Market: Trade Statistics and Trends

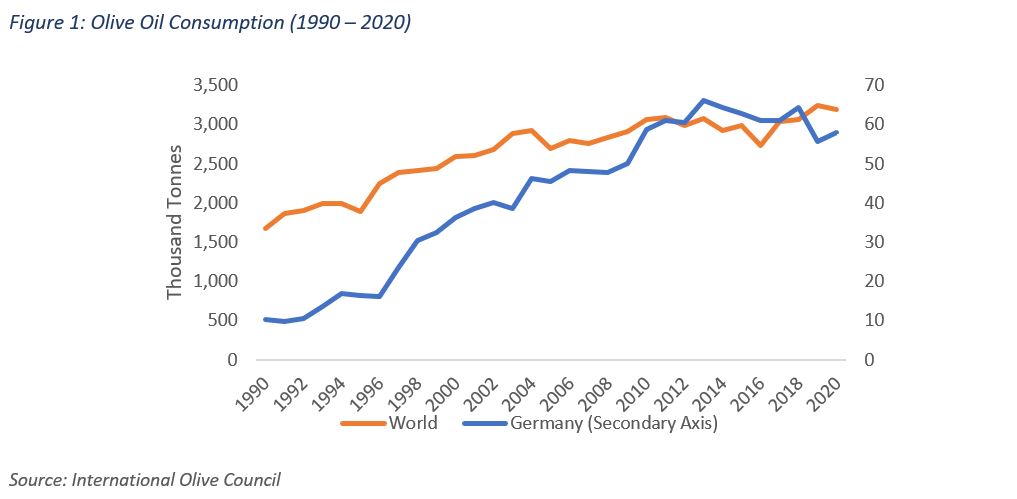

Germany does not produce olive oil; however, it is one of Europe’s largest markets for olive oil. In 2020, Germany was the 14th largest consumer of olive oil with a global consumption share of 1.8%. More specifically , olive oil consumption in Germany has been growing at a CAGR of 5.8% between 1990 and 2020, faster than the global rate of 2.1%. In terms of per capita consumption, Germany ranked 21st with 0.7 liters per capita in 2018. The per capita consumption of Turks or Germans with Turkish origin who are the largest group of minorities (accounting for around 3.4% of the German population), is triple that amount. In 2020, Germany ranked as the 12th largest olive oil exporter with a global share of 0.5%, which means that a small share of the imported olive oil is re-exported, mostly to neighboring countries.

Import Trends

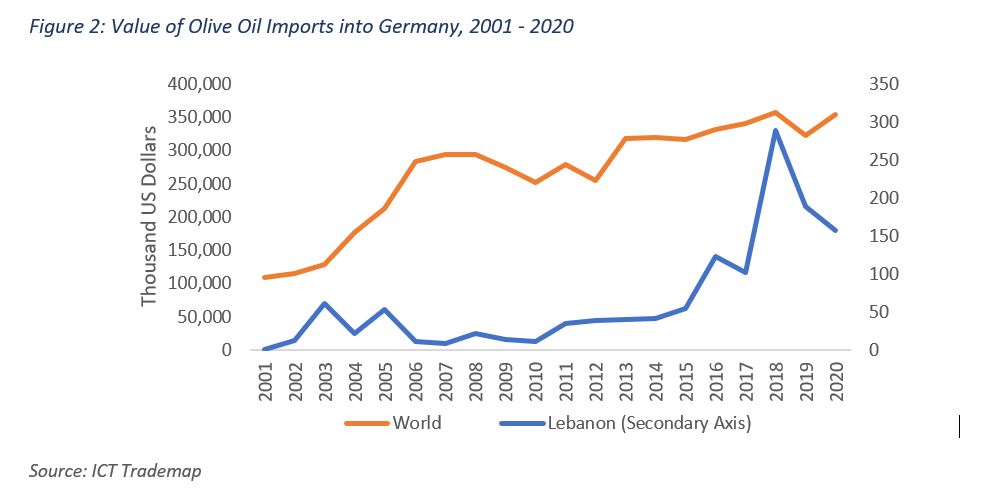

Most of Germany’s olive oil is imported from Italy, but the country also imports a small amount directly from developing countries. In 2020, Germany ranked as the 6th largest olive oil importer with olive oil imports growing by 3.36 times their 2001 value. The value of German olive oil imports has fluctuated over the year but have reached their highest value in 2018. That same year, German imports from Lebanon peaked at $288,000, but dropped sharply in the subsequent years reaching $157,000 in 2020. Back in 2001, Germany did not import any olive oil from Lebanon, but since 2002, the value of Lebanese olive oil exports to Germany started to rise following a sharp upward trend after 2010. In 2020, Lebanese exports constituted 0.04% of German olive oil imports while German imports constituted 0.8% of Lebanon’s olive oil exports.

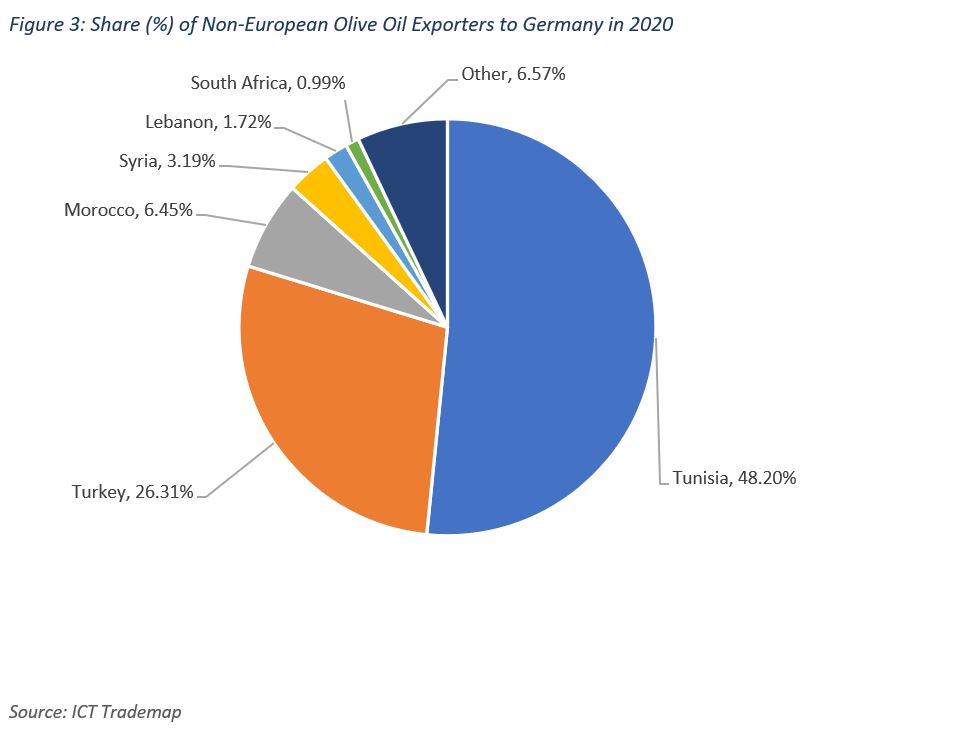

In 2020, more than 97% of German olive oil imports were from the European Union with almost 60% from Italy, 18% from Spain, 15% from Greece, 4% from France and the rest from 16 other EU countries. Non-European countries account for only 2.4% of Germany’s olive oil imports, with Tunisia as the leading supplier, followed by Turkey. Other emerging olive oil suppliers to Germany are Syria, Lebanon, Palestine and Morocco, but still in very small volumes.

The world average imported unit value in 2020s stood at $4,407/ton. The unit value of imports from Italy, Greece, France, Tunisia, Portugal and Poland exceeded the world average. The unit value of imports from Morocco, South Africa, Liberia and Thailand surpassed double the world average, while those from Syria and Egypt were less than half. Meanwhile, olive oil from Lebanon was imported for a competitive price of $3,204/ ton in 2020 despite its comparative disadvantage in terms of transportation costs and tariffs compared to EU countries. Therefore, with a thorough study of the market and proper strategies of market entry, Lebanese olive oil export to Germany has the potential to grow.

Market Trends

Imports of extra virgin olive oil are increasing, while imports of non-virgin olive oil are decreasing. This indicates that higher quality olive oil is gaining share in the German market. According to CBI, in 2019, 76% of all imported olive oil to Germany was extra virgin, followed by ordinary olive oil (12%) and other virgin olive oil (7%). As the largest market in Europe for organic products, Germany provides opportunities for suppliers of organic olive oil. However Germany is a very price competitive market and many organic brands do not have significantly higher prices compared to brands of conventional olive oil.

The growing consumer interest in olive oil in Germany and Europe has three main driving forces combined: the growing popularity of the Mediterranean diet, the increasing awareness of olive oil’s health benefits and the quality of certain types olive oil.

The emergence of several studies that indicate the health benefits of the Mediterranean diet (lower the risk of cardiovascular diseases, overall cancer incidence, neurodegenerative diseases, diabetes and early death) and the rising popularity of food dishes that use olive oil have been driving consumption. Several European Commission projects promote the Mediterranean diet and olive oil consumption.

Authenticity of olive oil is an important issue in the German market; it revolves around oil composition and oil origin. With the increased interest in specialty olive oils, opportunities for oils with a geographic indication or coming from a specific origin or terroir is growing.

Market Entry: Trade Channels and Segments

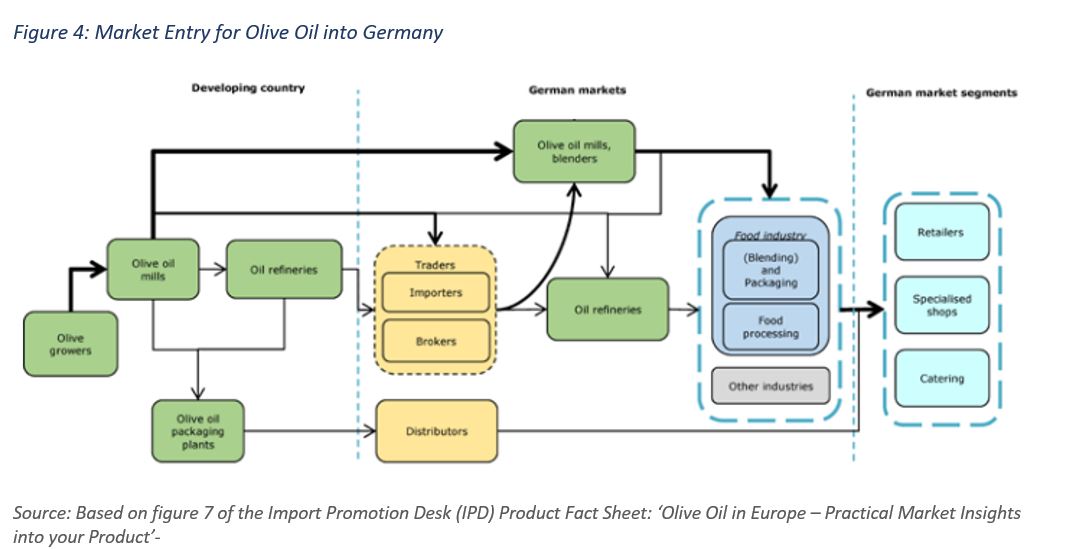

- Through the intermediary role of traders (importers or brokers), or

- Directly to olive oil mills and blenders or oil refineries

If you are a (relatively) small supplier of olive oil or new to the German market, it may be more sensible to enter the market through traders. These companies have an extensive network in the German market. Alternatively, if you can supply large volumes of good quality and priced olive oil it may be feasible to build up a long-term trade relationship with olive oil blenders. If your olive oil needs to be refined, it needs to go to a refinery in Germany, with or without going through traders.

Traders can specialize in general food ingredients, a specific product group (example: vegetable oils) or olive oils only. They intermediate the contact between exporters and customers, such as refineries and processing industries.

The majority of the imported olive oil is already labelled and packaged when it enters the German market. The packaged sizes vary from very small volumes like 0.08 L, 0.1 L and 0.25 L, medium volumes over 0.5 L up to 5L and 10L and large volume of 174L. While the 10L package is distributed only to big consumers (hotels, restaurants etc.) and the 174L are imported by an oil mill for the food industry, all other package sizes are distributed through the other different possible channels in the supply chain. In oil mills, oils are blended with oils from other origins. The olive oil is either packaged immediately or proceeds to specialized packaging/bottling companies before reaching final consumers in Germany. There are also companies in the value chain who take on all steps of this process of blending and packaging/bottling, rather than going through different channels.

Refining of olive oils, if needed or required, takes place in oil refineries in Germany. This is an extra step before the oil is blended. Oil refineries can act as blenders as well; the refined olive oil may be blended with other (virgin) olive oils or other vegetable oils (e.g. sunflower oil) before being packaged/bottled for consumption. Packaging/bottling activities may be integrated into the oil refinery or carried out by a separate company.

Olive oil is also used by the food processing industry in Germany and other European countries to produce a number of food products such as margarines, chips, dips, canned fish, salad sauces etc. The food industry will rarely process products using specialty olive oils.

Olive oils which are exported from the country of origin as a final consumer product are mostly distributed in Germany via food distributors or specialized vegetable/olive oil distributors. If olive oil exporters have a direct contact with a German retailer, the distributing company might belong to the retailer as well.

factsheet olive oil

Other industries using olive oils in their products are:

• Cosmetics and toiletries: e.g. lotions, skin oils, creams, soaps

• Pharmaceutical: as a base for plasters and other products, carrier for active ingredients, soft gelatin capsules, nose sprays

• Veterinary: pet food industry

• Detergent industries for cleaning and hygiene

Finding Potential Buyers

Germany does not have an association of olive oil importers or suppliers. Contact points especially for

small producers and exporters interested in the German market are the embassies and consulates of their countries.

The departments of foreign trade of the embassies conduct market studies and have an important role in the

information flows between the producers and the German buyers.

Exporters can also approach potential customers in Germany through direct (e-)mail with follow-up through

personal visits or invitations of potential customers to visit in their country. They may also meet with potential

buyers by visiting international trade fairs.

Most of the olive oil sold in Germany is sold under a private label, such as Primadonna

(by discounter chain Lidl), El Cantinelle and Cucina

(by Aldi Süd), Casa Morando

(by Aldi Nord), Aro

(by Metro Cash & Carry), REWE Feine

Welt and ja! (by REWE), and Edeka and

Gut&Günstig (by Edeka). Most

private label oils are blends from different origins. Independent brands include Bertolli and Carapelli (Italian), Mazola (Spanish origin by Peter

Kölln), Minerva, Minos and Jordan (Greek), Ybarra (Spanish) and La Española

(by Feinkost Dittmann). You can also find alternative products using

the Codecheck website or application and check available products in supermarkets on SupermarktCheck.

As the largest market in Europe for organic products, Germany provides opportunities for

suppliers of organic olive oil. A large share of organic olive oils in Germany are sold under private label

brands of specialized organic retailers, such as Denn’s, Alnatura, Basic, Bio Company, ebl-Naturkost and Super

Biomarkt. Leading

retail chains also have their own organic private labels.

Rapunzel, Ölmühle Solling and Henry Lamotte Oils are examples of specialized companies that deal with organic, fair trade and high quality olive oil. Consider such companies for potential partnerships.

More olive oil companies in Germany can

be found on EUROPAGES, WLW and Organic Bio (for organic olive

oil). LinkedIn can be used to look up and contact

professionals who work at companies in Germany specialized in olive oil. Organic Bio is an international

directory of organic food wholesale and supply companies with a section on olive oil in Germany. Information

about olive oil companies in Germany can also be found on webpages specialized in exhibitions, trade fairs,

F&B events and competitions such as Anuga (leading trade fair for worldwide

food and beverages, which is held biannually in Cologne, Germany), BIOFACH (fair for organic and natural

products, which is held annually in Nuremberg, Germany), Olive Oil Market.

Export Promotional Activities

In a survey conducted in 2019 (http://dx.doi.org/10.3390/su12166379) on a sample of 705 German and 175 British consumers of olive oil, three consumer segments were identified. These three segments differed significantly with regard to purchase and consumption patterns, as well as attitudes toward the extrinsic, intrinsic, sensorial, and health attributes of olive oil. The main preferences of the German respondents related to health properties of olive oil, followed by hedonic attributes; therefore, these aspects should be focused on in marketing strategies of olive oil in German markets.

The main official body in Germany dealing with questions regarding olive oil is the information agency of olive oil

(Informationsgemeinschaft

Olivenöl). Its main objective is the promotion of olive oil consumption in Germany. It mostly addresses

issues related to quality and nutrition. It undertakes seminars, presentations and consulting services with the aim

of making the special characteristics of olive oil, the different qualities and the factors that influence it, well

known to the consumers. Together with the German olive oil panel (Deutsches

Olivenöl Panel) it organizes sensory test groups for the examination of the quality of olive oil.

Make sure that you meet the sensory (organoleptic) properties of olive oil as demanded in Europe if you intend to

market blended olive oils as a branded consumer product. In Northern Europe, including Germany, olive oil blends

have a mild organoleptic profile (not too strong, not too weak). Develop expertise and skills in terms of blending

and quality control to ensure that you can offer oils with this profile consistently all-year-round.

The harmony value (also called balance) is used in Germany and other neighboring countries as a discrimination

factor for extra virgin olive

oils to rate them as bad,

average, good, very good, and of premium quality. It was accredited by the German authorities as part of the

official national organoleptic

assessment process in 2015, while it

remains an unofficial parameter for the rest of the continent. Since then, it has evolved into an important factor

for importers of olive oil in Germany and other German-speaking countries.

Every successful olive oil brand has a noticeable aesthetic apparent in brand messaging, online presence, the packaging and the labels. The packaging is the first thing that customers see on the shelf, that is, the first impression of the olive oil brand. Thus, the perception of ‘high quality’ begins with the bottle which is central in the brand’s marketing strategy.

It is important to develop a strong marketing story for your olive oil, especially if you want to enter the market for specialty oils. Positioning your brand as unique is critical in such a competitive industry, and the best to do so is with a personal narrative, which is much more than facts and data. This can cover the origin of the olive oil (including elements of producing communities), the production methods (especially if they are traditional), the ingredients (what they add to the product) and environmental and social impact (substantiated with certificates).

Promote the various applications and nutritional properties of olive oil, which are backed by scientific evidence. A good idea is to test your olive oil for its content of polyphenols, which are specifically connected to the health benefits of olive oil.

If your olive oil brand has a promotional website make sure it is mobile-friendly, it is optimized for Google (Search Engine Optimization - SEO) and it is straightforward and easy to navigate. You can also opt for paid advertising to increase visibility of your website and consider the retarget option. Another option is to generate organic traffic from content which could be increased through email marketing, blogs (such as free recipes and engaging video tutorials), and SEO-optimized website.

A strong social media presence is essential for a business nowadays. Work on posting regularly using consistent branding and information across social media platforms using linked profiles. Be creative in your posts by running contests or giving cooking advice to keep users engaged. Use Facebook to interact with customers, advertise promotions and help locate nearest retail store with your product. Use Instagram to showcase your olive oil in an attractive photo or a useful video and to partner with influencer chefs.

Check the websites of European trade shows and exhibitions to discover the newest trends. The most important trade fair in Germany for olive oil trends and trade are Anuga and BioFach. If you produce organic olive oil, consider participating in specific organic food and olive oil events and competitions, most importantly the world’s largest organic event, Biofach in Germany. It is also important to have a distributor. Promoting olive oil without being able to distribute it in the target market may harm sales. Participate in international competitions if you aim to place your olive oil in the premium segment. You can find the list of award-winning olive oils from international competitions at the EVOO World Ranking. When choosing a competition, select those that have respected, reliable and independent judges. Consider placing a label on your olive oil showing where the olive oil was tested and by what panel. This may provide a strong competitive advantage, because it is not frequently done.

Doing Business: Business Culture

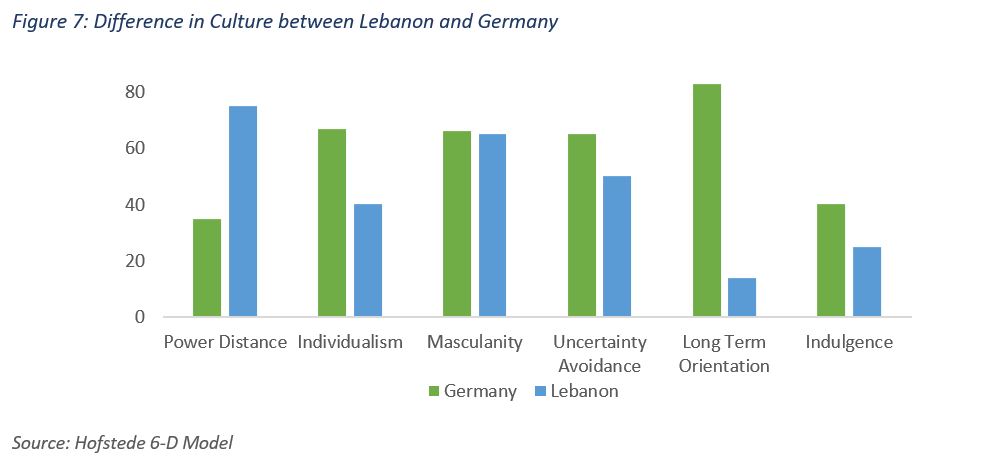

Power Distance: the extent to which the less powerful members of institutions and organizations within a country expect and accept that power is distributed unequally. There is a large gap in the score of Lebanon and Germany on power distance. While Lebanon follows a hierarchical and centralized system, Germany is highly decentralized with a comparatively extensive co-determination right.

Individualism: the degree of interdependence a society maintains among its members. While Lebanon scores low on individualism reflecting its collectivistic society, Germany scores high echoing a truly individualistic society. While the former perceives employer/ employee relationships in moral terms, the latter defines it in a contract and fosters direct and honest communication.

Masculinity: whether society is driven by competition, achievement and success (masculine) or dominant values in society are caring for others and quality of life (feminine). Both Lebanon and Germany score high on masculinity highlighting their masculine societies. Managers in both countries are expected to be decisive and assertive. There is a lot of emphasis on equity, competition and performance.

Uncertain Avoidance: the extent to which the members of a culture feel threatened by ambiguous or unknown situations and have created beliefs and institutions that try to avoid these. Lebanon scored midway and thus, shows no clear preference. Germany, however, is among the uncertainty avoidant countries with a strong preference for deductive rather than inductive approaches. For the Germans, details are important to create certainty that things are well-thought-out. Germans prefer to compensate for higher uncertainty by strongly relying on expertise.

Long Term Orientation: how every society has to maintain some links with its own past while dealing with the challenges of the present and future. The gap between Lebanon and German is substantial. While Lebanon scores low and its culture is considered normative, Germany scores high indicating a pragmatic culture. Lebanese, in general, exhibit great respect for traditions, a relatively small propensity to save for the future, and a focus on achieving quick results.

Germans, in general, show the ability to adapt traditions easily to changed conditions, a strong propensity to save and invest, thriftiness and perseverance in achieving results.

Indulgence: the extent to which people try to control their desires and impulses Both countries score low on this dimension indicating that both cultures are rather restrained in nature. Such societies have a tendency to cynicism and pessimism. They have the perception that their actions are restrained by social norms and that self-indulgence is wrong. Restrained societies do not put much emphasis on leisure time and control the gratification of their desires.

Germans are punctual and task-oriented. They are likely to be formal in their meetings and interested in getting to know more about your experience, credentials and longevity of your company. They will get down to business very quickly. They follow strict agendas with regards to the timeframe and goal of the meeting. Expect their participation in the discussion to be well thought-out and straight to the point. Germans will most likely openly disagree with you and point out your errors instead of speaking ambiguously for reasons of diplomacy and politeness. They value and ensure transparency in the course of their work and are not flexible once a final and best decision has been reached; they expect adherence with precision and consistency.

Expect a German company to have a well-founded confidence in its own way of doing things. They closely adhere to any regulations or rules that relate to the task and are hesitant to do work with those who show a tendency to cut corners. Displays of passionate emotion, exaggerations or promises that sound too good to be true are likely to make Germans hesitant or suspicious of doing business with you. When negotiating, they tend to use written communication to record discussions and uphold agreements.

Tips

- Familiarize yourself with the German olive oil market and get to know your competitors.

- Study you market entry options to select from an appropriate pool of buyers.

- Make use of available trade fairs and exhibitions to promote your product. If you produce organic olive oil, check expositions (Biofach) and companies (Organic Bio) specialized in organics.

- Consider participating in competitions to attain a competitive advantage over other brands.

- Promotion of single-origin premium olive oil, as well as sustainable and ethical production methods are favorable aspects for emerging suppliers

- Remember that the packaging of your product gives the first impression to the customer. Use attractive containers, add your story and any special qualifications of your olive oil; but only those that can be substantiated with certificates.

- Take advantage of your website and social media to promote your product and keep your customers engaged through promotions and useful videos.

- When dealing with the Germans, remember the cultural differences and respect their way of doing business.