and go international. The Investment Development Authority of Lebanon (IDAL) covers part of the exporters’ participation fees in key international fairs that are beneficial for Lebanese exporters. However, the Productive Sectors Development Programme (PSDP) is currently providing institutional support for IDAL in order to achieve its export support activities. It’s worth mentioning that being members of any of the following entities will help you to exhibit your products in international fairs: Association of Lebanese Industrialists (ALI), Qoot Cluster (Berytech), Fair Trade Lebanon (BIEEL Initiative), and Oxfam. For more info on the list of fairs and exhibitions check Section 4.

Other Indirect Connections: e-commerce platforms are thriving in the U.S., especially after the boom induced by the pandemic. Amazon, eBay, Alibaba, Walmart, and others offer several options to distribute your product by either distributing it directly to consumers or receiving orders; in this case, the seller will be responsible for shipping their orders. In addition, connecting with the Lebanese diaspora could be another way to reach out to importers in the U.S. who are of Lebanese origin and are already bringing Lebanese products to the country.

For the list of buyers, importers, and distributors check here.

Export Promotional Activities

Your marketing strategy should be set on specific aspects to highlight your product’s innovation and quality standards as well as to reach the relevant audience. For example, advertising your organic pickles requires different promotional techniques than pickle-flavored snacks. Nonetheless, standard export promotional activities include participation in international fairs and exhibitions, local trade and business events, and a strong presence on social media as well as other innovative techniques that highlight the specialties of your product. As mentioned before, partnering with a local business company will help you in your marketing strategy due to their high level of expertise in the market. The series of marketing activities comprise:

Several food and beverage trade fairs have shown success in the U.S., bringing together all industry professionals, retailers, and connections such as Fancy Food Show, Sweets and Snacks, SIAL America, America Food and Beverage Show, and others. For the list of exhibitions and fairs taking place in the U.S., check the U.S. Department of Agriculture website, as for shows around the world, check the list of Agriculture and Food Trade Shows published on the website of the government of Canada, including the U.S. events.

Moreover, you can always benefit from the expertise of a local advertising agency to market your products such as ExportUSA by attending practical, technical, and hands-on training offering knowledge in the export field including market opportunities, market trends, legal requirements, finding agents/brokers, distribution channels, and others.

As for social media platforms and online marketing, pickle companies should have a strong presence to generate deals and reach out to new consumers. However, digital marketing is one of the most efficient ways to promote your product including search engine optimization and paid ads on the most popular social media platforms like Facebook, Instagram, Twitter, and LinkedIn. You’ll have to stay updated on all the new trends on these platforms and to be creative in terms of posts and content. Furthermore, all your online platforms should be relatively related and linked to help consumers access your products/services.

Few suggestions on how to reach out to new consumers on Social Media:

It's worth noting that the advertising industry in the U.S. is regulated by several public and private entities including the Federal Trade Commission (FTC), Bureau of Consumer Protection, Federal Communications Commission (FCC), and Food and Drug Administration (FDA). In order to ensure that all your advertising campaigns abide by the rules and laws, it’s advised to consult with an expert in the U.S. market or a U.S.-based advertising company.

- Traditional Marketing Campaigns (newspapers, TV, and radio)

- Point-of-sale Displays

- International Exhibitions/Fairs

- Digital Marketing and social media

- Local Festivals and Tasting Events

- Restaurants and Food Services

Several food and beverage trade fairs have shown success in the U.S., bringing together all industry professionals, retailers, and connections such as Fancy Food Show, Sweets and Snacks, SIAL America, America Food and Beverage Show, and others. For the list of exhibitions and fairs taking place in the U.S., check the U.S. Department of Agriculture website, as for shows around the world, check the list of Agriculture and Food Trade Shows published on the website of the government of Canada, including the U.S. events.

Moreover, you can always benefit from the expertise of a local advertising agency to market your products such as ExportUSA by attending practical, technical, and hands-on training offering knowledge in the export field including market opportunities, market trends, legal requirements, finding agents/brokers, distribution channels, and others.

As for social media platforms and online marketing, pickle companies should have a strong presence to generate deals and reach out to new consumers. However, digital marketing is one of the most efficient ways to promote your product including search engine optimization and paid ads on the most popular social media platforms like Facebook, Instagram, Twitter, and LinkedIn. You’ll have to stay updated on all the new trends on these platforms and to be creative in terms of posts and content. Furthermore, all your online platforms should be relatively related and linked to help consumers access your products/services.

Few suggestions on how to reach out to new consumers on Social Media:

- Youtube (the most popular media platform in the U.S.): popular Youtube channels and paid ads

- Facebook (the second-largest platform in the U.S.): sponsored ads and influencers’ accounts might be efficient to advertise your products

- Facebook (the second-largest platform in the U.S.): sponsored ads and influencers’ accounts might be efficient to advertise your products

- Food Blogs such as Serious Eats and The Recipe Critic

- Pinterest (more than 60% of its user are women )

- LinkedIn: to promote your business and products (using ads, account upgrades, and analytics)

Doing Business: Business Culture

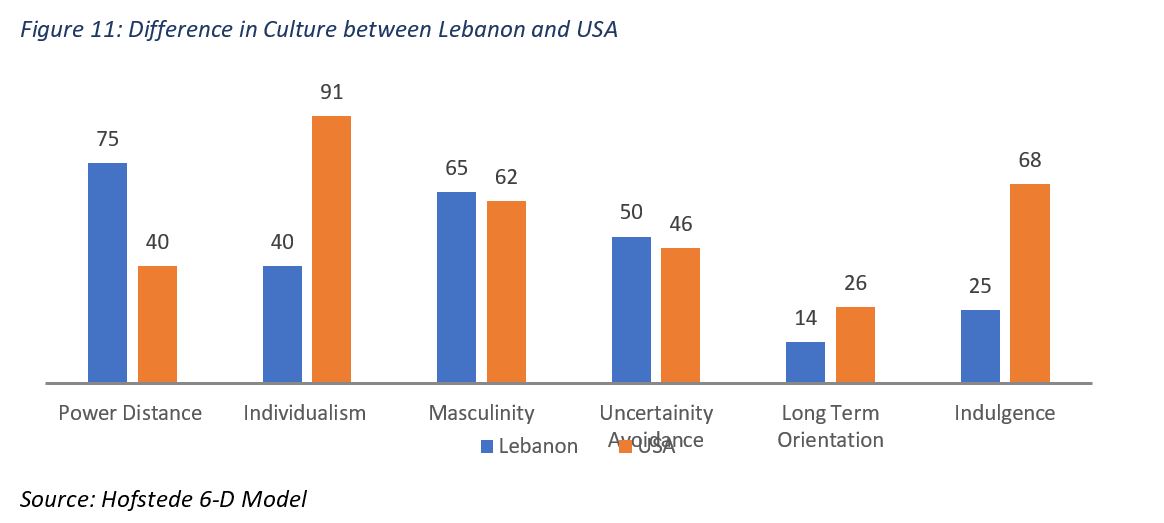

Power Distance: the extent to which the less powerful members of institutions and organizations within a country expect and accept that power is distributed unequally.

There is a large gap in the score between Lebanon and the U.S. on power distance. While Lebanon follows a hierarchical and centralized system, the U.S. emphasizes the uniqueness of the individuals which leads to power inequalities.

Individualism: the degree of interdependence a society maintains among its members.

While Lebanon scores low on individualism reflecting its collectivistic society, the U.S. follows the “Liberty and Justice for all” principle as one of the most individualist countries worldwide. This is manifested by ensuring equal rights for American citizens as well as the government. Within the work environment, information is circulated between the team from employees to managers, as they are both being consulted for their knowledge and expertise. However, employees are likely to be independent and self-efficient, and can also create new initiatives. As for Lebanon, society members are related to their “group”, whether their family or not, and therefore, handle responsibility for their group members.

Masculinity: whether society is driven by competition, achievement, and success (masculine), or dominant values in society are caring for others and quality of life (feminine).

Both countries, Lebanon and the U.S. score high on masculinity highlighting their masculine societies. In the U.S., this behavior is combined with the individualistic culture. Americans work mostly on showing their success as winners in work and life as well, not only on achieving their targets.

Uncertain Avoidance: the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these.

Lebanon scored midway, and thus, shows no clear preference. Nevertheless, the U.S. scored low (below the average) while undertaking innovative concepts, either for a product or business idea, and is willing to accept them. Furthermore, the U.S. is an open-minded community that encourages the freedom of speech.

Long Term Orientation: the extent to which a society maintains some links with its own past, while dealing with the challenges of the present and future.

Both Lebanon and the U.S score low on long-term orientation, indicating normative rather than pragmatic societies. People in both societies exhibit great respect for traditions, a relatively small propensity to save for the future, and a focus on achieving quick results. In the U.S., people are empirical and are affected by the “can-do” mindset. This is highly reflected in the business field, where Americans evaluate their work on a short-term basis (including incomes and losses), leading workers to attempt achievements in a short duration.

Indulgence: the extent to which people try to control their desires and impulses.

Lebanon scores low on indulgence indicating a restrained culture, whereas the U.S. is ranked as an indulgent society with opposite perspectives. Moreover, restrained societies have a tendency to cynicism and pessimism. They have the perception that their actions are restrained by social norms and that self-indulgence is wrong. In other words, restrained societies do not put much emphasis on leisure time and control the gratification of their desires. Although many campaigns have been launched against drugs in the U.S., the country is still facing a high rate of drug addiction under the concept of having a work-life balance. However, the U.S. is considered a proper/puritanical society, even though many preachers that show up on TV seem unethical.

There is a large gap in the score between Lebanon and the U.S. on power distance. While Lebanon follows a hierarchical and centralized system, the U.S. emphasizes the uniqueness of the individuals which leads to power inequalities.

Individualism: the degree of interdependence a society maintains among its members.

While Lebanon scores low on individualism reflecting its collectivistic society, the U.S. follows the “Liberty and Justice for all” principle as one of the most individualist countries worldwide. This is manifested by ensuring equal rights for American citizens as well as the government. Within the work environment, information is circulated between the team from employees to managers, as they are both being consulted for their knowledge and expertise. However, employees are likely to be independent and self-efficient, and can also create new initiatives. As for Lebanon, society members are related to their “group”, whether their family or not, and therefore, handle responsibility for their group members.

Masculinity: whether society is driven by competition, achievement, and success (masculine), or dominant values in society are caring for others and quality of life (feminine).

Both countries, Lebanon and the U.S. score high on masculinity highlighting their masculine societies. In the U.S., this behavior is combined with the individualistic culture. Americans work mostly on showing their success as winners in work and life as well, not only on achieving their targets.

Uncertain Avoidance: the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these.

Lebanon scored midway, and thus, shows no clear preference. Nevertheless, the U.S. scored low (below the average) while undertaking innovative concepts, either for a product or business idea, and is willing to accept them. Furthermore, the U.S. is an open-minded community that encourages the freedom of speech.

Long Term Orientation: the extent to which a society maintains some links with its own past, while dealing with the challenges of the present and future.

Both Lebanon and the U.S score low on long-term orientation, indicating normative rather than pragmatic societies. People in both societies exhibit great respect for traditions, a relatively small propensity to save for the future, and a focus on achieving quick results. In the U.S., people are empirical and are affected by the “can-do” mindset. This is highly reflected in the business field, where Americans evaluate their work on a short-term basis (including incomes and losses), leading workers to attempt achievements in a short duration.

Indulgence: the extent to which people try to control their desires and impulses.

Lebanon scores low on indulgence indicating a restrained culture, whereas the U.S. is ranked as an indulgent society with opposite perspectives. Moreover, restrained societies have a tendency to cynicism and pessimism. They have the perception that their actions are restrained by social norms and that self-indulgence is wrong. In other words, restrained societies do not put much emphasis on leisure time and control the gratification of their desires. Although many campaigns have been launched against drugs in the U.S., the country is still facing a high rate of drug addiction under the concept of having a work-life balance. However, the U.S. is considered a proper/puritanical society, even though many preachers that show up on TV seem unethical.

Tips

- Add new flavors to your pickled product: innovative, seasonal, or trendy flavors which make your product more attractive to consumers and have better chances to be purchased.

- New trends in food consumption: heading towards healthier choices including low calories, gluten-free, organic, or vegan products. Categorizing your pickles under any of these brackets will shift your sales records.

- Use eco-friendly packages: such as recyclable jars instead of using plastic or containers. You will hereby attract the eco-friendly community.

- Pickles in the U.S. are considered a grab-and-go product. Therefore, your product is preferable when it’s a single serving, i.e. an easy ready-to-go snack.

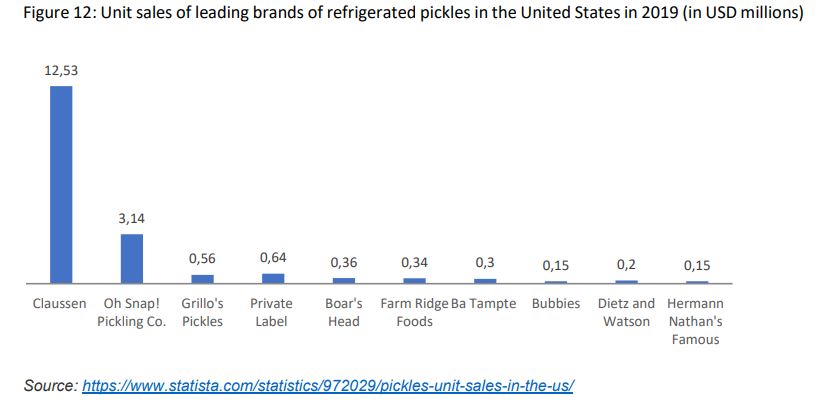

- Explore the U.S. top pickles brands in the U.S., their variety of products, innovation aspects, packaging and labeling, and distribution channels.

- When dealing with buyers, ensure an accurate delivery time in order not to lose any of your gains in the market.

- Having one buyer is not considered a good business practice. It is better if you try to reach out to several buyers, in order to be able to maintain your export activities in case any of them stop. However, at the same time, ensure that you do not have too many so you won’t be able to sustain your deliveries. ,

- Having a well-designed website with detailed information about your product specifications is crucial before reaching out to any buyer.

- Make sure to follow up with the buyers after attending fairs/exhibitions. Most of the deals will happen after the show.